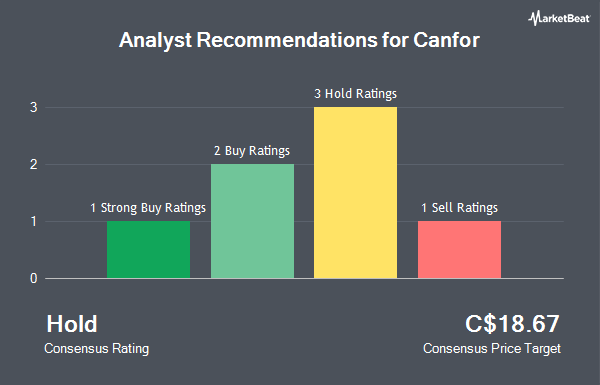

Canfor Co. (TSE:CFP - Get Free Report) has been given an average rating of "Hold" by the seven research firms that are covering the firm, MarketBeat.com reports. One equities research analyst has rated the stock with a sell recommendation, three have assigned a hold recommendation, two have given a buy recommendation and one has assigned a strong buy recommendation to the company. The average 12 month target price among brokers that have updated their coverage on the stock in the last year is C$18.67.

Several equities research analysts recently weighed in on the company. TD Securities decreased their price target on Canfor from C$19.00 to C$17.00 and set a "buy" rating for the company in a report on Thursday, April 17th. Royal Bank of Canada reduced their target price on shares of Canfor from C$19.00 to C$16.00 and set an "outperform" rating for the company in a research note on Tuesday, April 22nd. CIBC lowered shares of Canfor from an "outperform" rating to a "neutral" rating and dropped their price target for the stock from C$19.00 to C$16.00 in a research note on Tuesday, April 22nd. Raymond James reduced their price objective on shares of Canfor from C$28.00 to C$24.00 in a research report on Thursday, January 30th. Finally, Cibc World Mkts lowered Canfor from a "strong-buy" rating to a "hold" rating in a report on Tuesday, April 22nd.

Read Our Latest Stock Report on Canfor

Canfor Stock Performance

Canfor stock traded up C$0.28 during mid-day trading on Friday, reaching C$13.30. 131,274 shares of the company were exchanged, compared to its average volume of 188,506. The firm's 50-day simple moving average is C$14.41 and its two-hundred day simple moving average is C$15.50. Canfor has a twelve month low of C$12.60 and a twelve month high of C$18.38. The firm has a market cap of C$1.60 billion, a PE ratio of -2.21 and a beta of 2.08. The company has a debt-to-equity ratio of 21.94, a quick ratio of 2.14 and a current ratio of 2.19.

Canfor Company Profile

(

Get Free ReportCanfor Corporation operates as an integrated forest products company in the United States, Asia, Canada, Europe, and internationally. It operates in two segments, Lumber, and Pulp and Paper. The company manufactures and sells softwood lumber, remanufactured lumber products, engineered wood, and other lumber-related products, as well as wood chips and pellets; and generates green energy.

Featured Articles

Before you consider Canfor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canfor wasn't on the list.

While Canfor currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.