Royal Bank of Canada reiterated their sector perform rating on shares of Canadian Imperial Bank of Commerce (NYSE:CM - Free Report) TSE: CM in a report released on Friday morning,Benzinga reports. They currently have a $97.00 target price on the bank's stock, up from their previous target price of $74.00.

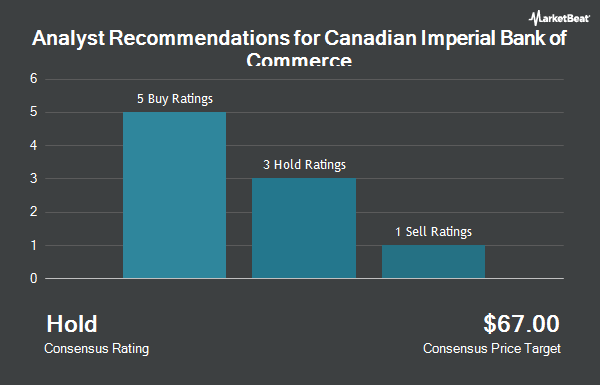

CM has been the topic of a number of other reports. StockNews.com cut Canadian Imperial Bank of Commerce from a "hold" rating to a "sell" rating in a research note on Saturday, October 19th. Bank of America raised Canadian Imperial Bank of Commerce from a "neutral" rating to a "buy" rating in a research report on Friday, August 30th. BMO Capital Markets upped their price target on Canadian Imperial Bank of Commerce from $77.00 to $81.00 and gave the company an "outperform" rating in a report on Friday, August 30th. Finally, Cormark raised shares of Canadian Imperial Bank of Commerce from a "hold" rating to a "moderate buy" rating in a report on Friday, August 30th. One analyst has rated the stock with a sell rating, three have issued a hold rating and six have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $89.00.

Read Our Latest Report on Canadian Imperial Bank of Commerce

Canadian Imperial Bank of Commerce Stock Up 0.1 %

CM traded up $0.08 on Friday, hitting $66.66. 1,114,515 shares of the company were exchanged, compared to its average volume of 709,301. The firm has a 50-day moving average price of $62.99 and a two-hundred day moving average price of $55.94. The company has a current ratio of 1.05, a quick ratio of 1.05 and a debt-to-equity ratio of 0.14. Canadian Imperial Bank of Commerce has a twelve month low of $42.28 and a twelve month high of $67.14. The company has a market cap of $62.97 billion, a price-to-earnings ratio of 12.47, a price-to-earnings-growth ratio of 1.67 and a beta of 1.06.

Canadian Imperial Bank of Commerce Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, January 28th. Investors of record on Friday, December 27th will be paid a dividend of $0.6912 per share. The ex-dividend date of this dividend is Friday, December 27th. This represents a $2.76 dividend on an annualized basis and a yield of 4.15%. This is a boost from Canadian Imperial Bank of Commerce's previous quarterly dividend of $0.65. Canadian Imperial Bank of Commerce's dividend payout ratio is currently 49.91%.

Institutional Trading of Canadian Imperial Bank of Commerce

A number of hedge funds have recently added to or reduced their stakes in CM. Ridgewood Investments LLC purchased a new position in Canadian Imperial Bank of Commerce during the second quarter worth about $29,000. BNP Paribas Financial Markets acquired a new position in Canadian Imperial Bank of Commerce during the 3rd quarter worth approximately $44,000. Blue Trust Inc. increased its position in Canadian Imperial Bank of Commerce by 571.6% during the 3rd quarter. Blue Trust Inc. now owns 732 shares of the bank's stock worth $45,000 after purchasing an additional 623 shares during the period. Massmutual Trust Co. FSB ADV raised its stake in shares of Canadian Imperial Bank of Commerce by 23.1% during the 3rd quarter. Massmutual Trust Co. FSB ADV now owns 911 shares of the bank's stock worth $56,000 after buying an additional 171 shares in the last quarter. Finally, City State Bank acquired a new stake in shares of Canadian Imperial Bank of Commerce in the 3rd quarter valued at approximately $61,000. 49.88% of the stock is owned by institutional investors and hedge funds.

Canadian Imperial Bank of Commerce Company Profile

(

Get Free Report)

Canadian Imperial Bank of Commerce, a diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally. The company operates through Canadian Personal and Business Banking; Canadian Commercial Banking and Wealth Management; U.S.

See Also

Before you consider Canadian Imperial Bank of Commerce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Imperial Bank of Commerce wasn't on the list.

While Canadian Imperial Bank of Commerce currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.