Carnival Co. & (NYSE:CCL - Get Free Report) updated its first quarter 2025 earnings guidance on Friday. The company provided EPS guidance of 0.000-0.000 for the period, compared to the consensus EPS estimate of -0.010. The company issued revenue guidance of -. Carnival Co. & also updated its FY 2025 guidance to 1.700-1.700 EPS.

Analyst Ratings Changes

A number of brokerages recently issued reports on CCL. Bank of America raised their price objective on Carnival Co. & from $24.00 to $28.00 and gave the stock a "buy" rating in a research report on Wednesday, November 13th. Hsbc Global Res upgraded shares of Carnival Co. & to a "moderate sell" rating in a research report on Tuesday, September 3rd. Citigroup upped their price objective on shares of Carnival Co. & from $28.00 to $30.00 and gave the stock a "buy" rating in a report on Wednesday, December 11th. Wells Fargo & Company lifted their target price on shares of Carnival Co. & from $25.00 to $30.00 and gave the company an "overweight" rating in a report on Monday. Finally, Barclays boosted their target price on Carnival Co. & from $26.00 to $31.00 and gave the company an "overweight" rating in a research report on Friday, December 13th. One research analyst has rated the stock with a sell rating, three have assigned a hold rating and fourteen have assigned a buy rating to the company. Based on data from MarketBeat, Carnival Co. & currently has an average rating of "Moderate Buy" and an average price target of $26.62.

Read Our Latest Stock Analysis on Carnival Co. &

Carnival Co. & Stock Up 6.4 %

NYSE:CCL traded up $1.62 during mid-day trading on Friday, hitting $26.80. The stock had a trading volume of 60,814,160 shares, compared to its average volume of 28,719,791. Carnival Co. & has a twelve month low of $13.78 and a twelve month high of $27.17. The stock has a 50-day simple moving average of $24.03 and a two-hundred day simple moving average of $19.49. The company has a current ratio of 0.30, a quick ratio of 0.26 and a debt-to-equity ratio of 3.10. The company has a market capitalization of $30.93 billion, a PE ratio of 23.93 and a beta of 2.67.

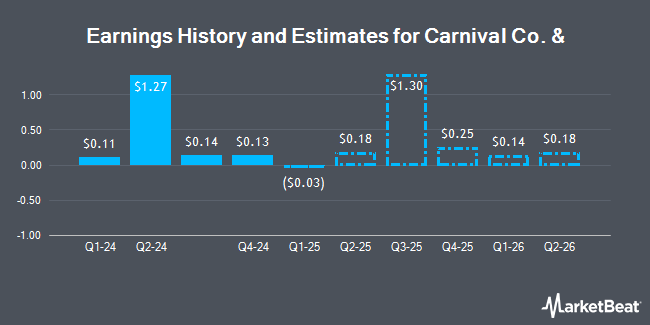

Carnival Co. & (NYSE:CCL - Get Free Report) last announced its quarterly earnings data on Friday, December 20th. The company reported $0.14 earnings per share for the quarter, beating analysts' consensus estimates of $0.08 by $0.06. The business had revenue of $5.94 billion for the quarter, compared to analyst estimates of $5.94 billion. Carnival Co. & had a net margin of 6.39% and a return on equity of 22.30%. The company's revenue was up 10.0% on a year-over-year basis. During the same period last year, the business earned ($0.07) EPS. On average, equities research analysts anticipate that Carnival Co. & will post 1.33 EPS for the current year.

Insider Transactions at Carnival Co. &

In other Carnival Co. & news, Director Sir Jonathon Band sold 17,500 shares of the firm's stock in a transaction that occurred on Tuesday, October 29th. The shares were sold at an average price of $21.72, for a total transaction of $380,100.00. Following the sale, the director now owns 65,789 shares of the company's stock, valued at approximately $1,428,937.08. This trade represents a 21.01 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Insiders own 11.00% of the company's stock.

About Carnival Co. &

(

Get Free Report)

Carnival Corporation & plc engages in the provision of leisure travel services in North America, Australia, Europe, Asia, and internationally. The company operates through four segments: NAA Cruise Operations, Europe Cruise Operations, Cruise Support, and Tour and Other. It operates port destinations, private islands, and a solar park, as well as owns and operates hotels, lodges, glass-domed railcars, and motor coaches.

Further Reading

Before you consider Carnival Co. &, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carnival Co. & wasn't on the list.

While Carnival Co. & currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.