Inari Medical (NASDAQ:NARI - Get Free Report)'s stock had its "hold" rating reissued by equities researchers at Canaccord Genuity Group in a research note issued on Tuesday,Benzinga reports. They currently have a $80.00 price objective on the stock, up from their previous price objective of $74.00. Canaccord Genuity Group's target price would suggest a potential upside of 0.69% from the stock's previous close.

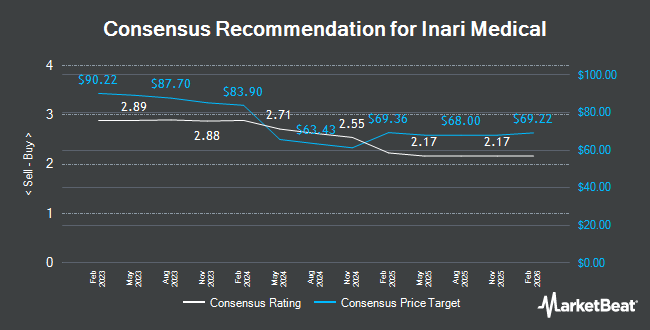

NARI has been the topic of a number of other reports. Truist Financial upped their price target on shares of Inari Medical from $50.00 to $63.00 and gave the stock a "hold" rating in a research note on Wednesday, December 18th. Needham & Company LLC reaffirmed a "hold" rating on shares of Inari Medical in a research note on Tuesday, October 29th. Oppenheimer started coverage on shares of Inari Medical in a research note on Tuesday, December 17th. They set an "outperform" rating and a $75.00 price target on the stock. Stifel Nicolaus started coverage on shares of Inari Medical in a research note on Tuesday, September 17th. They set a "hold" rating and a $50.00 price target on the stock. Finally, Piper Sandler upped their price target on shares of Inari Medical from $50.00 to $52.00 and gave the stock a "neutral" rating in a research note on Tuesday, October 29th. Ten equities research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. Based on data from MarketBeat, Inari Medical currently has an average rating of "Hold" and an average price target of $68.00.

Get Our Latest Report on Inari Medical

Inari Medical Trading Up 22.2 %

Shares of NASDAQ:NARI traded up $14.45 on Tuesday, reaching $79.45. 24,469,891 shares of the company were exchanged, compared to its average volume of 9,994,396. Inari Medical has a 1-year low of $36.73 and a 1-year high of $79.50. The firm has a market cap of $4.65 billion, a price-to-earnings ratio of -58.85 and a beta of 0.97. The company has a 50-day moving average of $52.85 and a 200-day moving average of $48.92.

Insider Buying and Selling at Inari Medical

In other news, CEO Andrew Hykes sold 3,000 shares of the stock in a transaction dated Friday, December 20th. The shares were sold at an average price of $55.29, for a total transaction of $165,870.00. Following the transaction, the chief executive officer now directly owns 439,310 shares in the company, valued at $24,289,449.90. This represents a 0.68 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, Director William Hoffman sold 60,000 shares of the stock in a transaction dated Monday, December 16th. The stock was sold at an average price of $55.66, for a total transaction of $3,339,600.00. Following the transaction, the director now owns 441,233 shares in the company, valued at approximately $24,559,028.78. The trade was a 11.97 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 206,000 shares of company stock worth $10,527,870. Corporate insiders own 10.60% of the company's stock.

Institutional Inflows and Outflows

Several large investors have recently modified their holdings of NARI. Aigen Investment Management LP acquired a new stake in Inari Medical during the 3rd quarter worth approximately $428,000. Vestal Point Capital LP increased its position in Inari Medical by 342.9% during the 3rd quarter. Vestal Point Capital LP now owns 1,550,000 shares of the company's stock worth $63,922,000 after purchasing an additional 1,200,000 shares in the last quarter. Lighthouse Investment Partners LLC acquired a new stake in Inari Medical during the 2nd quarter worth approximately $2,145,000. Dynamic Technology Lab Private Ltd acquired a new stake in Inari Medical during the 3rd quarter worth approximately $1,397,000. Finally, Verition Fund Management LLC acquired a new stake in Inari Medical during the 3rd quarter worth approximately $1,235,000. 90.98% of the stock is currently owned by hedge funds and other institutional investors.

Inari Medical Company Profile

(

Get Free Report)

Inari Medical, Inc builds minimally invasive, novel, and catheter-based mechanical thrombectomy devices and accessories for the specific disease states in the United States. The company provides ClotTriever system, which is designed to core, capture, and remove large clots from large vessels for treatment of deep vein thrombosis and peripheral thrombus; FlowTriever system, a large bore catheter-based aspiration and mechanical thrombectomy system to remove large clots from large vessels in the peripheral vasculature for treating pulmonary embolism and other complex venous thromboembolism cases; InThrill system to treat small vessel thrombosis; and LimFlow system for patients who have chronic limb-threatening ischemia with no suitable endovascular or surgical revascularization options and risk of major amputation.

See Also

Before you consider Inari Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inari Medical wasn't on the list.

While Inari Medical currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.