Lisanti Capital Growth LLC lifted its stake in Carpenter Technology Co. (NYSE:CRS - Free Report) by 29.3% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 49,315 shares of the basic materials company's stock after buying an additional 11,180 shares during the period. Carpenter Technology makes up approximately 2.0% of Lisanti Capital Growth LLC's investment portfolio, making the stock its 4th biggest position. Lisanti Capital Growth LLC owned about 0.10% of Carpenter Technology worth $7,870,000 as of its most recent SEC filing.

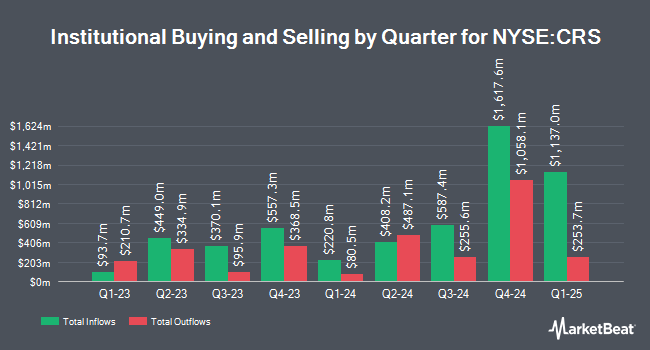

Other hedge funds and other institutional investors have also bought and sold shares of the company. CWM LLC raised its position in Carpenter Technology by 12.6% in the second quarter. CWM LLC now owns 921 shares of the basic materials company's stock valued at $101,000 after purchasing an additional 103 shares during the last quarter. GAMMA Investing LLC grew its holdings in Carpenter Technology by 9.2% during the 2nd quarter. GAMMA Investing LLC now owns 1,614 shares of the basic materials company's stock worth $177,000 after acquiring an additional 136 shares during the last quarter. EverSource Wealth Advisors LLC increased its position in Carpenter Technology by 58.0% in the 2nd quarter. EverSource Wealth Advisors LLC now owns 485 shares of the basic materials company's stock valued at $53,000 after acquiring an additional 178 shares during the period. First Trust Direct Indexing L.P. raised its stake in shares of Carpenter Technology by 8.9% during the third quarter. First Trust Direct Indexing L.P. now owns 2,212 shares of the basic materials company's stock valued at $353,000 after acquiring an additional 180 shares during the last quarter. Finally, Private Advisor Group LLC lifted its holdings in shares of Carpenter Technology by 3.8% during the third quarter. Private Advisor Group LLC now owns 5,300 shares of the basic materials company's stock worth $846,000 after purchasing an additional 196 shares during the period. Institutional investors and hedge funds own 92.03% of the company's stock.

Analysts Set New Price Targets

Several research analysts recently issued reports on CRS shares. BTIG Research raised their target price on Carpenter Technology from $120.00 to $165.00 and gave the stock a "buy" rating in a research report on Tuesday, July 30th. Benchmark reaffirmed a "buy" rating and set a $175.00 target price on shares of Carpenter Technology in a research note on Friday, October 25th. One equities research analyst has rated the stock with a sell rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat.com, Carpenter Technology currently has a consensus rating of "Moderate Buy" and a consensus target price of $139.60.

Get Our Latest Report on CRS

Carpenter Technology Trading Up 1.0 %

Shares of Carpenter Technology stock traded up $1.71 on Monday, hitting $178.87. The stock had a trading volume of 256,710 shares, compared to its average volume of 591,967. The stock's 50-day simple moving average is $154.37 and its two-hundred day simple moving average is $129.83. Carpenter Technology Co. has a one year low of $58.87 and a one year high of $182.52. The stock has a market cap of $8.92 billion, a price-to-earnings ratio of 39.87, a PEG ratio of 0.89 and a beta of 1.46. The company has a quick ratio of 2.00, a current ratio of 3.84 and a debt-to-equity ratio of 0.42.

Carpenter Technology (NYSE:CRS - Get Free Report) last posted its quarterly earnings data on Thursday, October 24th. The basic materials company reported $1.73 earnings per share for the quarter, beating the consensus estimate of $1.58 by $0.15. The business had revenue of $717.60 million for the quarter, compared to analysts' expectations of $742.96 million. Carpenter Technology had a return on equity of 18.01% and a net margin of 8.05%. The business's revenue was up 10.1% on a year-over-year basis. During the same period in the previous year, the firm posted $0.88 EPS. As a group, sell-side analysts predict that Carpenter Technology Co. will post 6.68 EPS for the current year.

Carpenter Technology Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, December 5th. Shareholders of record on Tuesday, October 22nd will be paid a dividend of $0.20 per share. This represents a $0.80 dividend on an annualized basis and a yield of 0.45%. The ex-dividend date is Tuesday, October 22nd. Carpenter Technology's payout ratio is 17.82%.

Carpenter Technology Company Profile

(

Free Report)

Carpenter Technology Corporation engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally. It operates in two segments, Specialty Alloys Operations and Performance Engineered Products. The company offers specialty alloys, including titanium alloys, powder metals, stainless steels, alloy steels, and tool steels, as well as additives, and metal powders and parts.

See Also

Before you consider Carpenter Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carpenter Technology wasn't on the list.

While Carpenter Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.