Captrust Financial Advisors trimmed its position in Parker-Hannifin Co. (NYSE:PH - Free Report) by 16.6% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 9,316 shares of the industrial products company's stock after selling 1,858 shares during the period. Captrust Financial Advisors' holdings in Parker-Hannifin were worth $5,886,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

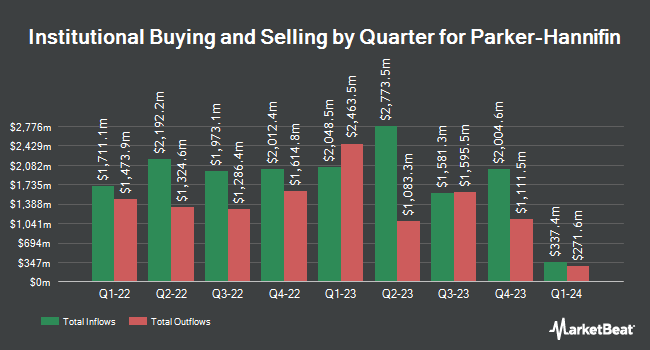

A number of other institutional investors have also recently modified their holdings of PH. International Assets Investment Management LLC lifted its stake in shares of Parker-Hannifin by 64,081.5% during the third quarter. International Assets Investment Management LLC now owns 381,880 shares of the industrial products company's stock valued at $241,279,000 after buying an additional 381,285 shares during the period. Mizuho Securities USA LLC lifted its stake in shares of Parker-Hannifin by 3,566.4% in the 3rd quarter. Mizuho Securities USA LLC now owns 363,302 shares of the industrial products company's stock worth $229,541,000 after acquiring an additional 353,393 shares during the period. FMR LLC raised its holdings in shares of Parker-Hannifin by 7.1% during the third quarter. FMR LLC now owns 4,116,257 shares of the industrial products company's stock valued at $2,600,733,000 after acquiring an additional 272,531 shares during the period. Mackenzie Financial Corp increased its stake in Parker-Hannifin by 107.7% in the 2nd quarter. Mackenzie Financial Corp now owns 271,717 shares of the industrial products company's stock valued at $137,437,000 after buying an additional 140,898 shares during the period. Finally, Swedbank AB grew its position in Parker-Hannifin by 377.8% in the third quarter. Swedbank AB now owns 158,085 shares of the industrial products company's stock worth $99,881,000 after acquiring an additional 125,000 shares in the last quarter. 82.44% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In other news, VP Joseph R. Leonti sold 5,877 shares of the business's stock in a transaction that occurred on Friday, November 1st. The stock was sold at an average price of $631.04, for a total transaction of $3,708,622.08. Following the completion of the transaction, the vice president now directly owns 15,350 shares in the company, valued at approximately $9,686,464. The trade was a 27.69 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, VP Thomas C. Gentile sold 2,430 shares of the stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $701.16, for a total value of $1,703,818.80. Following the completion of the sale, the vice president now owns 5,465 shares of the company's stock, valued at $3,831,839.40. The trade was a 30.78 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 18,077 shares of company stock valued at $12,303,829 in the last quarter. Insiders own 0.39% of the company's stock.

Analyst Upgrades and Downgrades

PH has been the topic of several recent research reports. TD Cowen raised their target price on shares of Parker-Hannifin from $520.00 to $575.00 and gave the company a "hold" rating in a research note on Tuesday, November 12th. Barclays increased their price target on Parker-Hannifin from $650.00 to $703.00 and gave the stock an "overweight" rating in a report on Wednesday, October 2nd. Stifel Nicolaus downgraded Parker-Hannifin from a "buy" rating to a "hold" rating and set a $691.00 target price for the company. in a research note on Monday, November 18th. Evercore ISI lifted their price objective on Parker-Hannifin from $620.00 to $656.00 and gave the stock an "outperform" rating in a research report on Monday, August 19th. Finally, Truist Financial upped their price target on Parker-Hannifin from $673.00 to $788.00 and gave the company a "buy" rating in a report on Wednesday, October 9th. Three research analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the company. Based on data from MarketBeat.com, Parker-Hannifin currently has a consensus rating of "Moderate Buy" and an average price target of $691.40.

View Our Latest Stock Report on Parker-Hannifin

Parker-Hannifin Stock Performance

NYSE PH traded up $0.12 during trading on Tuesday, hitting $700.81. 328,030 shares of the company's stock traded hands, compared to its average volume of 637,446. The company has a debt-to-equity ratio of 0.52, a quick ratio of 0.57 and a current ratio of 0.96. The business has a 50 day moving average of $659.52 and a 200-day moving average of $588.16. The stock has a market capitalization of $90.21 billion, a price-to-earnings ratio of 31.65, a PEG ratio of 2.83 and a beta of 1.43. Parker-Hannifin Co. has a 12-month low of $431.98 and a 12-month high of $712.42.

Parker-Hannifin (NYSE:PH - Get Free Report) last issued its earnings results on Thursday, October 31st. The industrial products company reported $6.20 earnings per share for the quarter, topping analysts' consensus estimates of $6.14 by $0.06. The business had revenue of $4.90 billion during the quarter, compared to analyst estimates of $4.90 billion. Parker-Hannifin had a return on equity of 27.95% and a net margin of 14.47%. Parker-Hannifin's revenue was up 1.2% on a year-over-year basis. During the same quarter in the previous year, the firm earned $5.96 EPS. As a group, equities research analysts anticipate that Parker-Hannifin Co. will post 26.77 earnings per share for the current fiscal year.

Parker-Hannifin Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, December 6th. Stockholders of record on Friday, November 8th will be paid a $1.63 dividend. This represents a $6.52 dividend on an annualized basis and a dividend yield of 0.93%. The ex-dividend date of this dividend is Friday, November 8th. Parker-Hannifin's dividend payout ratio is presently 29.45%.

Parker-Hannifin Company Profile

(

Free Report)

Parker-Hannifin Corporation manufactures and sells motion and control technologies and systems for various mobile, industrial, and aerospace markets worldwide. The company operates through two segments: Diversified Industrial and Aerospace Systems. The Diversified Industrial segment offers sealing, shielding, thermal products and systems, adhesives, coatings, and noise vibration and harshness solutions; filters, systems, and diagnostics solutions to ensure purity and remove contaminants from fuel, air, oil, water, and other liquids and gases; connectors used in fluid and gas handling; and hydraulic, pneumatic, and electromechanical components and systems for builders and users of mobile and industrial machinery and equipment.

Further Reading

Before you consider Parker-Hannifin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Parker-Hannifin wasn't on the list.

While Parker-Hannifin currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report