Carrera Capital Advisors bought a new position in Roblox Co. (NYSE:RBLX - Free Report) during the third quarter, according to its most recent filing with the SEC. The firm bought 12,674 shares of the company's stock, valued at approximately $561,000.

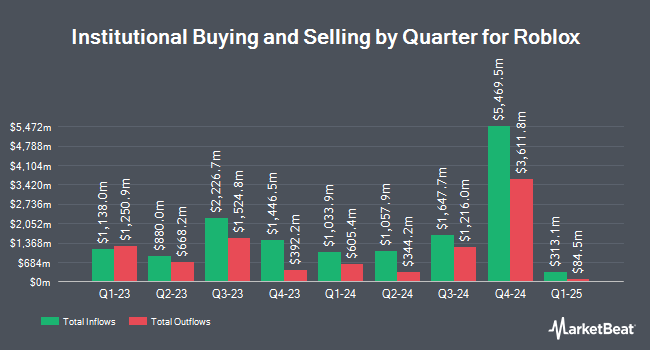

Other hedge funds have also bought and sold shares of the company. V Square Quantitative Management LLC purchased a new stake in shares of Roblox in the third quarter worth approximately $27,000. PARK CIRCLE Co purchased a new stake in Roblox in the 2nd quarter valued at $30,000. Strategic Financial Concepts LLC bought a new position in Roblox during the 2nd quarter valued at $33,000. Gilliland Jeter Wealth Management LLC boosted its holdings in Roblox by 102.4% during the 2nd quarter. Gilliland Jeter Wealth Management LLC now owns 1,000 shares of the company's stock worth $37,000 after acquiring an additional 506 shares during the last quarter. Finally, GAMMA Investing LLC grew its stake in shares of Roblox by 132.8% in the 3rd quarter. GAMMA Investing LLC now owns 929 shares of the company's stock worth $41,000 after acquiring an additional 530 shares in the last quarter. Institutional investors and hedge funds own 91.08% of the company's stock.

Insiders Place Their Bets

In other Roblox news, CFO Michael Guthrie sold 30,000 shares of the stock in a transaction on Wednesday, August 14th. The shares were sold at an average price of $38.82, for a total transaction of $1,164,600.00. Following the completion of the sale, the chief financial officer now owns 374,633 shares of the company's stock, valued at $14,543,253.06. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. In related news, CAO Amy Marie Rawlings sold 2,186 shares of the stock in a transaction dated Monday, November 4th. The shares were sold at an average price of $52.90, for a total value of $115,639.40. Following the completion of the transaction, the chief accounting officer now directly owns 91,062 shares of the company's stock, valued at $4,817,179.80. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CFO Michael Guthrie sold 30,000 shares of the firm's stock in a transaction that occurred on Wednesday, August 14th. The shares were sold at an average price of $38.82, for a total value of $1,164,600.00. Following the completion of the transaction, the chief financial officer now owns 374,633 shares of the company's stock, valued at approximately $14,543,253.06. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 1,029,373 shares of company stock valued at $46,476,179 in the last ninety days. Company insiders own 22.15% of the company's stock.

Analyst Ratings Changes

Several research analysts recently weighed in on the stock. The Goldman Sachs Group boosted their price target on shares of Roblox from $45.00 to $55.00 and gave the stock a "neutral" rating in a report on Friday, November 1st. Wedbush restated an "outperform" rating and issued a $49.00 target price on shares of Roblox in a research note on Friday, October 25th. Needham & Company LLC increased their price target on Roblox from $50.00 to $60.00 and gave the company a "buy" rating in a research report on Friday, November 1st. Piper Sandler lifted their price target on Roblox from $54.00 to $65.00 and gave the stock an "overweight" rating in a report on Friday, November 1st. Finally, Barclays upped their price objective on Roblox from $40.00 to $50.00 and gave the company an "equal weight" rating in a research note on Friday, November 1st. Seven investment analysts have rated the stock with a hold rating, fourteen have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $55.30.

View Our Latest Stock Analysis on RBLX

Roblox Trading Up 0.4 %

Shares of RBLX traded up $0.24 during mid-day trading on Tuesday, reaching $54.80. The company's stock had a trading volume of 1,619,828 shares, compared to its average volume of 7,483,653. The company has a current ratio of 0.98, a quick ratio of 0.98 and a debt-to-equity ratio of 5.64. Roblox Co. has a 52 week low of $29.55 and a 52 week high of $55.10. The company's fifty day moving average price is $44.68 and its two-hundred day moving average price is $40.09. The stock has a market cap of $33.29 billion, a PE ratio of -33.27 and a beta of 1.56.

Roblox (NYSE:RBLX - Get Free Report) last announced its quarterly earnings data on Thursday, October 31st. The company reported ($0.37) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.39) by $0.02. Roblox had a negative return on equity of 986.36% and a negative net margin of 30.90%. The firm had revenue of $919.00 million for the quarter, compared to analysts' expectations of $1.02 billion. During the same period last year, the firm earned ($0.45) earnings per share. The company's revenue for the quarter was up 9.5% compared to the same quarter last year. On average, analysts predict that Roblox Co. will post -1.56 earnings per share for the current fiscal year.

About Roblox

(

Free Report)

Roblox Corporation develops and operates an online entertainment platform in the United States and internationally. It offers Roblox Studio, a free toolset that allows developers and creators to build, publish, and operate 3D experiences, and other content; Roblox Client, an application that allows users to explore 3D experience; and Roblox Cloud, which provides services and infrastructure that power the platform.

See Also

Want to see what other hedge funds are holding RBLX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Roblox Co. (NYSE:RBLX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Roblox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Roblox wasn't on the list.

While Roblox currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.