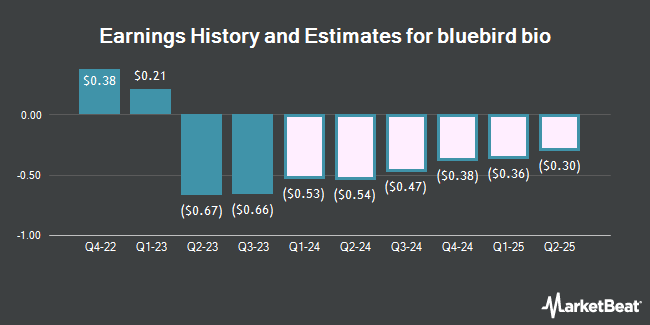

bluebird bio, Inc. (NASDAQ:BLUE - Free Report) - Stock analysts at Cantor Fitzgerald issued their FY2025 earnings per share estimates for shares of bluebird bio in a note issued to investors on Tuesday, January 21st. Cantor Fitzgerald analyst E. Schmidt expects that the biotechnology company will post earnings per share of ($23.60) for the year. The consensus estimate for bluebird bio's current full-year earnings is ($27.17) per share.

Other analysts have also recently issued reports about the company. Royal Bank of Canada reissued a "sector perform" rating and issued a $80.00 price target on shares of bluebird bio in a research report on Friday, November 15th. Bank of America downgraded bluebird bio from a "buy" rating to a "neutral" rating and dropped their target price for the stock from $60.00 to $10.00 in a report on Friday, November 15th. Wells Fargo & Company lowered their price target on bluebird bio from $60.00 to $40.00 and set an "equal weight" rating for the company in a research report on Wednesday, September 25th. StockNews.com started coverage on shares of bluebird bio in a research note on Friday, December 20th. They set a "sell" rating for the company. Finally, Barclays lifted their target price on shares of bluebird bio from $2.00 to $40.00 and gave the stock an "overweight" rating in a report on Tuesday, December 31st. Three analysts have rated the stock with a sell rating, five have assigned a hold rating and two have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average target price of $49.14.

View Our Latest Analysis on bluebird bio

bluebird bio Stock Down 2.8 %

NASDAQ:BLUE traded down $0.23 during mid-day trading on Wednesday, hitting $7.92. 230,926 shares of the company's stock were exchanged, compared to its average volume of 193,952. The company has a market cap of $76.93 million, a PE ratio of -0.21 and a beta of 0.68. The company has a debt-to-equity ratio of 0.37, a current ratio of 0.51 and a quick ratio of 0.33. bluebird bio has a one year low of $5.80 and a one year high of $38.40. The business has a fifty day moving average price of $8.12 and a 200 day moving average price of $12.07.

Institutional Investors Weigh In On bluebird bio

Hedge funds have recently added to or reduced their stakes in the stock. Barclays PLC increased its position in bluebird bio by 273.7% during the third quarter. Barclays PLC now owns 252,062 shares of the biotechnology company's stock valued at $130,000 after acquiring an additional 184,605 shares during the last quarter. Geode Capital Management LLC increased its position in shares of bluebird bio by 3.7% during the 3rd quarter. Geode Capital Management LLC now owns 4,683,042 shares of the biotechnology company's stock valued at $2,433,000 after purchasing an additional 166,771 shares during the last quarter. State Street Corp lifted its stake in shares of bluebird bio by 1.1% in the 3rd quarter. State Street Corp now owns 3,841,923 shares of the biotechnology company's stock worth $1,996,000 after purchasing an additional 43,382 shares during the period. Verition Fund Management LLC purchased a new position in shares of bluebird bio in the third quarter worth approximately $42,000. Finally, Captrust Financial Advisors grew its position in bluebird bio by 48.2% during the third quarter. Captrust Financial Advisors now owns 237,648 shares of the biotechnology company's stock valued at $123,000 after buying an additional 77,293 shares during the period. 87.43% of the stock is currently owned by hedge funds and other institutional investors.

bluebird bio Company Profile

(

Get Free Report)

bluebird bio, Inc, a biotechnology company, researches, develops, and commercializes gene therapies for severe genetic diseases. Its product candidates for severe genetic diseases include ZYNTEGLO (betibeglogene autotemcel) for the treatment of transfusion-dependent ß-thalassemia; lovotibeglogene autotemcel for the treatment of sickle cell disease (SCD); and SKYSONA (elivaldogene autotemcel) to treat cerebral adrenoleukodystrophy.

Recommended Stories

Before you consider bluebird bio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and bluebird bio wasn't on the list.

While bluebird bio currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.