Cantillon Capital Management LLC lowered its stake in BlackRock, Inc. (NYSE:BLK - Free Report) by 4.5% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 488,699 shares of the asset manager's stock after selling 22,990 shares during the period. BlackRock accounts for 2.8% of Cantillon Capital Management LLC's holdings, making the stock its 16th largest holding. Cantillon Capital Management LLC owned approximately 0.33% of BlackRock worth $464,025,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

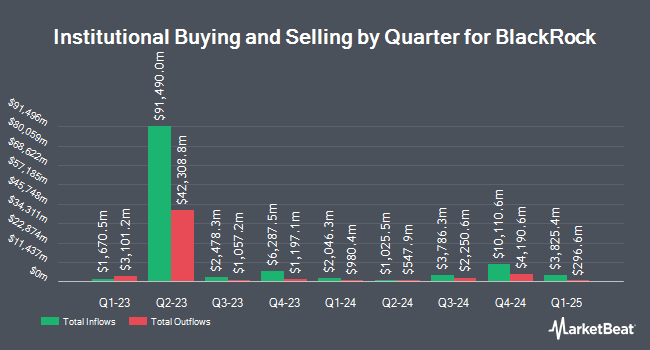

A number of other hedge funds have also recently added to or reduced their stakes in the stock. Pathway Financial Advisers LLC grew its holdings in BlackRock by 89,389.4% in the third quarter. Pathway Financial Advisers LLC now owns 1,046,131 shares of the asset manager's stock worth $993,312,000 after purchasing an additional 1,044,962 shares during the period. International Assets Investment Management LLC raised its position in BlackRock by 104,468.9% in the third quarter. International Assets Investment Management LLC now owns 792,632 shares of the asset manager's stock worth $7,526,120,000 after acquiring an additional 791,874 shares during the period. Capital Research Global Investors raised its position in BlackRock by 11.1% in the first quarter. Capital Research Global Investors now owns 4,354,236 shares of the asset manager's stock worth $3,630,127,000 after acquiring an additional 435,358 shares during the period. Sarasin & Partners LLP raised its position in BlackRock by 174.8% in the second quarter. Sarasin & Partners LLP now owns 184,291 shares of the asset manager's stock worth $145,096,000 after acquiring an additional 117,218 shares during the period. Finally, Swedbank AB bought a new stake in shares of BlackRock in the first quarter valued at approximately $86,282,000. Institutional investors and hedge funds own 80.69% of the company's stock.

Analyst Ratings Changes

BLK has been the topic of a number of analyst reports. StockNews.com assumed coverage on shares of BlackRock in a report on Wednesday, November 13th. They set a "hold" rating on the stock. Barclays upped their price objective on shares of BlackRock from $1,010.00 to $1,120.00 and gave the company an "overweight" rating in a research note on Monday, October 14th. Morgan Stanley upped their price target on shares of BlackRock from $1,150.00 to $1,245.00 and gave the company an "overweight" rating in a report on Monday, October 14th. Wells Fargo & Company upped their price objective on shares of BlackRock from $1,000.00 to $1,070.00 and gave the stock an "overweight" rating in a report on Wednesday, October 9th. Finally, Deutsche Bank Aktiengesellschaft upped their price objective on shares of BlackRock from $1,105.00 to $1,133.00 and gave the stock a "buy" rating in a report on Monday, November 11th. Three analysts have rated the stock with a hold rating and eleven have given a buy rating to the company. Based on data from MarketBeat, BlackRock has a consensus rating of "Moderate Buy" and an average price target of $1,019.62.

Check Out Our Latest Research Report on BLK

Insider Buying and Selling

In other news, Director Mark Wiedman sold 12,000 shares of the firm's stock in a transaction that occurred on Friday, August 30th. The shares were sold at an average price of $900.00, for a total transaction of $10,800,000.00. Following the sale, the director now owns 6,480 shares of the company's stock, valued at $5,832,000. This trade represents a 64.94 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 0.90% of the stock is owned by corporate insiders.

BlackRock Stock Performance

Shares of BlackRock stock traded down $21.59 during midday trading on Tuesday, hitting $1,028.38. The company had a trading volume of 673,495 shares, compared to its average volume of 575,065. The stock has a market cap of $159.28 billion, a price-to-earnings ratio of 25.38, a PEG ratio of 1.87 and a beta of 1.30. The company has a quick ratio of 5.06, a current ratio of 5.06 and a debt-to-equity ratio of 0.37. The company has a fifty day simple moving average of $975.38 and a 200 day simple moving average of $875.55. BlackRock, Inc. has a 12-month low of $712.11 and a 12-month high of $1,068.34.

BlackRock (NYSE:BLK - Get Free Report) last announced its quarterly earnings data on Friday, October 11th. The asset manager reported $11.46 EPS for the quarter, beating the consensus estimate of $10.42 by $1.04. BlackRock had a net margin of 31.37% and a return on equity of 15.52%. The firm had revenue of $5.20 billion during the quarter, compared to analyst estimates of $5.03 billion. During the same period last year, the firm posted $10.91 EPS. BlackRock's revenue was up 14.9% on a year-over-year basis. As a group, analysts predict that BlackRock, Inc. will post 43.17 earnings per share for the current fiscal year.

BlackRock Company Profile

(

Free Report)

BlackRock, Inc is a publicly owned investment manager. The firm primarily provides its services to institutional, intermediary, and individual investors including corporate, public, union, and industry pension plans, insurance companies, third-party mutual funds, endowments, public institutions, governments, foundations, charities, sovereign wealth funds, corporations, official institutions, and banks.

Recommended Stories

Before you consider BlackRock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlackRock wasn't on the list.

While BlackRock currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.