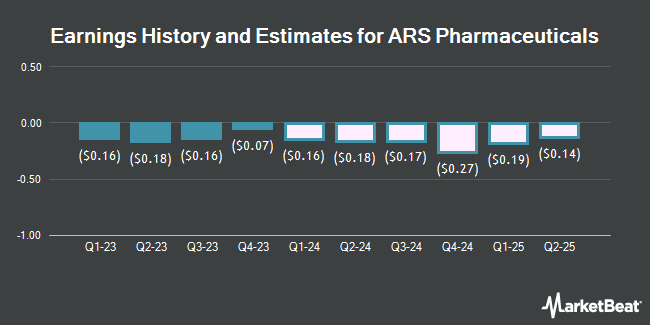

ARS Pharmaceuticals, Inc. (NASDAQ:SPRY - Free Report) - Analysts at Cantor Fitzgerald decreased their FY2024 earnings per share (EPS) estimates for ARS Pharmaceuticals in a research report issued on Wednesday, December 4th. Cantor Fitzgerald analyst J. Schimmer now anticipates that the company will post earnings per share of ($0.76) for the year, down from their prior estimate of ($0.42). Cantor Fitzgerald currently has a "Overweight" rating and a $30.00 target price on the stock. The consensus estimate for ARS Pharmaceuticals' current full-year earnings is ($0.58) per share.

SPRY has been the subject of several other research reports. William Blair upgraded shares of ARS Pharmaceuticals to a "strong-buy" rating in a research note on Friday, August 30th. Raymond James upgraded ARS Pharmaceuticals from an "outperform" rating to a "strong-buy" rating and boosted their price target for the company from $18.00 to $22.00 in a research note on Tuesday, August 13th. Finally, Leerink Partners upped their target price on ARS Pharmaceuticals from $21.00 to $25.00 and gave the company an "outperform" rating in a research report on Friday, September 20th. Four equities research analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat.com, ARS Pharmaceuticals presently has a consensus rating of "Buy" and an average price target of $24.00.

View Our Latest Analysis on SPRY

ARS Pharmaceuticals Stock Up 0.1 %

Shares of SPRY traded up $0.02 during midday trading on Friday, reaching $14.02. 727,227 shares of the stock were exchanged, compared to its average volume of 1,266,213. The stock's 50 day simple moving average is $14.79 and its 200 day simple moving average is $12.21. ARS Pharmaceuticals has a twelve month low of $5.01 and a twelve month high of $18.51. The company has a market cap of $1.36 billion, a P/E ratio of -27.49 and a beta of 0.88.

Insider Buying and Selling at ARS Pharmaceuticals

In related news, major shareholder James E. Flynn sold 528,456 shares of the company's stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $18.04, for a total transaction of $9,533,346.24. Following the completion of the transaction, the insider now directly owns 5,274,735 shares in the company, valued at $95,156,219.40. This represents a 9.11 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Also, insider Eric Karas sold 10,000 shares of the firm's stock in a transaction that occurred on Wednesday, September 18th. The shares were sold at an average price of $14.00, for a total transaction of $140,000.00. Following the completion of the sale, the insider now owns 5,693 shares in the company, valued at $79,702. This represents a 63.72 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 1,115,786 shares of company stock valued at $17,683,286. 40.10% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the stock. Barclays PLC grew its holdings in shares of ARS Pharmaceuticals by 189.7% during the third quarter. Barclays PLC now owns 111,666 shares of the company's stock worth $1,618,000 after purchasing an additional 73,127 shares during the last quarter. Geode Capital Management LLC grew its holdings in ARS Pharmaceuticals by 3.3% during the 3rd quarter. Geode Capital Management LLC now owns 1,234,805 shares of the company's stock worth $17,909,000 after acquiring an additional 38,927 shares during the last quarter. XTX Topco Ltd acquired a new position in ARS Pharmaceuticals in the 3rd quarter valued at approximately $250,000. Wellington Management Group LLP raised its stake in shares of ARS Pharmaceuticals by 38.9% during the third quarter. Wellington Management Group LLP now owns 162,335 shares of the company's stock valued at $2,354,000 after acquiring an additional 45,452 shares during the last quarter. Finally, Wexford Capital LP acquired a new position in shares of ARS Pharmaceuticals during the third quarter worth $3,601,000. 68.16% of the stock is currently owned by institutional investors and hedge funds.

ARS Pharmaceuticals Company Profile

(

Get Free Report)

ARS Pharmaceuticals, Inc, a biopharmaceutical company, develops treatments for severe allergic reactions. The company is developing neffy, a needle-free and low-dose intranasal epinephrine nasal spray for the emergency treatment of Type I allergic reactions, including anaphylaxis. It serves healthcare professionals, patients, and caregivers.

Recommended Stories

Before you consider ARS Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ARS Pharmaceuticals wasn't on the list.

While ARS Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.