Caprock Group LLC purchased a new position in shares of SmartRent, Inc. (NYSE:SMRT - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 1,154,058 shares of the company's stock, valued at approximately $1,997,000. Caprock Group LLC owned about 0.57% of SmartRent at the end of the most recent quarter.

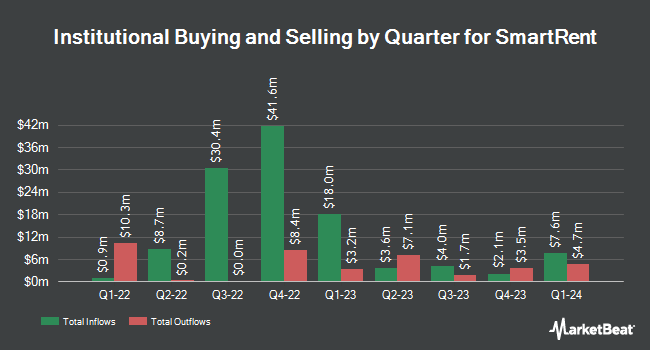

A number of other institutional investors also recently bought and sold shares of SMRT. Long Pond Capital LP grew its stake in shares of SmartRent by 133.1% during the 2nd quarter. Long Pond Capital LP now owns 9,316,093 shares of the company's stock worth $22,265,000 after purchasing an additional 5,320,147 shares during the period. Vanguard Group Inc. grew its stake in SmartRent by 1.9% in the 1st quarter. Vanguard Group Inc. now owns 20,244,087 shares of the company's stock valued at $54,254,000 after acquiring an additional 386,845 shares during the period. Land & Buildings Investment Management LLC grew its stake in SmartRent by 82.0% in the 2nd quarter. Land & Buildings Investment Management LLC now owns 5,658,366 shares of the company's stock valued at $13,523,000 after acquiring an additional 2,549,856 shares during the period. Dimensional Fund Advisors LP grew its stake in SmartRent by 16.9% in the 2nd quarter. Dimensional Fund Advisors LP now owns 3,248,368 shares of the company's stock valued at $7,763,000 after acquiring an additional 468,619 shares during the period. Finally, Price T Rowe Associates Inc. MD grew its stake in SmartRent by 18.2% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 53,177 shares of the company's stock valued at $143,000 after acquiring an additional 8,169 shares during the period. 59.42% of the stock is owned by hedge funds and other institutional investors.

Insider Activity at SmartRent

In related news, Director Frank Martell purchased 48,204 shares of the business's stock in a transaction dated Monday, November 18th. The stock was acquired at an average price of $1.45 per share, for a total transaction of $69,895.80. Following the completion of the purchase, the director now directly owns 248,204 shares of the company's stock, valued at $359,895.80. This trade represents a 24.10 % increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CMO Robyn Young purchased 14,793 shares of the business's stock in a transaction dated Friday, August 30th. The shares were bought at an average price of $1.70 per share, with a total value of $25,148.10. Following the purchase, the chief marketing officer now directly owns 52,305 shares of the company's stock, valued at approximately $88,918.50. The trade was a 39.44 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders acquired 187,997 shares of company stock valued at $291,794 over the last three months. 9.00% of the stock is owned by corporate insiders.

SmartRent Stock Performance

Shares of SMRT opened at $1.47 on Thursday. SmartRent, Inc. has a 12-month low of $1.17 and a 12-month high of $3.47. The company's 50-day moving average price is $1.67 and its 200 day moving average price is $1.99.

SmartRent (NYSE:SMRT - Get Free Report) last released its earnings results on Wednesday, November 6th. The company reported ($0.05) earnings per share for the quarter, missing the consensus estimate of ($0.02) by ($0.03). SmartRent had a negative net margin of 12.77% and a negative return on equity of 6.08%. The firm had revenue of $40.50 million during the quarter, compared to analyst estimates of $45.94 million. During the same period in the prior year, the firm earned ($0.04) earnings per share. The business's revenue was down 30.3% compared to the same quarter last year. On average, analysts forecast that SmartRent, Inc. will post -0.14 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several equities research analysts have issued reports on SMRT shares. Colliers Securities cut shares of SmartRent from a "buy" rating to a "neutral" rating in a research note on Wednesday, July 31st. Cantor Fitzgerald cut shares of SmartRent from an "overweight" rating to a "neutral" rating and lowered their target price for the stock from $4.00 to $2.00 in a research note on Thursday, August 8th. BTIG Research cut shares of SmartRent from a "buy" rating to a "neutral" rating in a research note on Friday, August 2nd. Keefe, Bruyette & Woods cut shares of SmartRent from an "outperform" rating to a "market perform" rating and lowered their target price for the stock from $3.50 to $2.00 in a research note on Thursday, August 8th. Finally, DA Davidson cut shares of SmartRent from a "buy" rating to a "neutral" rating and lowered their target price for the stock from $3.25 to $2.00 in a research note on Wednesday, July 31st. Five equities research analysts have rated the stock with a hold rating, According to data from MarketBeat, SmartRent presently has an average rating of "Hold" and an average price target of $2.50.

Read Our Latest Report on SmartRent

SmartRent Profile

(

Free Report)

SmartRent, Inc, an enterprise software company, provides an integrated smart home operating system to residential property owners and operators, homebuilders, institutional home buyers, developers, and residents in the United States. The company's products and solutions include smart apartments and homes, access control for buildings, common areas, and rental units, asset protection and monitoring, parking management, self-guided tours, and community and resident Wi-Fi.

Further Reading

Before you consider SmartRent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SmartRent wasn't on the list.

While SmartRent currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.