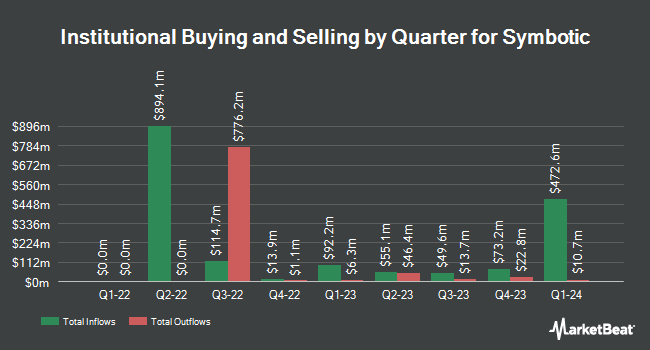

Captrust Financial Advisors lessened its stake in Symbotic Inc. (NASDAQ:SYM - Free Report) by 79.2% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 10,919 shares of the company's stock after selling 41,667 shares during the quarter. Captrust Financial Advisors' holdings in Symbotic were worth $266,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also modified their holdings of SYM. Castleview Partners LLC boosted its holdings in shares of Symbotic by 50.0% during the 3rd quarter. Castleview Partners LLC now owns 1,500 shares of the company's stock worth $37,000 after purchasing an additional 500 shares during the last quarter. Arcadia Investment Management Corp MI acquired a new position in shares of Symbotic during the 3rd quarter worth approximately $49,000. RiverPark Advisors LLC boosted its holdings in shares of Symbotic by 147.1% during the 3rd quarter. RiverPark Advisors LLC now owns 2,034 shares of the company's stock worth $50,000 after purchasing an additional 1,211 shares during the last quarter. RFP Financial Group LLC boosted its holdings in shares of Symbotic by 22.4% during the 2nd quarter. RFP Financial Group LLC now owns 1,692 shares of the company's stock worth $59,000 after purchasing an additional 310 shares during the last quarter. Finally, Quest Partners LLC boosted its holdings in shares of Symbotic by 19,307.7% during the 3rd quarter. Quest Partners LLC now owns 2,523 shares of the company's stock worth $62,000 after purchasing an additional 2,510 shares during the last quarter.

Analysts Set New Price Targets

A number of research analysts recently commented on SYM shares. William Blair reiterated a "market perform" rating on shares of Symbotic in a report on Thursday, December 5th. Craig Hallum lowered Symbotic from a "buy" rating to a "hold" rating and set a $25.00 price target for the company. in a research report on Wednesday, November 27th. BWS Financial restated a "sell" rating and set a $10.00 price target on shares of Symbotic in a research report on Tuesday, November 19th. KeyCorp reiterated a "sector weight" rating on shares of Symbotic in a report on Wednesday, November 27th. Finally, Cantor Fitzgerald reiterated an "overweight" rating and issued a $60.00 target price on shares of Symbotic in a report on Tuesday, November 19th. One research analyst has rated the stock with a sell rating, five have given a hold rating and eight have given a buy rating to the stock. According to data from MarketBeat.com, Symbotic has an average rating of "Moderate Buy" and a consensus price target of $42.54.

Read Our Latest Research Report on Symbotic

Insider Buying and Selling

In other news, insider William M. Boyd III sold 8,826 shares of Symbotic stock in a transaction on Monday, October 28th. The stock was sold at an average price of $28.33, for a total transaction of $250,040.58. Following the completion of the transaction, the insider now owns 23,012 shares of the company's stock, valued at $651,929.96. The trade was a 27.72 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. Also, insider Michael David Dunn sold 63,867 shares of Symbotic stock in a transaction on Monday, December 9th. The stock was sold at an average price of $30.08, for a total value of $1,921,119.36. Following the transaction, the insider now directly owns 24,055 shares of the company's stock, valued at $723,574.40. This trade represents a 72.64 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 111,745 shares of company stock valued at $3,261,675 over the last quarter. 38.30% of the stock is currently owned by insiders.

Symbotic Stock Down 0.5 %

Symbotic stock traded down $0.14 during midday trading on Friday, reaching $26.87. The company's stock had a trading volume of 2,062,683 shares, compared to its average volume of 4,334,410. The business has a 50-day simple moving average of $29.55 and a 200-day simple moving average of $29.38. Symbotic Inc. has a fifty-two week low of $17.11 and a fifty-two week high of $58.28. The company has a market cap of $15.78 billion, a P/E ratio of -447.83 and a beta of 1.73.

Symbotic (NASDAQ:SYM - Get Free Report) last posted its earnings results on Monday, November 18th. The company reported $0.05 EPS for the quarter, hitting analysts' consensus estimates of $0.05. Symbotic had a positive return on equity of 6.49% and a negative net margin of 0.32%. The business had revenue of $576.77 million for the quarter, compared to analysts' expectations of $470.24 million. During the same quarter in the previous year, the firm earned ($0.08) earnings per share. The business's revenue was up 47.2% compared to the same quarter last year. As a group, equities analysts forecast that Symbotic Inc. will post 0.12 earnings per share for the current year.

Symbotic Profile

(

Free Report)

Symbotic Inc, an automation technology company, engages in developing technologies to improve operating efficiencies in modern warehouses. The company automates the processing of pallets and cases in large warehouses or distribution centers for retail companies. Its systems enhance operations at the front end of the supply chain.

Featured Articles

Before you consider Symbotic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Symbotic wasn't on the list.

While Symbotic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.