CareDx (NASDAQ:CDNA - Get Free Report) had its price target lowered by stock analysts at BTIG Research from $40.00 to $35.00 in a research note issued to investors on Tuesday, Benzinga reports. The firm currently has a "buy" rating on the stock. BTIG Research's target price would indicate a potential upside of 52.84% from the company's previous close.

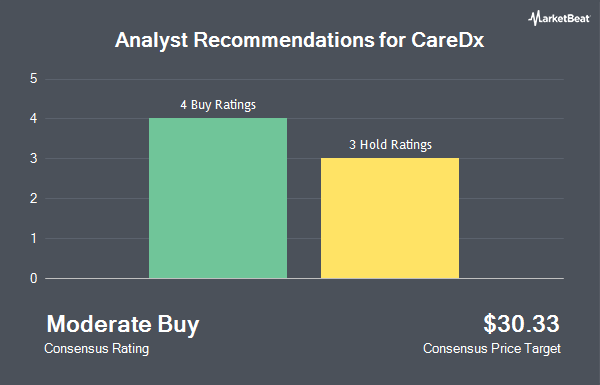

Several other research analysts also recently commented on CDNA. StockNews.com raised shares of CareDx from a "hold" rating to a "buy" rating in a report on Thursday, October 17th. HC Wainwright reiterated a "neutral" rating on shares of CareDx in a research note on Tuesday, October 22nd. Craig Hallum increased their target price on shares of CareDx from $22.00 to $32.00 and gave the stock a "buy" rating in a research note on Thursday, August 1st. The Goldman Sachs Group increased their target price on shares of CareDx from $26.00 to $35.00 and gave the stock a "buy" rating in a research note on Wednesday, October 16th. Finally, Wells Fargo & Company began coverage on shares of CareDx in a research note on Tuesday, August 27th. They issued an "underweight" rating and a $28.00 target price on the stock. One analyst has rated the stock with a sell rating, two have issued a hold rating and five have issued a buy rating to the company's stock. According to MarketBeat, CareDx has an average rating of "Moderate Buy" and an average price target of $29.60.

Read Our Latest Report on CDNA

CareDx Price Performance

Shares of CareDx stock traded down $0.03 on Tuesday, reaching $22.90. 1,713,788 shares of the company traded hands, compared to its average volume of 902,495. The company has a 50 day moving average of $27.88 and a 200 day moving average of $20.86. The firm has a market capitalization of $1.21 billion, a PE ratio of -8.48 and a beta of 1.80. CareDx has a 52 week low of $6.11 and a 52 week high of $34.84.

CareDx (NASDAQ:CDNA - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The company reported ($0.14) EPS for the quarter, topping the consensus estimate of ($0.25) by $0.11. The company had revenue of $82.88 million during the quarter, compared to the consensus estimate of $80.04 million. CareDx had a negative net margin of 53.73% and a negative return on equity of 53.65%. CareDx's revenue for the quarter was up 23.4% on a year-over-year basis. During the same period last year, the firm earned ($0.43) EPS. As a group, analysts anticipate that CareDx will post -0.83 earnings per share for the current year.

Insider Activity

In other news, Director Peter Maag sold 35,552 shares of the firm's stock in a transaction on Tuesday, August 20th. The shares were sold at an average price of $33.04, for a total transaction of $1,174,638.08. Following the sale, the director now owns 330,024 shares in the company, valued at approximately $10,903,992.96. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. In related news, Director Peter Maag sold 35,552 shares of CareDx stock in a transaction on Tuesday, August 20th. The shares were sold at an average price of $33.04, for a total value of $1,174,638.08. Following the transaction, the director now owns 330,024 shares in the company, valued at $10,903,992.96. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Alexander L. Johnson sold 21,557 shares of CareDx stock in a transaction on Wednesday, August 21st. The stock was sold at an average price of $32.58, for a total transaction of $702,327.06. Following the completion of the transaction, the insider now owns 284,983 shares in the company, valued at approximately $9,284,746.14. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 91,340 shares of company stock worth $3,025,415. 4.90% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On CareDx

A number of large investors have recently added to or reduced their stakes in the business. Vanguard Group Inc. grew its holdings in CareDx by 4.4% in the 1st quarter. Vanguard Group Inc. now owns 4,300,016 shares of the company's stock worth $45,537,000 after acquiring an additional 180,334 shares during the last quarter. Gagnon Securities LLC grew its holdings in CareDx by 7.1% in the 1st quarter. Gagnon Securities LLC now owns 2,245,529 shares of the company's stock worth $23,780,000 after acquiring an additional 149,485 shares during the last quarter. Millennium Management LLC boosted its stake in shares of CareDx by 1,085.4% during the 2nd quarter. Millennium Management LLC now owns 2,140,909 shares of the company's stock valued at $33,248,000 after purchasing an additional 1,960,308 shares in the last quarter. Renaissance Technologies LLC boosted its stake in shares of CareDx by 6.2% during the 2nd quarter. Renaissance Technologies LLC now owns 1,512,700 shares of the company's stock valued at $23,492,000 after purchasing an additional 88,100 shares in the last quarter. Finally, Bamco Inc. NY bought a new stake in shares of CareDx during the 1st quarter valued at about $13,025,000.

About CareDx

(

Get Free Report)

CareDx, Inc engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally. It also provides AlloSure Kidney, a donor-derived cell-free DNA (dd-cfDNA) solution for kidney transplant patients; AlloMap Heart, a gene expression solution for heart transplant patients; AlloSure Heart, a dd-cfDNA solution for heart transplant patients; and AlloSure Lung, a dd-cfDNA solution for lung transplant patients.

Recommended Stories

Before you consider CareDx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CareDx wasn't on the list.

While CareDx currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.