Capital Management Associates Inc lowered its position in shares of FS KKR Capital Corp. (NYSE:FSK - Free Report) by 39.0% in the fourth quarter, according to its most recent disclosure with the SEC. The institutional investor owned 25,530 shares of the company's stock after selling 16,349 shares during the quarter. Capital Management Associates Inc's holdings in FS KKR Capital were worth $555,000 as of its most recent SEC filing.

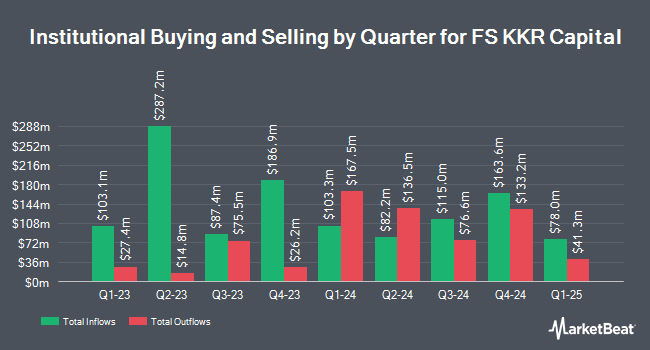

A number of other institutional investors and hedge funds have also recently made changes to their positions in FSK. McIlrath & Eck LLC grew its holdings in shares of FS KKR Capital by 47.5% during the third quarter. McIlrath & Eck LLC now owns 2,096 shares of the company's stock valued at $41,000 after buying an additional 675 shares during the last quarter. FNY Investment Advisers LLC purchased a new stake in shares of FS KKR Capital in the fourth quarter worth about $52,000. Thurston Springer Miller Herd & Titak Inc. boosted its holdings in FS KKR Capital by 122.6% in the 4th quarter. Thurston Springer Miller Herd & Titak Inc. now owns 2,760 shares of the company's stock valued at $60,000 after purchasing an additional 1,520 shares during the period. Nomura Asset Management Co. Ltd. raised its position in FS KKR Capital by 164.8% during the third quarter. Nomura Asset Management Co. Ltd. now owns 6,016 shares of the company's stock valued at $119,000 after purchasing an additional 3,744 shares in the last quarter. Finally, Financial Life Planners bought a new stake in FS KKR Capital in the fourth quarter valued at approximately $206,000. Institutional investors and hedge funds own 36.26% of the company's stock.

FS KKR Capital Price Performance

Shares of FS KKR Capital stock traded up $0.21 during trading hours on Wednesday, reaching $23.37. 1,060,245 shares of the company's stock were exchanged, compared to its average volume of 1,213,109. The company has a quick ratio of 2.96, a current ratio of 2.96 and a debt-to-equity ratio of 1.21. The business has a fifty day moving average of $22.02 and a two-hundred day moving average of $20.89. FS KKR Capital Corp. has a 1 year low of $18.31 and a 1 year high of $23.47. The company has a market capitalization of $6.55 billion, a P/E ratio of 12.43 and a beta of 1.25.

Wall Street Analyst Weigh In

FSK has been the subject of several research analyst reports. Wells Fargo & Company reiterated an "equal weight" rating and issued a $21.00 price objective on shares of FS KKR Capital in a report on Monday, December 2nd. JPMorgan Chase & Co. lifted their price objective on FS KKR Capital from $20.00 to $22.00 and gave the company a "neutral" rating in a research report on Monday, February 3rd. Royal Bank of Canada lifted their price target on shares of FS KKR Capital from $20.00 to $21.00 and gave the company a "sector perform" rating in a report on Monday, November 18th. Finally, B. Riley lowered FS KKR Capital from a "buy" rating to a "neutral" rating and set a $21.50 price objective for the company. in a research report on Wednesday, December 11th. Eight investment analysts have rated the stock with a hold rating, Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $20.63.

View Our Latest Analysis on FSK

Insider Activity at FS KKR Capital

In other FS KKR Capital news, insider Brian Gerson purchased 5,000 shares of the business's stock in a transaction that occurred on Tuesday, December 3rd. The shares were purchased at an average price of $22.08 per share, for a total transaction of $110,400.00. Following the completion of the acquisition, the insider now owns 15,109 shares of the company's stock, valued at approximately $333,606.72. This represents a 49.46 % increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Insiders purchased a total of 11,500 shares of company stock valued at $248,910 over the last ninety days. Insiders own 0.25% of the company's stock.

About FS KKR Capital

(

Free Report)

FS KKR Capital Corp. is a business development company specializing in investments in debt securities. It provides customized credit solutions to private middle market U.S. companies. It invest primarily in the senior secured debt and, to a lesser extent, the subordinated debt of private middle market U.S.

Read More

Before you consider FS KKR Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FS KKR Capital wasn't on the list.

While FS KKR Capital currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.