BCE (TSE:BCE - Free Report) NYSE: BCE had its price target cut by Canaccord Genuity Group from C$33.50 to C$31.50 in a research note released on Monday,BayStreet.CA reports. They currently have a hold rating on the stock.

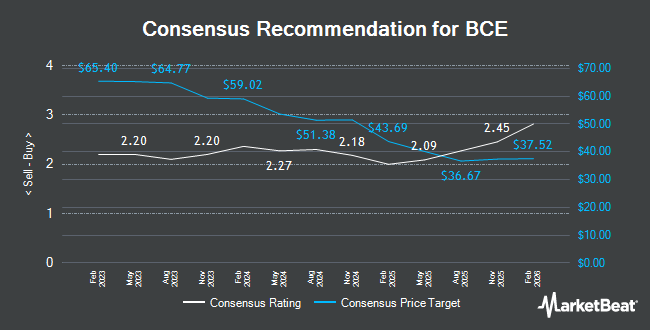

Other analysts also recently issued reports about the company. National Bankshares raised their target price on BCE from C$35.00 to C$36.00 and gave the stock a "sector perform" rating in a research report on Tuesday, March 11th. Barclays lowered BCE from an "equal weight" rating to an "underperform" rating and decreased their price objective for the stock from C$41.00 to C$30.00 in a report on Thursday, January 30th. National Bank Financial upgraded shares of BCE from a "hold" rating to a "strong-buy" rating in a research report on Thursday, April 3rd. Scotiabank lowered their price target on shares of BCE from C$42.00 to C$40.00 and set a "sector perform" rating on the stock in a research report on Friday, February 7th. Finally, JPMorgan Chase & Co. dropped their price target on shares of BCE from C$29.00 to C$28.00 and set an "underweight" rating on the stock in a research note on Thursday, April 3rd. Two research analysts have rated the stock with a sell rating, eight have assigned a hold rating, one has issued a buy rating and one has given a strong buy rating to the company. According to MarketBeat, BCE has an average rating of "Hold" and an average target price of C$38.82.

Get Our Latest Report on BCE

BCE Stock Performance

BCE traded up C$0.29 during midday trading on Monday, reaching C$29.61. The company had a trading volume of 4,885,678 shares, compared to its average volume of 4,069,882. BCE has a 12-month low of C$28.73 and a 12-month high of C$49.13. The business has a 50-day moving average price of C$33.05 and a two-hundred day moving average price of C$36.60. The stock has a market cap of C$26.82 billion, a PE ratio of 99.34, a P/E/G ratio of 4.67 and a beta of 0.48. The company has a debt-to-equity ratio of 226.73, a quick ratio of 0.43 and a current ratio of 0.62.

BCE Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 15th. Stockholders of record on Tuesday, April 15th will be issued a $0.9975 dividend. The ex-dividend date is Friday, March 14th. This represents a $3.99 dividend on an annualized basis and a dividend yield of 13.48%. BCE's payout ratio is 1,338.57%.

About BCE

(

Get Free Report)

BCE is both a wireless and internet service provider, offering wireless, broadband, television, and landline phone services in Canada. It is one of the big three national wireless carriers, with its roughly 10 million customers constituting about 30% of the market. It is also the ILEC (incumbent local exchange carrierthe legacy telephone provider) throughout much of the eastern half of Canada, including in the most populous Canadian provincesOntario and Quebec.

Read More

Before you consider BCE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BCE wasn't on the list.

While BCE currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.