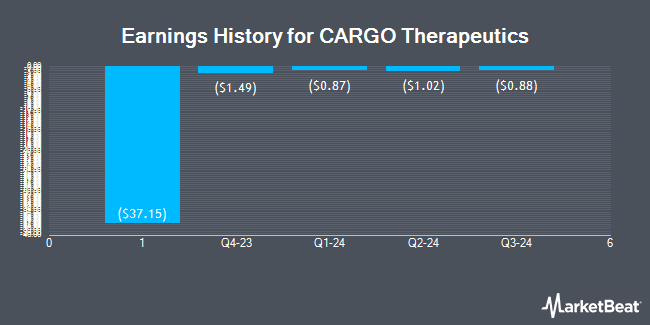

CARGO Therapeutics (NASDAQ:CRGX - Get Free Report) is expected to be issuing its quarterly earnings data before the market opens on Thursday, March 20th. Analysts expect the company to announce earnings of ($0.95) per share for the quarter.

CARGO Therapeutics Price Performance

Shares of NASDAQ CRGX opened at $4.15 on Thursday. CARGO Therapeutics has a fifty-two week low of $3.00 and a fifty-two week high of $33.84. The stock has a market capitalization of $191.02 million, a PE ratio of -0.97 and a beta of 1.63. The business has a fifty day moving average price of $7.57 and a two-hundred day moving average price of $14.75.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently commented on CRGX shares. William Blair cut CARGO Therapeutics from an "outperform" rating to a "market perform" rating in a report on Thursday, January 30th. HC Wainwright cut CARGO Therapeutics from a "buy" rating to a "neutral" rating in a report on Thursday, January 30th. Piper Sandler cut CARGO Therapeutics from an "overweight" rating to a "neutral" rating and lowered their price target for the stock from $34.00 to $4.00 in a report on Thursday, January 30th. Chardan Capital cut CARGO Therapeutics from a "buy" rating to a "neutral" rating in a report on Thursday, January 30th. Finally, Jefferies Financial Group cut CARGO Therapeutics from a "buy" rating to a "hold" rating and lowered their price target for the stock from $32.00 to $3.00 in a report on Thursday, January 30th. One research analyst has rated the stock with a sell rating and six have assigned a hold rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $15.00.

View Our Latest Research Report on CARGO Therapeutics

About CARGO Therapeutics

(

Get Free Report)

CARGO Therapeutics, Inc, a clinical-stage biotechnology company, develops chimeric antigen receptor (CAR) T-cell therapies for cancer patients. The company's lead program is CRG-022, an autologous CD22 CAR T-cell product candidate designed to address resistance mechanisms by targeting CD22, an alternate tumor antigen that is expressed in B-cell malignancies.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CARGO Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CARGO Therapeutics wasn't on the list.

While CARGO Therapeutics currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.