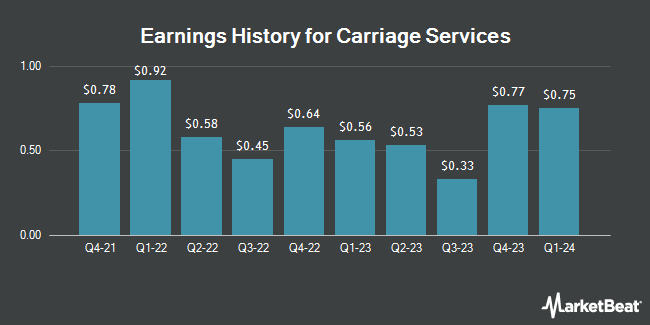

Carriage Services (NYSE:CSV - Get Free Report) is expected to post its quarterly earnings results after the market closes on Wednesday, February 26th. Analysts expect Carriage Services to post earnings of $0.51 per share and revenue of $96.72 million for the quarter. Investors that wish to register for the company's conference call can do so using this link.

Carriage Services Stock Performance

Carriage Services stock traded down $0.23 during trading hours on Friday, hitting $40.77. 99,182 shares of the stock traded hands, compared to its average volume of 136,520. The company has a debt-to-equity ratio of 2.03, a current ratio of 0.72 and a quick ratio of 0.59. The firm's 50 day moving average price is $40.32 and its 200-day moving average price is $36.43. The stock has a market capitalization of $620.53 million, a price-to-earnings ratio of 18.28, a P/E/G ratio of 0.98 and a beta of 0.92. Carriage Services has a 1 year low of $23.20 and a 1 year high of $42.75.

Carriage Services Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, March 3rd. Shareholders of record on Monday, February 3rd will be paid a dividend of $0.1125 per share. The ex-dividend date is Monday, February 3rd. This represents a $0.45 annualized dividend and a yield of 1.10%. Carriage Services's payout ratio is presently 20.18%.

Analysts Set New Price Targets

Separately, Barrington Research restated an "outperform" rating and issued a $50.00 target price on shares of Carriage Services in a research note on Monday, February 10th.

Check Out Our Latest Stock Analysis on CSV

Carriage Services Company Profile

(

Get Free Report)

Carriage Services, Inc provides funeral and cemetery services, and merchandise in the United States. It operates in two segments, Funeral Home Operations and Cemetery Operations. The Funeral Home Operations segment provides consultation services; funeral home facilities for visitation and memorial services; transportation services; removal and preparation of remains; sale of caskets and urns; cremation services; and related funeral merchandise.

Recommended Stories

Before you consider Carriage Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carriage Services wasn't on the list.

While Carriage Services currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.