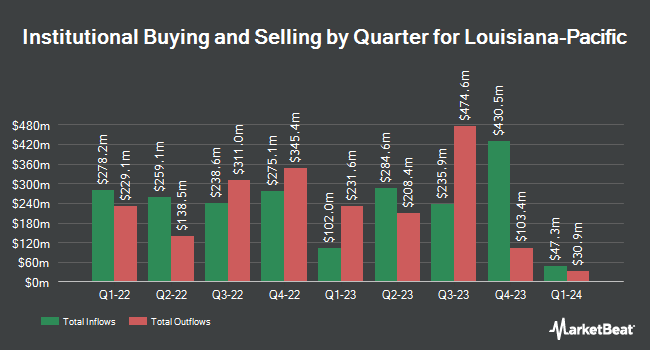

Capstone Investment Advisors LLC decreased its position in Louisiana-Pacific Co. (NYSE:LPX - Free Report) by 69.5% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 2,015 shares of the building manufacturing company's stock after selling 4,586 shares during the quarter. Capstone Investment Advisors LLC's holdings in Louisiana-Pacific were worth $217,000 at the end of the most recent reporting period.

A number of other institutional investors also recently modified their holdings of LPX. Tidal Investments LLC bought a new position in Louisiana-Pacific in the first quarter valued at $413,000. Swedbank AB acquired a new stake in shares of Louisiana-Pacific in the first quarter valued at about $777,000. Burney Co. bought a new stake in Louisiana-Pacific during the first quarter worth about $229,000. Cetera Advisors LLC acquired a new position in Louisiana-Pacific during the first quarter valued at approximately $400,000. Finally, GAMMA Investing LLC grew its stake in Louisiana-Pacific by 57.3% in the second quarter. GAMMA Investing LLC now owns 486 shares of the building manufacturing company's stock valued at $40,000 after purchasing an additional 177 shares in the last quarter. 94.73% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

A number of brokerages have recently issued reports on LPX. BMO Capital Markets upped their price objective on Louisiana-Pacific from $99.00 to $103.00 and gave the stock a "market perform" rating in a research note on Tuesday, November 12th. StockNews.com cut shares of Louisiana-Pacific from a "buy" rating to a "hold" rating in a report on Sunday, November 10th. Truist Financial lifted their price target on Louisiana-Pacific from $105.00 to $113.00 and gave the stock a "buy" rating in a report on Tuesday, October 15th. TD Securities upped their price objective on Louisiana-Pacific from $115.00 to $123.00 and gave the company a "hold" rating in a research note on Wednesday, November 6th. Finally, Bank of America lifted their target price on Louisiana-Pacific from $73.00 to $75.00 and gave the stock an "underperform" rating in a research note on Thursday, September 12th. Two equities research analysts have rated the stock with a sell rating, six have assigned a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus target price of $102.22.

View Our Latest Stock Analysis on Louisiana-Pacific

Insider Buying and Selling

In other Louisiana-Pacific news, Director Ozey K. Horton, Jr. sold 300 shares of the company's stock in a transaction on Tuesday, November 12th. The shares were sold at an average price of $113.41, for a total transaction of $34,023.00. Following the sale, the director now owns 28,638 shares of the company's stock, valued at approximately $3,247,835.58. This represents a 1.04 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, Director Lizanne C. Gottung sold 2,500 shares of Louisiana-Pacific stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $98.30, for a total value of $245,750.00. Following the completion of the transaction, the director now directly owns 21,005 shares of the company's stock, valued at approximately $2,064,791.50. This trade represents a 10.64 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.26% of the stock is owned by insiders.

Louisiana-Pacific Trading Up 1.3 %

NYSE:LPX traded up $1.56 during mid-day trading on Friday, hitting $118.20. 230,390 shares of the company's stock were exchanged, compared to its average volume of 656,343. Louisiana-Pacific Co. has a fifty-two week low of $60.37 and a fifty-two week high of $122.87. The company has a current ratio of 2.92, a quick ratio of 1.69 and a debt-to-equity ratio of 0.21. The firm has a market capitalization of $8.30 billion, a P/E ratio of 20.38, a PEG ratio of 2.85 and a beta of 1.88. The company has a 50 day simple moving average of $107.68 and a 200-day simple moving average of $97.27.

Louisiana-Pacific Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, November 27th. Stockholders of record on Wednesday, November 20th were given a dividend of $0.26 per share. The ex-dividend date of this dividend was Wednesday, November 20th. This represents a $1.04 dividend on an annualized basis and a dividend yield of 0.88%. Louisiana-Pacific's dividend payout ratio (DPR) is 17.93%.

Louisiana-Pacific Company Profile

(

Free Report)

Louisiana-Pacific Corporation, together with its subsidiaries, provides building solutions primarily for use in new home construction, repair and remodeling, and outdoor structure markets. It operates through Siding, Oriented Strand Board, LP South America, and Other segments. The Siding segment offers LP SmartSide trim and siding products, LP SmartSide ExpertFinish trim and siding products, LP BuilderSeries lap siding products, and LP Outdoor Building Solutions; and engineered wood siding, trim, soffit, and fascia products.

Featured Articles

Before you consider Louisiana-Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Louisiana-Pacific wasn't on the list.

While Louisiana-Pacific currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.