Cargojet (TSE:CJT - Free Report) had its target price lowered by National Bankshares from C$158.00 to C$151.00 in a report released on Tuesday,BayStreet.CA reports. The firm currently has an outperform rating on the stock.

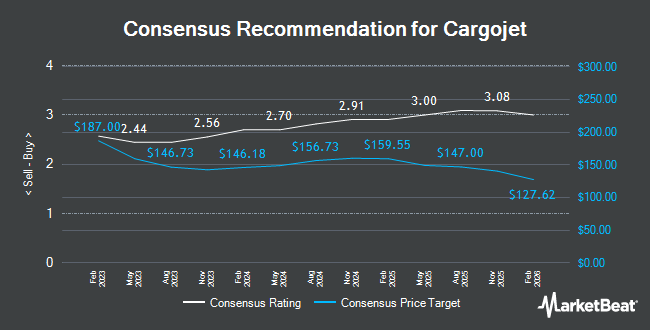

A number of other brokerages have also commented on CJT. CIBC increased their price objective on Cargojet from C$172.00 to C$177.00 in a report on Wednesday, December 4th. Scotiabank dropped their price target on shares of Cargojet from C$174.00 to C$170.00 in a research report on Monday. ATB Capital decreased their price objective on shares of Cargojet from C$165.00 to C$155.00 in a report on Wednesday, November 6th. Canaccord Genuity Group raised their target price on shares of Cargojet from C$160.00 to C$165.00 in a research note on Wednesday, November 6th. Finally, TD Securities cut their target price on shares of Cargojet from C$167.00 to C$165.00 and set a "buy" rating for the company in a research report on Thursday, November 21st. Two equities research analysts have rated the stock with a hold rating, seven have given a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of C$160.50.

Get Our Latest Report on CJT

Cargojet Stock Down 4.4 %

TSE CJT traded down C$5.62 during trading on Tuesday, reaching C$121.38. The company's stock had a trading volume of 83,613 shares, compared to its average volume of 92,968. The business has a 50-day moving average price of C$115.12 and a 200-day moving average price of C$125.76. Cargojet has a 1-year low of C$100.01 and a 1-year high of C$144.97. The stock has a market capitalization of C$1.96 billion, a PE ratio of -127.77 and a beta of 0.91. The company has a current ratio of 0.59, a quick ratio of 0.79 and a debt-to-equity ratio of 99.84.

Cargojet (TSE:CJT - Get Free Report) last issued its quarterly earnings data on Monday, November 4th. The company reported C$1.48 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of C$1.14 by C$0.34. Cargojet had a negative net margin of 1.88% and a negative return on equity of 2.13%. During the same period in the previous year, the firm earned $0.30 earnings per share. On average, research analysts forecast that Cargojet will post 5.890933 earnings per share for the current fiscal year.

Cargojet Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, January 3rd. Investors of record on Friday, January 3rd were paid a $0.35 dividend. This represents a $1.40 annualized dividend and a dividend yield of 1.15%. The ex-dividend date of this dividend was Friday, December 20th. Cargojet's payout ratio is presently -147.37%.

About Cargojet

(

Get Free Report)

Cargojet Inc operates a domestic air cargo co-load network between sixteen major Canadian cities. The company provides dedicated aircraft to customers on an Aircraft, Crew, Maintenance and Insurance basis, operating between points in Canada, USA, Mexico and Europe. The company also operates scheduled international routes for multiple cargo customers between the USA and Bermuda, between Canada, UK and Germany; and between Canada and Mexico.

Featured Stories

Before you consider Cargojet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cargojet wasn't on the list.

While Cargojet currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.