TELUS (TSE:T - Free Report) NYSE: TU had its price target decreased by Canaccord Genuity Group from C$21.25 to C$20.25 in a research report released on Monday morning,BayStreet.CA reports. Canaccord Genuity Group currently has a hold rating on the stock.

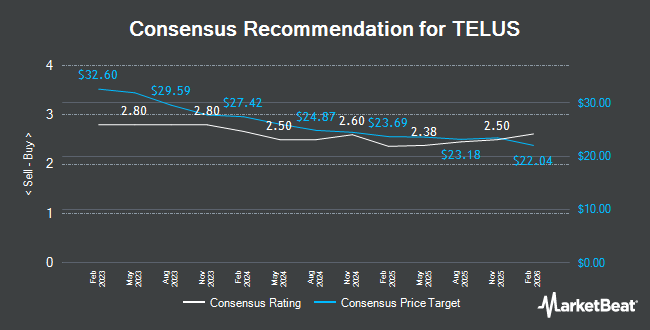

A number of other analysts have also recently issued reports on the stock. Royal Bank of Canada cut their target price on shares of TELUS from C$25.00 to C$24.00 and set an "outperform" rating for the company in a research note on Wednesday, December 18th. National Bank Financial cut TELUS from a "strong-buy" rating to a "hold" rating in a research note on Thursday, December 12th. Scotiabank lowered their price objective on TELUS from C$23.25 to C$22.50 and set a "sector perform" rating on the stock in a research note on Wednesday, January 8th. Barclays cut their target price on TELUS from C$23.00 to C$20.00 in a research report on Thursday, January 30th. Finally, JPMorgan Chase & Co. reduced their price objective on shares of TELUS from C$23.00 to C$22.00 and set a "neutral" rating on the stock in a research note on Thursday, January 2nd. Eight equities research analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to MarketBeat.com, TELUS has a consensus rating of "Hold" and a consensus price target of C$22.69.

View Our Latest Stock Report on T

TELUS Stock Performance

T traded up C$0.07 during trading hours on Monday, reaching C$20.23. The company's stock had a trading volume of 4,409,993 shares, compared to its average volume of 4,643,126. The company's 50-day moving average is C$21.21 and its 200-day moving average is C$21.23. TELUS has a 52 week low of C$19.10 and a 52 week high of C$23.43. The firm has a market cap of C$30.46 billion, a PE ratio of 32.82, a price-to-earnings-growth ratio of 1.65 and a beta of 0.72. The company has a debt-to-equity ratio of 183.41, a quick ratio of 0.52 and a current ratio of 0.69.

Insiders Place Their Bets

In related news, Director Hazel Cynthia Claxton bought 1,845 shares of the business's stock in a transaction that occurred on Thursday, February 20th. The stock was bought at an average cost of C$21.70 per share, with a total value of C$40,036.50. 0.02% of the stock is currently owned by insiders.

TELUS Company Profile

(

Get Free Report)

TELUS Corporation, together with its subsidiaries, provides a range of telecommunications and information technology products and services in Canada. It operates through Technology Solutions and Digitally-Led Customer Experiences segments. The Technology Solutions segment offers a range of telecommunications products and services; network services; healthcare services; mobile technologies equipment; data services, such as internet protocol; television; hosting, managed information technology, and cloud-based services; software, data management, and data analytics-driven smart food-chain and consumer goods technologies; home and business security; healthcare software and technology solutions; and voice and other telecommunications services, as well as mobile and fixed voice and data telecommunications services and products.

Recommended Stories

Before you consider TELUS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TELUS wasn't on the list.

While TELUS currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.