Cantillon Capital Management LLC increased its stake in Tencent Music Entertainment Group (NYSE:TME - Free Report) by 39.9% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 18,456,585 shares of the company's stock after purchasing an additional 5,265,783 shares during the quarter. Cantillon Capital Management LLC owned about 1.08% of Tencent Music Entertainment Group worth $222,402,000 at the end of the most recent quarter.

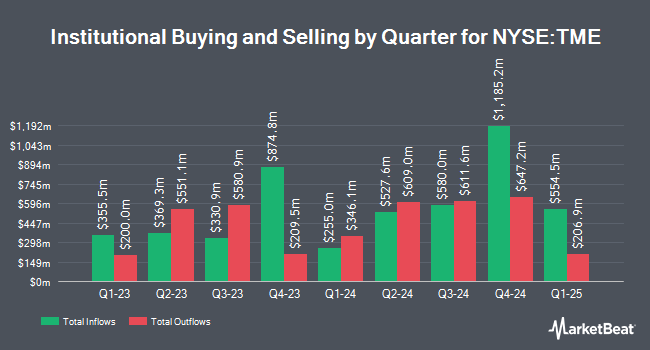

Several other institutional investors have also bought and sold shares of the stock. Ashton Thomas Private Wealth LLC acquired a new stake in Tencent Music Entertainment Group in the 2nd quarter valued at about $37,000. Tobam lifted its holdings in Tencent Music Entertainment Group by 37.7% in the 2nd quarter. Tobam now owns 3,498 shares of the company's stock valued at $49,000 after acquiring an additional 957 shares during the last quarter. iA Global Asset Management Inc. lifted its holdings in Tencent Music Entertainment Group by 728.9% in the 1st quarter. iA Global Asset Management Inc. now owns 11,687 shares of the company's stock valued at $131,000 after acquiring an additional 10,277 shares during the last quarter. Caprock Group LLC acquired a new stake in Tencent Music Entertainment Group in the 3rd quarter valued at about $147,000. Finally, Diversify Advisory Services LLC acquired a new stake in Tencent Music Entertainment Group in the 3rd quarter valued at about $166,000. Institutional investors and hedge funds own 24.32% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have weighed in on TME shares. Bank of America cut their price target on shares of Tencent Music Entertainment Group from $18.00 to $15.00 and set a "buy" rating for the company in a report on Wednesday, August 14th. Benchmark reduced their price objective on shares of Tencent Music Entertainment Group from $19.00 to $15.00 and set a "buy" rating for the company in a research note on Wednesday, August 14th. Daiwa Capital Markets lowered shares of Tencent Music Entertainment Group from an "outperform" rating to a "neutral" rating in a research note on Tuesday, August 13th. Morgan Stanley lowered shares of Tencent Music Entertainment Group from an "overweight" rating to an "equal weight" rating and reduced their price objective for the company from $15.00 to $13.00 in a research note on Wednesday, September 25th. Finally, Barclays assumed coverage on shares of Tencent Music Entertainment Group in a research note on Wednesday, November 6th. They set an "overweight" rating and a $16.00 price objective for the company. Four equities research analysts have rated the stock with a hold rating and ten have given a buy rating to the company. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $13.28.

Check Out Our Latest Stock Analysis on Tencent Music Entertainment Group

Tencent Music Entertainment Group Stock Down 2.8 %

NYSE:TME traded down $0.33 during mid-day trading on Tuesday, reaching $11.17. The stock had a trading volume of 4,370,990 shares, compared to its average volume of 8,641,945. The business's 50 day moving average is $11.51 and its 200 day moving average is $12.77. Tencent Music Entertainment Group has a fifty-two week low of $7.93 and a fifty-two week high of $15.77. The stock has a market cap of $19.16 billion, a P/E ratio of 20.68, a PEG ratio of 0.83 and a beta of 0.67. The company has a debt-to-equity ratio of 0.09, a current ratio of 2.34 and a quick ratio of 2.34.

About Tencent Music Entertainment Group

(

Free Report)

Tencent Music Entertainment Group operates online music entertainment platforms to provide music streaming, online karaoke, and live streaming services in the People's Republic of China. It offers QQ Music, Kugou Music, and Kuwo Music that enable users to discover music in personalized ways; long-form audio content, including audiobooks, podcasts and talk shows, as well as music-oriented video content comprising music videos, live performances, and short videos; and WeSing, which enables users to sing along from its library of karaoke songs and share their performances in audio or video formats with friends.

Featured Articles

Before you consider Tencent Music Entertainment Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tencent Music Entertainment Group wasn't on the list.

While Tencent Music Entertainment Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.