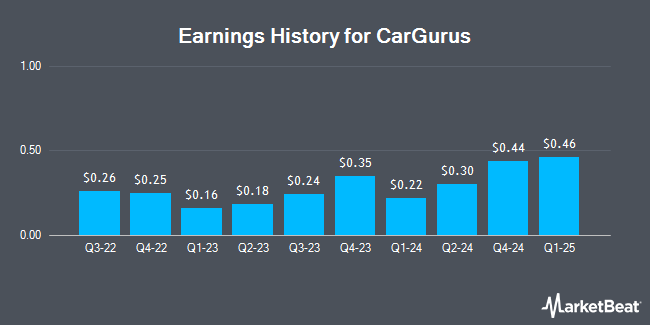

CarGurus (NASDAQ:CARG - Get Free Report) is projected to issue its quarterly earnings data after the market closes on Monday, February 24th. Analysts expect the company to announce earnings of $0.50 per share and revenue of $231.72 million for the quarter. Parties interested in registering for the company's conference call can do so using this link.

CarGurus Stock Down 4.5 %

Shares of CARG traded down $1.80 during trading hours on Wednesday, hitting $38.14. The company had a trading volume of 1,026,286 shares, compared to its average volume of 736,862. The firm has a market cap of $3.96 billion, a P/E ratio of -82.91, a P/E/G ratio of 1.82 and a beta of 1.59. The stock's 50 day moving average price is $37.94 and its 200 day moving average price is $33.58. CarGurus has a 52-week low of $21.18 and a 52-week high of $41.33.

Insiders Place Their Bets

In other news, CMO Dafna Sarnoff sold 10,570 shares of the business's stock in a transaction that occurred on Friday, January 3rd. The stock was sold at an average price of $35.78, for a total value of $378,194.60. Following the sale, the chief marketing officer now directly owns 95,261 shares of the company's stock, valued at $3,408,438.58. The trade was a 9.99 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, COO Samuel Zales sold 20,000 shares of the business's stock in a transaction that occurred on Monday, February 3rd. The stock was sold at an average price of $38.36, for a total value of $767,200.00. Following the completion of the sale, the chief operating officer now directly owns 400,025 shares in the company, valued at approximately $15,344,959. This represents a 4.76 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 59,388 shares of company stock worth $2,204,338. Company insiders own 17.20% of the company's stock.

Analysts Set New Price Targets

CARG has been the topic of several analyst reports. DA Davidson lifted their price objective on CarGurus from $26.50 to $38.50 and gave the stock a "neutral" rating in a report on Friday, November 8th. BTIG Research boosted their price target on CarGurus from $30.00 to $35.00 and gave the company a "buy" rating in a report on Tuesday, October 22nd. Jefferies Financial Group boosted their price target on CarGurus from $35.00 to $38.00 and gave the company a "buy" rating in a report on Tuesday, October 22nd. Oppenheimer boosted their price target on CarGurus from $32.00 to $44.00 and gave the company an "outperform" rating in a report on Friday, November 8th. Finally, B. Riley boosted their price target on CarGurus from $30.00 to $40.00 and gave the company a "buy" rating in a report on Monday, November 11th. Two investment analysts have rated the stock with a hold rating, eight have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $38.41.

Get Our Latest Research Report on CARG

CarGurus Company Profile

(

Get Free Report)

CarGurus, Inc operates an online automotive platform for buying and selling vehicles in the United States and internationally. It operates through two segments, U.S. Marketplace and Digital Wholesale. The company provides an online automotive marketplace where customers can search for new and used car listings from its dealers and sell their car to dealers and other consumers; and paid listings subscriptions for enhanced access to its marketplace that connects dealers to a large audience of informed and engaged consumers.

Featured Stories

Before you consider CarGurus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CarGurus wasn't on the list.

While CarGurus currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.