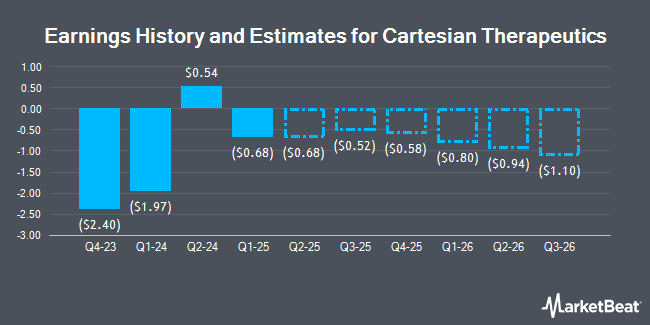

Cartesian Therapeutics, Inc. (NASDAQ:RNAC - Free Report) - Equities research analysts at Cantor Fitzgerald issued their FY2024 EPS estimates for Cartesian Therapeutics in a research note issued on Monday, December 2nd. Cantor Fitzgerald analyst K. Kluska anticipates that the company will post earnings of ($5.18) per share for the year. Cantor Fitzgerald has a "Hold" rating on the stock. The consensus estimate for Cartesian Therapeutics' current full-year earnings is $4.07 per share.

Several other equities analysts also recently weighed in on RNAC. TD Cowen assumed coverage on shares of Cartesian Therapeutics in a report on Tuesday, August 6th. They set a "buy" rating on the stock. Needham & Company LLC reissued a "buy" rating and issued a $41.00 target price on shares of Cartesian Therapeutics in a report on Tuesday. Finally, HC Wainwright reissued a "buy" rating and issued a $45.00 target price (up previously from $41.00) on shares of Cartesian Therapeutics in a report on Wednesday. Two research analysts have rated the stock with a hold rating and seven have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $43.00.

View Our Latest Stock Analysis on Cartesian Therapeutics

Cartesian Therapeutics Stock Up 9.6 %

NASDAQ:RNAC traded up $1.92 during trading hours on Wednesday, hitting $22.00. 239,591 shares of the stock traded hands, compared to its average volume of 96,766. Cartesian Therapeutics has a 1 year low of $11.66 and a 1 year high of $41.87. The company has a market cap of $559.13 million, a price-to-earnings ratio of -0.42 and a beta of 0.59. The stock has a 50 day moving average price of $19.88 and a 200 day moving average price of $19.73.

Insider Activity at Cartesian Therapeutics

In other news, Director Timothy A. Springer acquired 80,301 shares of the business's stock in a transaction on Friday, October 4th. The shares were acquired at an average price of $22.58 per share, for a total transaction of $1,813,196.58. Following the completion of the transaction, the director now directly owns 8,023,766 shares of the company's stock, valued at approximately $181,176,636.28. The trade was a 1.01 % increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CTO Metin Kurtoglu sold 32,789 shares of the business's stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $16.67, for a total transaction of $546,592.63. Following the transaction, the chief technology officer now owns 51,033 shares in the company, valued at $850,720.11. This trade represents a 39.12 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 128,089 shares of company stock valued at $2,169,555 over the last 90 days. 57.90% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

A number of hedge funds have recently bought and sold shares of the company. Vanguard Group Inc. bought a new position in Cartesian Therapeutics during the first quarter valued at $4,105,000. FMR LLC grew its holdings in shares of Cartesian Therapeutics by 458.3% in the third quarter. FMR LLC now owns 2,851,830 shares of the company's stock worth $45,972,000 after purchasing an additional 2,341,054 shares during the last quarter. Great Point Partners LLC bought a new position in shares of Cartesian Therapeutics in the third quarter worth about $3,224,000. State Street Corp grew its holdings in shares of Cartesian Therapeutics by 2.5% in the third quarter. State Street Corp now owns 157,495 shares of the company's stock worth $2,539,000 after purchasing an additional 3,830 shares during the last quarter. Finally, Geode Capital Management LLC grew its holdings in shares of Cartesian Therapeutics by 2.1% in the third quarter. Geode Capital Management LLC now owns 135,700 shares of the company's stock worth $2,188,000 after purchasing an additional 2,737 shares during the last quarter. Institutional investors own 86.95% of the company's stock.

About Cartesian Therapeutics

(

Get Free Report)

Cartesian Therapeutics, Inc, a clinical-stage biotechnology company, engages in the provision of mRNA cell therapies for the treatment of autoimmune diseases. It develops Descartes-08, an autologous anti-BCMA RNA-engineered chimeric antigen receptor T-cell therapy, currently under Phase 2b clinical development for generalized myasthenia gravis, as well as for patients with systemic lupus erythematosus, and myeloma autoimmune basket trials for other autoimmune diseases.

See Also

Before you consider Cartesian Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cartesian Therapeutics wasn't on the list.

While Cartesian Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.