Freshworks (NASDAQ:FRSH - Get Free Report) had its target price hoisted by stock analysts at Canaccord Genuity Group from $17.00 to $19.00 in a research report issued on Thursday,Benzinga reports. The brokerage currently has a "buy" rating on the stock. Canaccord Genuity Group's price objective would indicate a potential upside of 12.96% from the stock's current price.

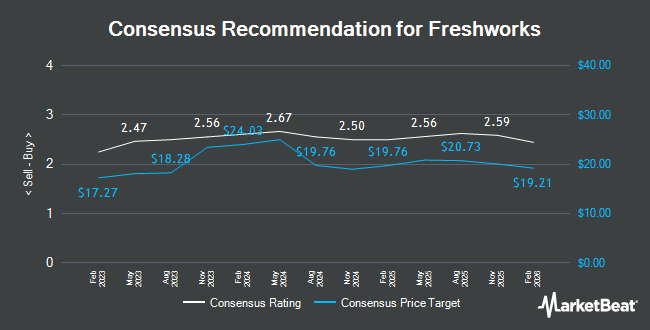

Other research analysts have also recently issued research reports about the company. Wells Fargo & Company boosted their price objective on Freshworks from $11.00 to $14.00 and gave the stock an "equal weight" rating in a research report on Thursday. JPMorgan Chase & Co. reduced their price target on shares of Freshworks from $19.00 to $17.00 and set an "overweight" rating for the company in a research report on Wednesday, July 31st. Scotiabank lowered their price objective on shares of Freshworks from $18.00 to $16.00 and set a "sector perform" rating on the stock in a research report on Wednesday, July 31st. Needham & Company LLC reiterated a "buy" rating and issued a $20.00 target price on shares of Freshworks in a research note on Thursday. Finally, Piper Sandler raised their price target on shares of Freshworks from $13.00 to $18.00 and gave the stock an "overweight" rating in a research note on Thursday. Seven investment analysts have rated the stock with a hold rating and eight have issued a buy rating to the stock. According to data from MarketBeat, Freshworks has a consensus rating of "Moderate Buy" and a consensus target price of $18.69.

Get Our Latest Stock Analysis on Freshworks

Freshworks Trading Up 28.5 %

Shares of FRSH traded up $3.73 during trading hours on Thursday, reaching $16.82. 16,528,799 shares of the stock traded hands, compared to its average volume of 2,746,653. Freshworks has a 52 week low of $10.81 and a 52 week high of $24.98. The company has a market cap of $5.08 billion, a price-to-earnings ratio of -49.47 and a beta of 0.72. The stock has a fifty day simple moving average of $11.55 and a 200 day simple moving average of $12.63.

Freshworks (NASDAQ:FRSH - Get Free Report) last posted its earnings results on Wednesday, November 6th. The company reported ($0.09) EPS for the quarter, topping the consensus estimate of ($0.10) by $0.01. Freshworks had a negative net margin of 15.72% and a negative return on equity of 9.08%. The firm had revenue of $186.58 million for the quarter, compared to analysts' expectations of $181.50 million. Analysts predict that Freshworks will post -0.38 earnings per share for the current fiscal year.

Insider Buying and Selling at Freshworks

In other news, Director Jennifer H. Taylor sold 4,690 shares of Freshworks stock in a transaction on Monday, August 12th. The stock was sold at an average price of $11.23, for a total value of $52,668.70. Following the completion of the transaction, the director now directly owns 35,853 shares in the company, valued at approximately $402,629.19. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. In related news, Director Jennifer H. Taylor sold 4,690 shares of the business's stock in a transaction that occurred on Monday, August 12th. The shares were sold at an average price of $11.23, for a total transaction of $52,668.70. Following the completion of the transaction, the director now owns 35,853 shares of the company's stock, valued at approximately $402,629.19. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Zachary Nelson sold 8,433 shares of the company's stock in a transaction that occurred on Monday, November 4th. The stock was sold at an average price of $12.19, for a total transaction of $102,798.27. Following the sale, the director now directly owns 23,497 shares in the company, valued at $286,428.43. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 46,456 shares of company stock valued at $530,102 in the last 90 days. 19.15% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Freshworks

Large investors have recently added to or reduced their stakes in the business. Capital International Investors bought a new position in shares of Freshworks in the 1st quarter worth $59,311,000. Clearbridge Investments LLC increased its stake in Freshworks by 107.4% in the first quarter. Clearbridge Investments LLC now owns 4,050,733 shares of the company's stock valued at $73,764,000 after acquiring an additional 2,097,280 shares during the last quarter. Vanguard Group Inc. raised its position in Freshworks by 6.8% during the first quarter. Vanguard Group Inc. now owns 21,171,044 shares of the company's stock valued at $385,525,000 after purchasing an additional 1,354,530 shares in the last quarter. M&G PLC bought a new stake in Freshworks during the third quarter worth about $9,094,000. Finally, Stanley Laman Group Ltd. purchased a new position in shares of Freshworks in the 2nd quarter worth about $9,133,000. Institutional investors own 75.58% of the company's stock.

Freshworks Company Profile

(

Get Free Report)

Freshworks Inc, a software development company, provides software-as-a-service products worldwide. It offers Freshworks Customer Service Suite, which provides automated, personalized self-service on various channels, including web, chat, mobile messaging, email, and social; Freshdesk, a ticketing-centric customer service solution; Freshsuccess, a customer success solution; and Freshchat that provides agents with a modern conversational experience to proactively engage customers across digital messaging channels.

Read More

Before you consider Freshworks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Freshworks wasn't on the list.

While Freshworks currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.