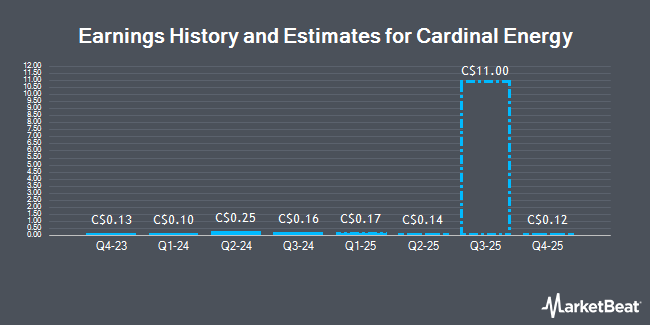

Cardinal Energy Ltd. (TSE:CJ - Free Report) - Analysts at Atb Cap Markets lowered their Q2 2025 earnings estimates for Cardinal Energy in a note issued to investors on Thursday, December 12th. Atb Cap Markets analyst A. Arif now forecasts that the company will earn $0.17 per share for the quarter, down from their prior forecast of $0.18. The consensus estimate for Cardinal Energy's current full-year earnings is $0.63 per share.

Several other brokerages have also commented on CJ. BMO Capital Markets decreased their price objective on shares of Cardinal Energy from C$7.50 to C$7.00 in a research report on Friday, October 4th. Royal Bank of Canada decreased their price objective on shares of Cardinal Energy from C$8.00 to C$7.00 in a research report on Tuesday, September 17th. Finally, CIBC decreased their price objective on shares of Cardinal Energy from C$8.75 to C$8.00 in a research report on Friday, November 8th.

View Our Latest Stock Report on Cardinal Energy

Cardinal Energy Stock Down 1.3 %

Shares of CJ stock traded down C$0.08 during mid-day trading on Monday, hitting C$6.29. 437,266 shares of the stock traded hands, compared to its average volume of 648,778. The stock has a market cap of C$1.00 billion, a P/E ratio of 8.62, a P/E/G ratio of -0.26 and a beta of 2.81. The stock's fifty day moving average is C$6.48 and its two-hundred day moving average is C$6.64. Cardinal Energy has a 52-week low of C$6.01 and a 52-week high of C$7.38. The company has a debt-to-equity ratio of 9.04, a current ratio of 0.73 and a quick ratio of 0.67.

Insider Buying and Selling at Cardinal Energy

In other Cardinal Energy news, Director John Albert Brussa acquired 6,400 shares of the business's stock in a transaction that occurred on Wednesday, September 25th. The stock was purchased at an average cost of C$6.40 per share, with a total value of C$40,960.00. Also, Director John Festival acquired 50,050 shares of the business's stock in a transaction that occurred on Monday, November 11th. The shares were acquired at an average cost of C$6.20 per share, with a total value of C$310,310.00. In the last 90 days, insiders have bought 59,050 shares of company stock worth $367,518. Corporate insiders own 23.38% of the company's stock.

Cardinal Energy Dividend Announcement

The company also recently disclosed a monthly dividend, which will be paid on Monday, December 16th. Shareholders of record on Friday, November 29th will be issued a $0.06 dividend. The ex-dividend date is Friday, November 29th. This represents a $0.72 dividend on an annualized basis and a yield of 11.45%. Cardinal Energy's payout ratio is currently 98.63%.

About Cardinal Energy

(

Get Free Report)

Cardinal Energy Ltd. engages in the acquisition, development, optimization, and production of petroleum and natural gas in the provinces of Alberta, British Columbia, and Saskatchewan. Cardinal Energy Ltd. was incorporated in 2010 and is headquartered in Calgary, Canada.

Further Reading

Before you consider Cardinal Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cardinal Energy wasn't on the list.

While Cardinal Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.