Canoo (NASDAQ:GOEV - Free Report) had its price target reduced by HC Wainwright from $4.00 to $2.00 in a research note published on Friday,Benzinga reports. They currently have a buy rating on the stock.

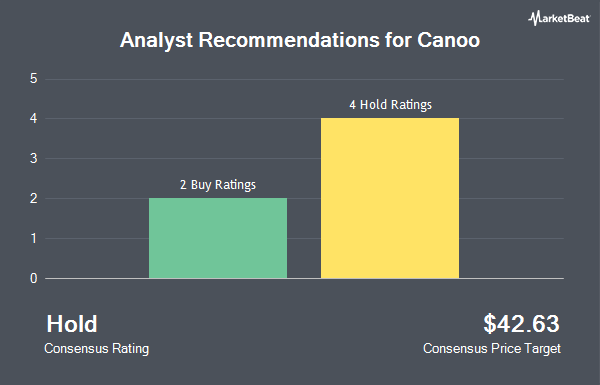

Separately, Roth Mkm dropped their price target on shares of Canoo from $3.00 to $1.50 and set a "neutral" rating on the stock in a research note on Thursday, August 15th. Two equities research analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. According to data from MarketBeat.com, Canoo has a consensus rating of "Moderate Buy" and an average target price of $22.71.

Get Our Latest Report on Canoo

Canoo Trading Down 6.1 %

Shares of Canoo stock traded down $0.03 on Friday, reaching $0.50. 4,405,766 shares of the stock were exchanged, compared to its average volume of 5,399,573. Canoo has a 1-year low of $0.37 and a 1-year high of $8.81. The business has a fifty day moving average price of $0.91 and a two-hundred day moving average price of $1.68. The firm has a market capitalization of $41.17 million, a PE ratio of -0.14 and a beta of 1.29.

Canoo (NASDAQ:GOEV - Get Free Report) last issued its quarterly earnings results on Wednesday, August 14th. The company reported ($0.09) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.77) by $0.68. The firm had revenue of $0.61 million for the quarter, compared to analyst estimates of $1.99 million. Research analysts expect that Canoo will post -3.75 EPS for the current year.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently added to or reduced their stakes in GOEV. SG Americas Securities LLC grew its position in Canoo by 95.6% during the first quarter. SG Americas Securities LLC now owns 22,065 shares of the company's stock worth $79,000 after buying an additional 10,786 shares during the period. Curbstone Financial Management Corp purchased a new position in shares of Canoo during the second quarter valued at approximately $43,000. MBL Wealth LLC purchased a new position in shares of Canoo during the second quarter valued at approximately $31,000. Harel Insurance Investments & Financial Services Ltd. purchased a new position in shares of Canoo during the second quarter valued at approximately $35,000. Finally, Bank of New York Mellon Corp purchased a new position in shares of Canoo during the second quarter valued at approximately $392,000. 36.23% of the stock is currently owned by institutional investors and hedge funds.

Canoo Company Profile

(

Get Free Report)

Canoo Inc, a mobility technology company, designs, develops, markets, and manufactures electric vehicles for consumer, commercial fleet, government, and military customers in the United States. the company utilizes its multi-purpose platform architecture, a self-contained, fully functional rolling chassis that directly houses the critical components for operation of an electric vehicle, including its in-house designed proprietary electric drivetrain, battery systems, advanced vehicle control electronics and software, and other critical components.

Recommended Stories

Before you consider Canoo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canoo wasn't on the list.

While Canoo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.