CarMax (NYSE:KMX - Free Report) had its price objective upped by Royal Bank of Canada from $92.00 to $99.00 in a report published on Thursday morning. They currently have an overweight rating on the stock.

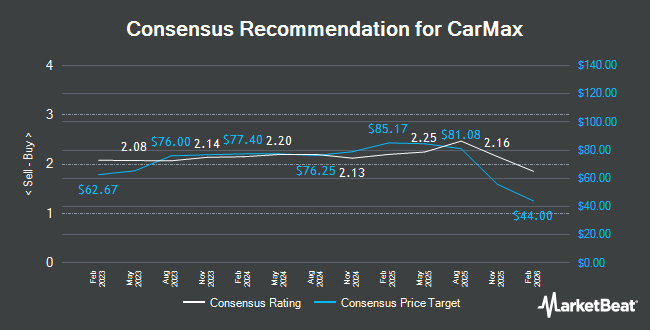

Several other research firms have also commented on KMX. Truist Financial upped their price target on shares of CarMax from $70.00 to $75.00 and gave the company a "hold" rating in a report on Monday, September 23rd. BNP Paribas upgraded CarMax to a "strong sell" rating in a research note on Friday, September 27th. Oppenheimer reiterated an "outperform" rating and set a $105.00 price target on shares of CarMax in a research report on Friday, October 4th. Stephens assumed coverage on CarMax in a report on Thursday, December 5th. They issued an "equal weight" rating and a $86.00 price target for the company. Finally, JPMorgan Chase & Co. raised their price objective on shares of CarMax from $65.00 to $70.00 and gave the stock an "underweight" rating in a research note on Thursday, December 5th. Four investment analysts have rated the stock with a sell rating, five have assigned a hold rating and six have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $82.58.

View Our Latest Report on CarMax

CarMax Stock Performance

Shares of NYSE:KMX traded up $2.81 during trading on Thursday, hitting $84.23. The stock had a trading volume of 5,329,398 shares, compared to its average volume of 1,936,437. The stock has a 50-day simple moving average of $78.77 and a two-hundred day simple moving average of $77.55. The stock has a market capitalization of $13.05 billion, a price-to-earnings ratio of 31.67, a price-to-earnings-growth ratio of 1.76 and a beta of 1.71. CarMax has a 12-month low of $65.83 and a 12-month high of $91.25. The company has a quick ratio of 0.68, a current ratio of 2.25 and a debt-to-equity ratio of 2.93.

CarMax (NYSE:KMX - Get Free Report) last posted its quarterly earnings results on Thursday, December 19th. The company reported $0.81 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.62 by $0.19. The company had revenue of $6.22 billion during the quarter, compared to analyst estimates of $6.05 billion. CarMax had a net margin of 1.61% and a return on equity of 6.83%. CarMax's revenue for the quarter was up 1.2% compared to the same quarter last year. During the same period last year, the firm posted $0.52 EPS. On average, equities research analysts expect that CarMax will post 3.01 earnings per share for the current fiscal year.

Hedge Funds Weigh In On CarMax

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Arete Wealth Advisors LLC increased its stake in shares of CarMax by 4.3% during the third quarter. Arete Wealth Advisors LLC now owns 3,438 shares of the company's stock worth $266,000 after purchasing an additional 141 shares in the last quarter. Northwestern Mutual Wealth Management Co. increased its stake in CarMax by 2.3% during the 2nd quarter. Northwestern Mutual Wealth Management Co. now owns 6,220 shares of the company's stock worth $456,000 after buying an additional 142 shares in the last quarter. Allegheny Financial Group LTD raised its holdings in shares of CarMax by 4.1% during the second quarter. Allegheny Financial Group LTD now owns 3,597 shares of the company's stock valued at $264,000 after acquiring an additional 143 shares during the last quarter. Sompo Asset Management Co. Ltd. lifted its position in shares of CarMax by 1.6% in the third quarter. Sompo Asset Management Co. Ltd. now owns 10,602 shares of the company's stock valued at $820,000 after acquiring an additional 170 shares in the last quarter. Finally, Signaturefd LLC lifted its position in shares of CarMax by 12.5% in the third quarter. Signaturefd LLC now owns 1,545 shares of the company's stock valued at $120,000 after acquiring an additional 172 shares in the last quarter.

About CarMax

(

Get Free Report)

CarMax, Inc, through its subsidiaries, operates as a retailer of used vehicles and related products in the United States. It operates in two segments: CarMax Sales Operations and CarMax Auto Finance. The CarMax Sales Operations segment offers customers a range of makes and models of used vehicles, including domestic, imported, and luxury vehicles, as well as hybrid and electric vehicles; used vehicle auctions; extended protection plans to customers at the time of sale; and reconditioning and vehicle repair services.

See Also

Before you consider CarMax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CarMax wasn't on the list.

While CarMax currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.