CANADA LIFE ASSURANCE Co reduced its position in shares of Landstar System, Inc. (NASDAQ:LSTR - Free Report) by 9.1% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 29,348 shares of the transportation company's stock after selling 2,947 shares during the period. CANADA LIFE ASSURANCE Co owned approximately 0.08% of Landstar System worth $5,043,000 at the end of the most recent reporting period.

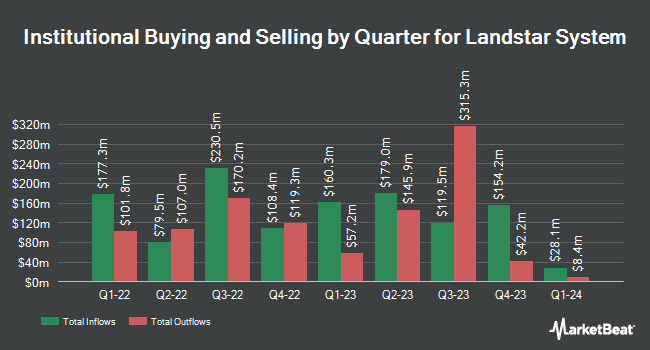

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the business. Golden State Wealth Management LLC bought a new position in Landstar System in the 4th quarter valued at approximately $25,000. HM Payson & Co. bought a new position in shares of Landstar System in the 4th quarter valued at $26,000. Trust Co. of Vermont acquired a new stake in shares of Landstar System during the 4th quarter valued at $34,000. Jones Financial Companies Lllp grew its position in Landstar System by 225.5% during the 4th quarter. Jones Financial Companies Lllp now owns 895 shares of the transportation company's stock worth $154,000 after acquiring an additional 620 shares during the last quarter. Finally, Huntington National Bank grew its position in Landstar System by 12.2% during the 4th quarter. Huntington National Bank now owns 1,037 shares of the transportation company's stock worth $178,000 after acquiring an additional 113 shares during the last quarter. 97.95% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Several equities analysts have issued reports on the stock. Susquehanna decreased their price target on shares of Landstar System from $130.00 to $120.00 and set a "neutral" rating for the company in a research report on Monday, April 7th. Stifel Nicolaus lowered their price objective on Landstar System from $162.00 to $147.00 and set a "hold" rating for the company in a research report on Monday, April 14th. TD Cowen dropped their price target on Landstar System from $161.00 to $145.00 and set a "hold" rating on the stock in a research note on Thursday, April 3rd. Truist Financial cut their price target on Landstar System from $150.00 to $135.00 and set a "hold" rating on the stock in a report on Thursday. Finally, Jefferies Financial Group dropped their price target on shares of Landstar System from $170.00 to $150.00 and set a "hold" rating on the stock in a research report on Friday, April 11th. One research analyst has rated the stock with a sell rating and thirteen have assigned a hold rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average target price of $155.67.

Check Out Our Latest Research Report on Landstar System

Landstar System Stock Performance

LSTR stock traded down $4.92 during midday trading on Friday, reaching $135.00. The stock had a trading volume of 658,922 shares, compared to its average volume of 283,974. The company has a debt-to-equity ratio of 0.07, a quick ratio of 2.21 and a current ratio of 1.96. Landstar System, Inc. has a 52-week low of $128.99 and a 52-week high of $196.86. The stock has a market cap of $4.72 billion, a PE ratio of 24.46 and a beta of 0.88. The firm has a fifty day simple moving average of $147.24 and a two-hundred day simple moving average of $166.92.

Landstar System (NASDAQ:LSTR - Get Free Report) last released its quarterly earnings results on Wednesday, January 29th. The transportation company reported $1.31 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.35 by ($0.04). Landstar System had a net margin of 4.07% and a return on equity of 19.56%. As a group, equities research analysts anticipate that Landstar System, Inc. will post 6.1 EPS for the current year.

About Landstar System

(

Free Report)

Landstar System, Inc provides integrated transportation management solutions in the United States, Canada, Mexico, and internationally. It operates through two segments: Transportation Logistics and Insurance. The Transportation Logistics segment offers a range of transportation services, including truckload and less-than-truckload transportation, rail intermodal, air cargo, ocean cargo, expedited ground and air delivery of time-critical freight, heavy-haul/specialized, U.S.-Canada and U.S.-Mexico cross-border, intra-Mexico, intra-Canada, project cargo, and customs brokerage, as well as offers transportation services to other transportation companies, such as third party logistics and less-than-truckload services.

Featured Articles

Before you consider Landstar System, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Landstar System wasn't on the list.

While Landstar System currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.