Citigroup upgraded shares of Canadian National Railway (TSE:CNR - Free Report) NYSE: CNI from a hold rating to a strong-buy rating in a research report report published on Tuesday,Zacks.com reports.

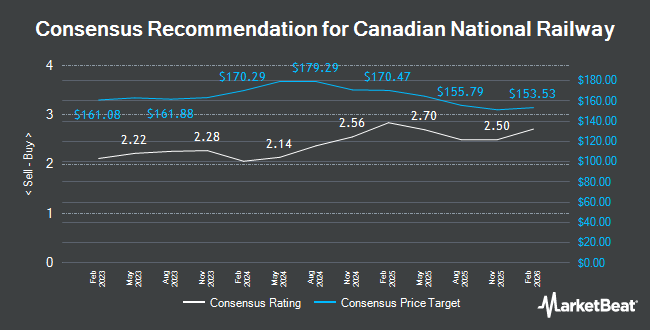

CNR has been the subject of several other research reports. Stephens raised Canadian National Railway to a "hold" rating in a research note on Wednesday, July 24th. UBS Group raised their price objective on shares of Canadian National Railway from C$189.00 to C$190.00 in a research report on Thursday, October 24th. Raymond James dropped their price target on Canadian National Railway from C$187.00 to C$180.00 and set an "outperform" rating on the stock in a report on Wednesday, September 11th. Wells Fargo & Company raised Canadian National Railway from an "equal weight" rating to an "overweight" rating in a research note on Monday, October 7th. Finally, JPMorgan Chase & Co. cut their target price on Canadian National Railway from C$176.00 to C$169.00 and set a "neutral" rating on the stock in a research report on Tuesday, October 8th. One investment analyst has rated the stock with a sell rating, seven have issued a hold rating, seven have assigned a buy rating and three have issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of C$171.07.

Get Our Latest Report on Canadian National Railway

Canadian National Railway Price Performance

Shares of Canadian National Railway stock traded up C$0.49 on Tuesday, hitting C$156.02. The company had a trading volume of 716,422 shares, compared to its average volume of 1,099,152. The business has a 50-day simple moving average of C$156.89 and a 200-day simple moving average of C$161.96. The company has a debt-to-equity ratio of 107.62, a current ratio of 0.63 and a quick ratio of 0.58. The company has a market cap of C$98.21 billion, a PE ratio of 18.47, a PEG ratio of 3.38 and a beta of 0.65. Canadian National Railway has a 52 week low of C$149.22 and a 52 week high of C$181.34.

Canadian National Railway Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, December 30th. Shareholders of record on Monday, December 9th will be given a $0.845 dividend. The ex-dividend date is Monday, December 9th. This represents a $3.38 dividend on an annualized basis and a yield of 2.17%. Canadian National Railway's payout ratio is 40.14%.

Insider Buying and Selling at Canadian National Railway

In other news, Director Susan C. Jones acquired 1,230 shares of the business's stock in a transaction that occurred on Tuesday, September 17th. The stock was acquired at an average cost of C$162.05 per share, for a total transaction of C$199,324.82. In other news, Director Susan C. Jones purchased 1,230 shares of the stock in a transaction that occurred on Tuesday, September 17th. The stock was acquired at an average price of C$162.05 per share, with a total value of C$199,324.82. Also, Director Shauneen Elizabeth Bruder acquired 543 shares of the business's stock in a transaction that occurred on Wednesday, September 25th. The shares were acquired at an average cost of C$157.53 per share, for a total transaction of C$85,539.88. Insiders purchased 4,559 shares of company stock valued at $714,135 in the last quarter. Company insiders own 2.64% of the company's stock.

About Canadian National Railway

(

Get Free Report)

Canadian National Railway Company, together with its subsidiaries, engages in the rail, intermodal, trucking, and marine transportation and logistics business in Canada and the United States. The company provides rail services, which include equipment, custom brokerage services, transloading and distribution, business development and real estate, and private car storage services; and intermodal services, such as temperature controlled cargo, port partnerships, and logistics parks.

Featured Articles

Before you consider Canadian National Railway, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian National Railway wasn't on the list.

While Canadian National Railway currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.