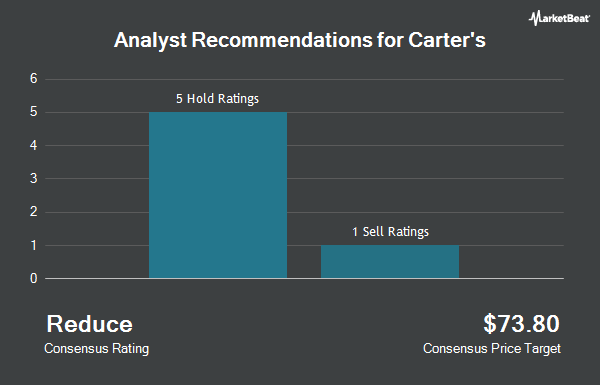

Shares of Carter's, Inc. (NYSE:CRI - Get Free Report) have been assigned an average rating of "Reduce" from the seven brokerages that are presently covering the stock, Marketbeat Ratings reports. Two investment analysts have rated the stock with a sell recommendation and five have given a hold recommendation to the company. The average 12-month target price among brokers that have updated their coverage on the stock in the last year is $70.00.

Several equities analysts have recently issued reports on the company. Bank of America reduced their target price on Carter's from $65.00 to $54.00 and set an "underperform" rating for the company in a report on Monday, July 29th. Wells Fargo & Company lowered their target price on Carter's from $72.00 to $65.00 and set an "equal weight" rating on the stock in a research note on Monday, October 28th.

Get Our Latest Stock Report on CRI

Institutional Trading of Carter's

A number of institutional investors have recently modified their holdings of CRI. O Shaughnessy Asset Management LLC lifted its holdings in Carter's by 173.0% during the 1st quarter. O Shaughnessy Asset Management LLC now owns 17,196 shares of the textile maker's stock worth $1,456,000 after purchasing an additional 10,897 shares in the last quarter. Price T Rowe Associates Inc. MD lifted its holdings in shares of Carter's by 35.8% in the first quarter. Price T Rowe Associates Inc. MD now owns 42,736 shares of the textile maker's stock worth $3,619,000 after buying an additional 11,265 shares in the last quarter. Mitsubishi UFJ Trust & Banking Corp boosted its position in shares of Carter's by 86.7% in the first quarter. Mitsubishi UFJ Trust & Banking Corp now owns 20,019 shares of the textile maker's stock valued at $1,714,000 after acquiring an additional 9,295 shares during the period. Mirae Asset Global Investments Co. Ltd. purchased a new position in Carter's during the first quarter valued at approximately $1,450,000. Finally, Qsemble Capital Management LP increased its holdings in Carter's by 91.2% during the 1st quarter. Qsemble Capital Management LP now owns 18,769 shares of the textile maker's stock worth $1,589,000 after acquiring an additional 8,955 shares during the period.

Carter's Stock Down 2.6 %

Carter's stock traded down $1.41 during midday trading on Wednesday, hitting $52.59. 1,989,211 shares of the stock were exchanged, compared to its average volume of 961,532. Carter's has a 52-week low of $51.98 and a 52-week high of $88.03. The company has a quick ratio of 0.96, a current ratio of 2.21 and a debt-to-equity ratio of 0.60. The business's 50-day moving average price is $64.59 and its 200-day moving average price is $64.88. The stock has a market capitalization of $1.90 billion, a price-to-earnings ratio of 8.57, a price-to-earnings-growth ratio of 3.31 and a beta of 1.24.

Carter's Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, September 13th. Investors of record on Tuesday, August 27th were paid a $0.80 dividend. This represents a $3.20 dividend on an annualized basis and a yield of 6.08%. The ex-dividend date of this dividend was Tuesday, August 27th. Carter's's dividend payout ratio is currently 50.79%.

Carter's Company Profile

(

Get Free ReportCarter's, Inc, together with its subsidiaries, designs, sources, and markets branded childrenswear under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally. It operates through three segments: U.S.

Featured Articles

Before you consider Carter's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carter's wasn't on the list.

While Carter's currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.