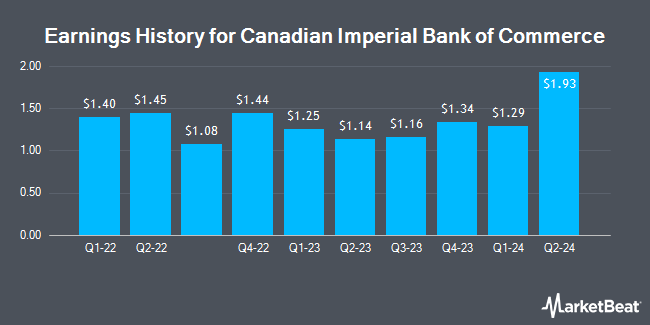

Canadian Imperial Bank of Commerce (NYSE:CM - Get Free Report) TSE: CM is scheduled to post its quarterly earnings results before the market opens on Thursday, December 5th. Analysts expect Canadian Imperial Bank of Commerce to post earnings of $1.29 per share for the quarter. Investors that wish to listen to the company's conference call can do so using this link.

Canadian Imperial Bank of Commerce (NYSE:CM - Get Free Report) TSE: CM last posted its quarterly earnings results on Thursday, August 29th. The bank reported $1.93 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.74 by $0.19. The firm had revenue of $6.60 billion for the quarter, compared to analyst estimates of $6.28 billion. Canadian Imperial Bank of Commerce had a net margin of 10.66% and a return on equity of 13.50%. The firm's quarterly revenue was up 12.9% compared to the same quarter last year. During the same quarter in the previous year, the business posted $1.14 earnings per share. On average, analysts expect Canadian Imperial Bank of Commerce to post $5 EPS for the current fiscal year and $6 EPS for the next fiscal year.

Canadian Imperial Bank of Commerce Price Performance

Shares of CM traded down $0.05 during trading hours on Thursday, hitting $64.68. 839,403 shares of the company were exchanged, compared to its average volume of 1,372,133. The company has a debt-to-equity ratio of 0.14, a current ratio of 1.05 and a quick ratio of 1.05. The company has a market capitalization of $61.10 billion, a PE ratio of 12.71, a PEG ratio of 1.71 and a beta of 1.06. The firm has a fifty day simple moving average of $62.66 and a 200-day simple moving average of $55.34. Canadian Imperial Bank of Commerce has a one year low of $37.97 and a one year high of $65.89.

Analyst Ratings Changes

Several analysts have issued reports on the company. Cormark upgraded Canadian Imperial Bank of Commerce from a "hold" rating to a "moderate buy" rating in a report on Friday, August 30th. BMO Capital Markets raised their price objective on shares of Canadian Imperial Bank of Commerce from $77.00 to $81.00 and gave the stock an "outperform" rating in a research note on Friday, August 30th. Desjardins raised shares of Canadian Imperial Bank of Commerce from a "hold" rating to a "moderate buy" rating in a research note on Friday, August 2nd. Bank of America raised Canadian Imperial Bank of Commerce from a "neutral" rating to a "buy" rating in a research report on Friday, August 30th. Finally, StockNews.com lowered Canadian Imperial Bank of Commerce from a "hold" rating to a "sell" rating in a research report on Saturday, October 19th. Two research analysts have rated the stock with a sell rating, one has issued a hold rating and six have issued a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $81.00.

Read Our Latest Research Report on CM

About Canadian Imperial Bank of Commerce

(

Get Free Report)

Canadian Imperial Bank of Commerce, a diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally. The company operates through Canadian Personal and Business Banking; Canadian Commercial Banking and Wealth Management; U.S.

Featured Articles

Before you consider Canadian Imperial Bank of Commerce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Imperial Bank of Commerce wasn't on the list.

While Canadian Imperial Bank of Commerce currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.