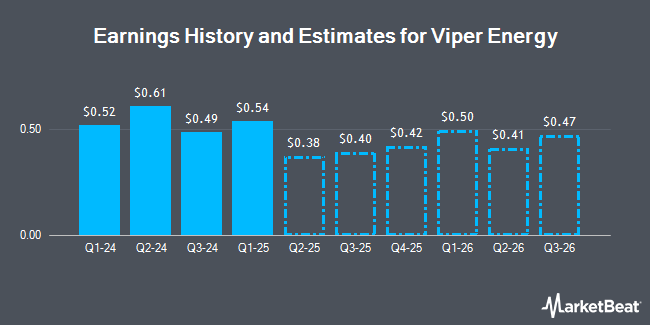

Viper Energy, Inc. (NASDAQ:VNOM - Free Report) - Investment analysts at Capital One Financial lowered their Q4 2024 earnings estimates for shares of Viper Energy in a research note issued on Wednesday, November 27th. Capital One Financial analyst B. Velie now forecasts that the oil and gas producer will earn $0.45 per share for the quarter, down from their previous estimate of $0.52. The consensus estimate for Viper Energy's current full-year earnings is $2.02 per share. Capital One Financial also issued estimates for Viper Energy's Q1 2025 earnings at $0.76 EPS, Q2 2025 earnings at $0.49 EPS, Q3 2025 earnings at $0.53 EPS, Q4 2025 earnings at $0.54 EPS, FY2025 earnings at $2.32 EPS and FY2026 earnings at $2.68 EPS.

Viper Energy (NASDAQ:VNOM - Get Free Report) last issued its quarterly earnings results on Monday, November 4th. The oil and gas producer reported $0.49 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.47 by $0.02. The business had revenue of $209.59 million for the quarter, compared to the consensus estimate of $210.54 million. Viper Energy had a return on equity of 6.72% and a net margin of 24.65%. The business's quarterly revenue was down 28.5% on a year-over-year basis. During the same period in the prior year, the firm posted $1.10 earnings per share.

VNOM has been the subject of several other reports. Raymond James increased their price objective on shares of Viper Energy from $58.00 to $62.00 and gave the company an "outperform" rating in a research report on Thursday, November 21st. Piper Sandler raised their price target on shares of Viper Energy from $61.00 to $64.00 and gave the stock an "overweight" rating in a report on Monday, November 18th. Truist Financial boosted their price objective on shares of Viper Energy from $57.00 to $64.00 and gave the company a "buy" rating in a report on Wednesday, November 6th. StockNews.com lowered Viper Energy from a "hold" rating to a "sell" rating in a research note on Tuesday, November 5th. Finally, Roth Mkm boosted their price target on Viper Energy from $46.00 to $53.00 and gave the company a "buy" rating in a research note on Wednesday, October 16th. One equities research analyst has rated the stock with a sell rating and nine have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $55.78.

Check Out Our Latest Stock Report on VNOM

Viper Energy Stock Down 0.6 %

NASDAQ:VNOM traded down $0.32 during mid-day trading on Thursday, hitting $53.94. 643,558 shares of the company's stock traded hands, compared to its average volume of 887,007. The company has a debt-to-equity ratio of 0.25, a quick ratio of 7.24 and a current ratio of 7.24. The company has a market capitalization of $10.16 billion, a P/E ratio of 23.15 and a beta of 1.72. The company has a fifty day moving average of $51.10 and a 200 day moving average of $44.72. Viper Energy has a twelve month low of $29.03 and a twelve month high of $56.76.

Institutional Trading of Viper Energy

Hedge funds and other institutional investors have recently bought and sold shares of the stock. Price T Rowe Associates Inc. MD purchased a new stake in Viper Energy in the 1st quarter worth approximately $601,000. California State Teachers Retirement System boosted its holdings in Viper Energy by 18.4% during the first quarter. California State Teachers Retirement System now owns 72,600 shares of the oil and gas producer's stock worth $2,792,000 after buying an additional 11,293 shares in the last quarter. Tidal Investments LLC acquired a new stake in Viper Energy during the first quarter valued at $290,000. Aurora Investment Counsel increased its holdings in Viper Energy by 1.5% in the first quarter. Aurora Investment Counsel now owns 52,626 shares of the oil and gas producer's stock valued at $2,024,000 after buying an additional 757 shares in the last quarter. Finally, SG Americas Securities LLC raised its position in shares of Viper Energy by 627.6% in the second quarter. SG Americas Securities LLC now owns 78,413 shares of the oil and gas producer's stock worth $2,943,000 after acquiring an additional 67,636 shares during the period. 87.72% of the stock is owned by institutional investors and hedge funds.

Viper Energy Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Thursday, November 21st. Stockholders of record on Thursday, November 14th were paid a $0.30 dividend. The ex-dividend date was Thursday, November 14th. This represents a $1.20 dividend on an annualized basis and a dividend yield of 2.22%. Viper Energy's payout ratio is 51.50%.

About Viper Energy

(

Get Free Report)

Viper Energy, Inc owns and acquires mineral and royalty interests in oil and natural gas properties in the Permian Basin, North America. Viper Energy Partners GP LLC operates as the general partner of the company. The company was formerly known as Viper Energy Partners LP and changed its name to Viper Energy, Inc in November 2023.

Recommended Stories

Before you consider Viper Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viper Energy wasn't on the list.

While Viper Energy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.