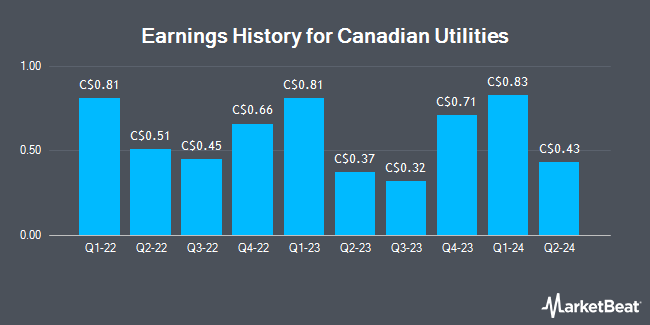

Canadian Utilities (TSE:CU - Get Free Report) is scheduled to announce its earnings results before the market opens on Thursday, November 14th. Analysts expect the company to announce earnings of C$0.35 per share for the quarter.

Canadian Utilities Stock Performance

Shares of TSE CU traded up C$0.16 during trading hours on Thursday, hitting C$34.59. 1,021,561 shares of the stock were exchanged, compared to its average volume of 501,932. The company has a debt-to-equity ratio of 149.94, a current ratio of 1.29 and a quick ratio of 1.30. The company's 50 day moving average is C$35.34 and its 200 day moving average is C$32.59. The firm has a market capitalization of C$7.09 billion, a P/E ratio of 17.47, a P/E/G ratio of 2.38 and a beta of 0.66. Canadian Utilities has a one year low of C$29.15 and a one year high of C$37.10.

Canadian Utilities Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Sunday, December 1st. Investors of record on Thursday, November 7th will be issued a dividend of $0.453 per share. This represents a $1.81 annualized dividend and a dividend yield of 5.24%. The ex-dividend date is Thursday, November 7th. Canadian Utilities's dividend payout ratio is currently 91.41%.

Analyst Upgrades and Downgrades

A number of brokerages have recently issued reports on CU. National Bankshares increased their price objective on shares of Canadian Utilities from C$34.00 to C$37.00 in a research note on Friday, August 23rd. Scotiabank increased their target price on shares of Canadian Utilities from C$34.00 to C$36.00 and gave the stock a "sector perform" rating in a research report on Tuesday, August 20th. CIBC increased their target price on shares of Canadian Utilities from C$34.00 to C$35.00 and gave the stock a "neutral" rating in a research report on Tuesday, August 6th. BMO Capital Markets increased their target price on shares of Canadian Utilities from C$35.50 to C$37.00 in a research report on Thursday, September 5th. Finally, Royal Bank of Canada increased their target price on shares of Canadian Utilities from C$36.00 to C$38.00 and gave the stock a "sector perform" rating in a research report on Thursday, October 3rd.

Get Our Latest Research Report on Canadian Utilities

Canadian Utilities Company Profile

(

Get Free Report)

Canadian Utilities Limited, together with its subsidiaries, engages in the electricity, natural gas, renewables, pipelines, liquids, and retail energy businesses in Canada, Australia, and internationally. It operates through ATCO Energy Systems, ATCO EnPower, and Corporate & Other segments. The ATCO Energy Systems segment provides regulated electricity transmission and distribution services in northern and central east Alberta, the Yukon, the Northwest Territories, and the Lloydminster area of Saskatchewan; and integrated natural gas transmission and distribution services in Alberta, the Lloydminster area of Saskatchewan, and Western Australia.

Recommended Stories

Before you consider Canadian Utilities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Utilities wasn't on the list.

While Canadian Utilities currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.