Canadian Natural Resources (TSE:CNQ - Get Free Report) NYSE: CNQ was downgraded by research analysts at Tudor Pickering from a "strong-buy" rating to a "hold" rating in a research note issued on Monday, February 10th,Zacks.com reports.

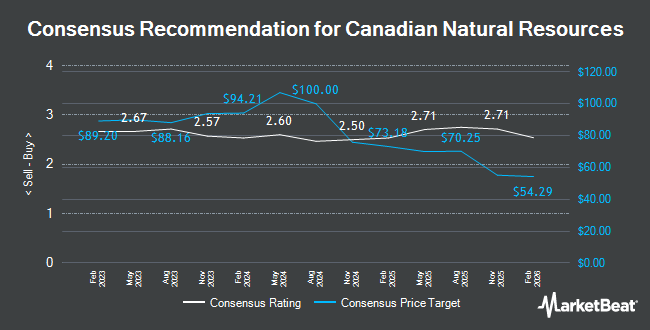

Other analysts have also recently issued research reports about the company. BMO Capital Markets decreased their target price on Canadian Natural Resources from C$60.00 to C$58.00 in a report on Friday, December 13th. Raymond James upped their price objective on Canadian Natural Resources from C$50.00 to C$51.00 and gave the stock a "market perform" rating in a report on Friday, November 1st. Wells Fargo & Company lifted their target price on Canadian Natural Resources from C$48.00 to C$50.00 in a research note on Monday, December 9th. Jefferies Financial Group cut their price target on Canadian Natural Resources from C$54.00 to C$50.00 in a research note on Thursday, January 30th. Finally, TD Securities set a C$58.00 price objective on Canadian Natural Resources and gave the stock a "buy" rating in a research report on Tuesday, December 3rd. Seven research analysts have rated the stock with a hold rating and eight have given a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of C$71.44.

Read Our Latest Stock Analysis on CNQ

Canadian Natural Resources Price Performance

Shares of TSE:CNQ traded down C$0.46 during trading on Monday, reaching C$42.67. The stock had a trading volume of 4,464,880 shares, compared to its average volume of 6,402,450. The stock has a market capitalization of C$89.55 billion, a PE ratio of 11.85, a P/E/G ratio of 0.53 and a beta of 1.89. Canadian Natural Resources has a 52 week low of C$40.63 and a 52 week high of C$56.49. The business's 50-day moving average price is C$44.59 and its 200 day moving average price is C$46.48. The company has a debt-to-equity ratio of 25.79, a current ratio of 0.84 and a quick ratio of 0.54.

Insiders Place Their Bets

In other Canadian Natural Resources news, Senior Officer Dwayne Frederick Giggs sold 2,000 shares of the firm's stock in a transaction on Friday, November 22nd. The stock was sold at an average price of C$48.70, for a total transaction of C$97,405.40. Also, Director Stephen W. Laut sold 6,400 shares of Canadian Natural Resources stock in a transaction on Tuesday, November 19th. The shares were sold at an average price of C$47.04, for a total value of C$301,056.00. Insiders have sold 155,332 shares of company stock worth $7,012,151 in the last 90 days. Company insiders own 4.26% of the company's stock.

About Canadian Natural Resources

(

Get Free Report)

Canadian Natural Resources Limited acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs). The company offers light and medium crude oil, primary heavy crude oil, Pelican Lake heavy crude oil, bitumen (thermal oil), and synthetic crude oil (SCO).

Further Reading

Before you consider Canadian Natural Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Natural Resources wasn't on the list.

While Canadian Natural Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.