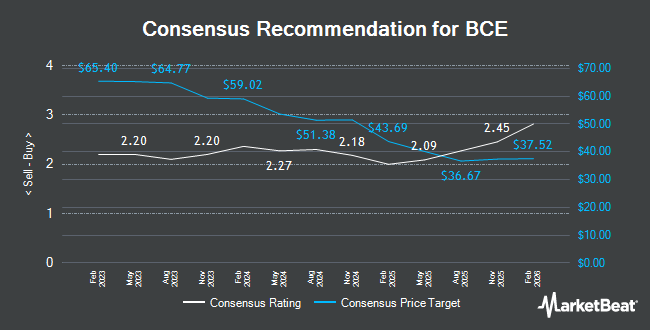

BCE (TSE:BCE - Get Free Report) NYSE: BCE had its target price reduced by equities researchers at Canaccord Genuity Group from C$41.00 to C$37.50 in a report issued on Friday,BayStreet.CA reports. Canaccord Genuity Group's price target indicates a potential downside of 5.57% from the stock's current price.

A number of other equities research analysts have also issued reports on BCE. Scotiabank cut their target price on BCE from C$50.50 to C$47.50 in a research report on Tuesday. National Bankshares cut their target price on BCE from C$48.00 to C$42.00 in a research report on Tuesday. National Bank Financial lowered BCE from a "strong-buy" rating to a "hold" rating in a research report on Monday, September 30th. Desjardins boosted their target price on BCE from C$48.00 to C$51.00 and gave the stock a "hold" rating in a research report on Friday, August 2nd. Finally, Cormark cut their target price on BCE from C$53.00 to C$52.00 in a research report on Friday, August 2nd. Ten analysts have rated the stock with a hold rating and one has assigned a buy rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus price target of C$46.36.

Get Our Latest Report on BCE

BCE Price Performance

Shares of BCE traded up C$0.77 during midday trading on Friday, reaching C$39.71. The stock had a trading volume of 4,387,754 shares, compared to its average volume of 3,075,447. BCE has a 52 week low of C$37.81 and a 52 week high of C$56.18. The company has a debt-to-equity ratio of 197.43, a current ratio of 0.65 and a quick ratio of 0.43. The firm's 50 day moving average price is C$46.32 and its 200-day moving average price is C$45.95. The company has a market capitalization of C$36.23 billion, a P/E ratio of 18.47, a P/E/G ratio of 4.67 and a beta of 0.48.

About BCE

(

Get Free Report)

BCE Inc, a communications company, provides wireless, wireline, Internet, and television (TV) services to residential, business, and wholesale customers in Canada. The company operates through two segments, Bell Communication and Technology Services, and Bell Media. The Bell Communication and Technology Services segment provides wireless products and services including mobile data and voice plans and devices; wireline products and services comprising data, including internet access, internet protocol television, cloud-based services, and business solutions, as well as voice, and other communication services and products; and satellite TV and connectivity services for residential, small and medium-sized business, government, and large enterprise customers.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BCE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BCE wasn't on the list.

While BCE currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.