FMR LLC trimmed its position in Canadian Natural Resources Limited (NYSE:CNQ - Free Report) TSE: CNQ by 0.7% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 85,177,386 shares of the oil and gas producer's stock after selling 625,150 shares during the quarter. FMR LLC owned approximately 4.03% of Canadian Natural Resources worth $2,828,465,000 at the end of the most recent quarter.

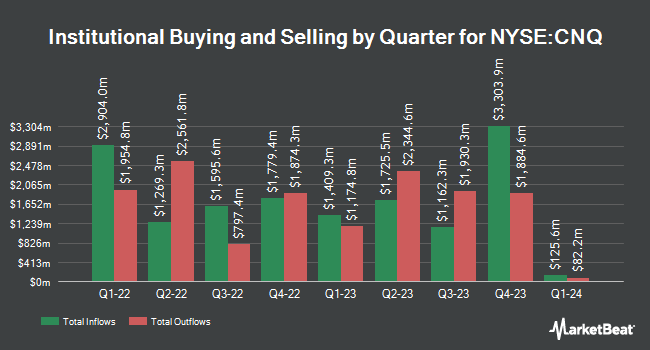

Several other institutional investors have also made changes to their positions in CNQ. Lighthouse Investment Partners LLC bought a new stake in Canadian Natural Resources during the second quarter valued at about $890,000. Canoe Financial LP increased its position in Canadian Natural Resources by 226.0% in the 3rd quarter. Canoe Financial LP now owns 1,549,610 shares of the oil and gas producer's stock worth $51,469,000 after buying an additional 1,074,199 shares during the period. Aigen Investment Management LP boosted its position in shares of Canadian Natural Resources by 123.0% in the third quarter. Aigen Investment Management LP now owns 54,323 shares of the oil and gas producer's stock valued at $1,804,000 after acquiring an additional 29,961 shares during the period. Capital Wealth Planning LLC grew its stake in shares of Canadian Natural Resources by 228.5% in the second quarter. Capital Wealth Planning LLC now owns 91,652 shares of the oil and gas producer's stock worth $3,263,000 after acquiring an additional 63,756 shares during the last quarter. Finally, Souders Financial Advisors increased its position in Canadian Natural Resources by 103.0% during the second quarter. Souders Financial Advisors now owns 99,999 shares of the oil and gas producer's stock worth $3,560,000 after acquiring an additional 50,744 shares during the period. 74.03% of the stock is owned by hedge funds and other institutional investors.

Canadian Natural Resources Trading Down 2.4 %

Canadian Natural Resources stock traded down $0.83 during midday trading on Tuesday, hitting $33.20. 6,007,832 shares of the stock were exchanged, compared to its average volume of 5,304,290. Canadian Natural Resources Limited has a 52 week low of $29.45 and a 52 week high of $41.29. The company has a quick ratio of 0.53, a current ratio of 0.84 and a debt-to-equity ratio of 0.21. The stock has a market capitalization of $70.07 billion, a PE ratio of 13.22 and a beta of 1.50. The company has a fifty day simple moving average of $34.62 and a two-hundred day simple moving average of $35.30.

Canadian Natural Resources (NYSE:CNQ - Get Free Report) TSE: CNQ last issued its quarterly earnings data on Thursday, October 31st. The oil and gas producer reported $0.97 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.67 by $0.30. Canadian Natural Resources had a return on equity of 20.07% and a net margin of 18.45%. The business had revenue of $7.62 billion during the quarter, compared to analyst estimates of $6.40 billion. During the same period in the previous year, the firm earned $0.96 EPS. Equities research analysts anticipate that Canadian Natural Resources Limited will post 2.47 EPS for the current fiscal year.

Canadian Natural Resources Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, January 3rd. Shareholders of record on Friday, December 13th will be paid a $0.388 dividend. This is a boost from Canadian Natural Resources's previous quarterly dividend of $0.38. The ex-dividend date is Friday, December 13th. This represents a $1.55 annualized dividend and a yield of 4.67%. Canadian Natural Resources's payout ratio is presently 60.58%.

Wall Street Analysts Forecast Growth

CNQ has been the topic of a number of recent research reports. StockNews.com downgraded Canadian Natural Resources from a "buy" rating to a "hold" rating in a research report on Friday, August 23rd. Desjardins upgraded Canadian Natural Resources from a "hold" rating to a "moderate buy" rating in a research report on Tuesday, October 8th. Five equities research analysts have rated the stock with a hold rating, According to data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $51.00.

Get Our Latest Research Report on Canadian Natural Resources

About Canadian Natural Resources

(

Free Report)

Canadian Natural Resources Limited acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs). The company offers light and medium crude oil, primary heavy crude oil, Pelican Lake heavy crude oil, bitumen (thermal oil), and synthetic crude oil (SCO).

Featured Stories

Before you consider Canadian Natural Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Natural Resources wasn't on the list.

While Canadian Natural Resources currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.