Cape Ann Asset Management Ltd bought a new position in Laureate Education, Inc. (NASDAQ:LAUR - Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund bought 1,048,300 shares of the company's stock, valued at approximately $17,412,000. Laureate Education comprises about 11.9% of Cape Ann Asset Management Ltd's holdings, making the stock its 4th biggest position. Cape Ann Asset Management Ltd owned 0.70% of Laureate Education at the end of the most recent quarter.

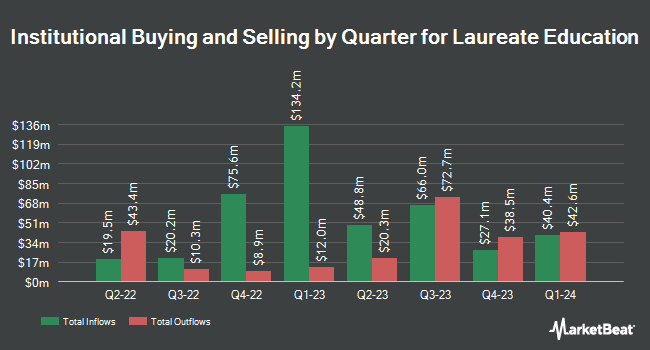

Several other hedge funds and other institutional investors have also bought and sold shares of the stock. Swedbank AB grew its stake in shares of Laureate Education by 225.8% during the 3rd quarter. Swedbank AB now owns 2,513,300 shares of the company's stock valued at $41,746,000 after purchasing an additional 1,741,800 shares during the period. Harbor Capital Advisors Inc. grew its position in Laureate Education by 207.4% during the third quarter. Harbor Capital Advisors Inc. now owns 824,985 shares of the company's stock valued at $13,703,000 after buying an additional 556,573 shares during the period. Van Berkom & Associates Inc. increased its holdings in Laureate Education by 2.2% during the second quarter. Van Berkom & Associates Inc. now owns 6,951,804 shares of the company's stock valued at $103,860,000 after buying an additional 151,397 shares during the last quarter. Vanguard Group Inc. raised its position in Laureate Education by 1.0% in the first quarter. Vanguard Group Inc. now owns 14,231,273 shares of the company's stock worth $207,350,000 after acquiring an additional 136,865 shares during the period. Finally, Renaissance Technologies LLC boosted its stake in shares of Laureate Education by 56.7% during the 2nd quarter. Renaissance Technologies LLC now owns 330,400 shares of the company's stock worth $4,936,000 after acquiring an additional 119,600 shares during the last quarter. Institutional investors own 96.27% of the company's stock.

Laureate Education Price Performance

Shares of NASDAQ LAUR traded up $0.25 during midday trading on Friday, reaching $19.52. The stock had a trading volume of 595,721 shares, compared to its average volume of 713,775. The company has a market capitalization of $2.94 billion, a price-to-earnings ratio of 12.35 and a beta of 0.82. Laureate Education, Inc. has a 12-month low of $12.45 and a 12-month high of $19.58. The stock has a 50-day moving average of $16.79 and a 200-day moving average of $15.69. The company has a debt-to-equity ratio of 0.15, a quick ratio of 0.63 and a current ratio of 0.63.

Laureate Education (NASDAQ:LAUR - Get Free Report) last posted its quarterly earnings results on Thursday, October 31st. The company reported $0.56 EPS for the quarter, beating analysts' consensus estimates of $0.16 by $0.40. The business had revenue of $368.60 million for the quarter, compared to analysts' expectations of $361.80 million. Laureate Education had a return on equity of 27.13% and a net margin of 15.76%. The business's quarterly revenue was up 2.0% on a year-over-year basis. During the same period last year, the firm earned $0.23 earnings per share. As a group, research analysts anticipate that Laureate Education, Inc. will post 1.42 EPS for the current fiscal year.

Analyst Ratings Changes

Separately, BMO Capital Markets raised their target price on Laureate Education from $17.00 to $20.00 and gave the stock an "outperform" rating in a report on Friday, November 1st.

Read Our Latest Research Report on LAUR

Laureate Education Profile

(

Free Report)

Laureate Education, Inc, together with its subsidiaries, offers higher education programs and services to students through a network of universities and higher education institutions. The company provides a range of undergraduate and graduate degree programs in the areas of business and management, medicine and health sciences, and engineering and information technology through campus-based, online, and hybrid programs.

Further Reading

Before you consider Laureate Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Laureate Education wasn't on the list.

While Laureate Education currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.