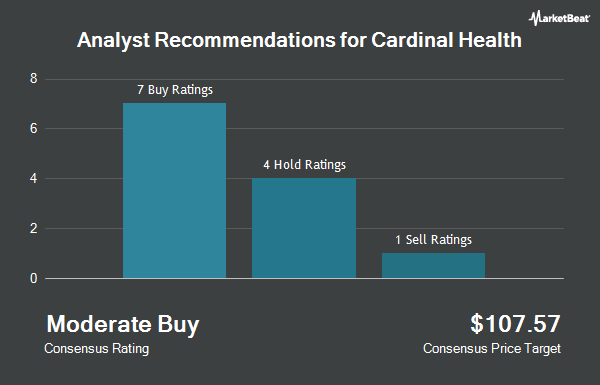

Cardinal Health, Inc. (NYSE:CAH - Get Free Report) has received a consensus recommendation of "Moderate Buy" from the fourteen research firms that are presently covering the company, Marketbeat reports. Four investment analysts have rated the stock with a hold rating and ten have given a buy rating to the company. The average 1 year price target among brokerages that have updated their coverage on the stock in the last year is $139.36.

A number of equities analysts recently issued reports on CAH shares. Wells Fargo & Company increased their price target on shares of Cardinal Health from $135.00 to $136.00 and gave the stock an "equal weight" rating in a research note on Tuesday, February 4th. Jefferies Financial Group raised shares of Cardinal Health from a "hold" rating to a "buy" rating and lifted their price target for the company from $140.00 to $150.00 in a report on Wednesday, February 5th. Morgan Stanley raised their target price on shares of Cardinal Health from $136.00 to $142.00 and gave the company an "overweight" rating in a research note on Friday, January 31st. Citigroup upped their target price on shares of Cardinal Health from $120.00 to $129.00 and gave the company a "neutral" rating in a research report on Friday, January 10th. Finally, Evercore ISI upgraded Cardinal Health from an "in-line" rating to an "outperform" rating and set a $140.00 price target on the stock in a report on Tuesday, January 7th.

Get Our Latest Stock Report on CAH

Cardinal Health Price Performance

Shares of CAH traded down $0.60 during trading hours on Thursday, hitting $126.24. The stock had a trading volume of 1,664,620 shares, compared to its average volume of 2,465,115. The firm has a 50 day simple moving average of $125.99 and a 200-day simple moving average of $119.14. The firm has a market capitalization of $30.49 billion, a P/E ratio of 23.55, a price-to-earnings-growth ratio of 1.49 and a beta of 0.66. Cardinal Health has a 1-year low of $93.17 and a 1-year high of $132.84.

Cardinal Health (NYSE:CAH - Get Free Report) last posted its quarterly earnings results on Thursday, January 30th. The company reported $1.93 earnings per share for the quarter, topping the consensus estimate of $1.74 by $0.19. Cardinal Health had a negative return on equity of 59.57% and a net margin of 0.59%. Equities analysts predict that Cardinal Health will post 7.95 EPS for the current fiscal year.

Cardinal Health Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, April 15th. Stockholders of record on Tuesday, April 1st will be issued a $0.5056 dividend. The ex-dividend date of this dividend is Tuesday, April 1st. This represents a $2.02 dividend on an annualized basis and a dividend yield of 1.60%. Cardinal Health's dividend payout ratio is 37.69%.

Institutional Investors Weigh In On Cardinal Health

Hedge funds and other institutional investors have recently made changes to their positions in the business. Mirae Asset Global Investments Co. Ltd. boosted its holdings in shares of Cardinal Health by 35.2% in the 4th quarter. Mirae Asset Global Investments Co. Ltd. now owns 32,520 shares of the company's stock worth $3,871,000 after acquiring an additional 8,471 shares in the last quarter. CHURCHILL MANAGEMENT Corp boosted its position in Cardinal Health by 1.5% during the fourth quarter. CHURCHILL MANAGEMENT Corp now owns 240,422 shares of the company's stock valued at $28,435,000 after purchasing an additional 3,576 shares during the last quarter. Geode Capital Management LLC lifted its position in shares of Cardinal Health by 0.7% in the third quarter. Geode Capital Management LLC now owns 5,749,859 shares of the company's stock valued at $633,298,000 after buying an additional 42,082 shares during the last quarter. Consolidated Planning Corp raised its position in shares of Cardinal Health by 40.0% in the fourth quarter. Consolidated Planning Corp now owns 8,926 shares of the company's stock valued at $1,056,000 after purchasing an additional 2,552 shares during the period. Finally, Charles Schwab Investment Management Inc. lifted its holdings in Cardinal Health by 2.3% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,474,625 shares of the company's stock worth $162,976,000 after purchasing an additional 33,388 shares during the last quarter. 87.17% of the stock is owned by institutional investors and hedge funds.

Cardinal Health Company Profile

(

Get Free ReportCardinal Health, Inc operates as a healthcare services and products company in the United States, Canada, Europe, Asia, and internationally. It provides customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices, and patients in the home.

Read More

Before you consider Cardinal Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cardinal Health wasn't on the list.

While Cardinal Health currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.