Point72 Hong Kong Ltd lessened its stake in shares of Carvana Co. (NYSE:CVNA - Free Report) by 21.2% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 24,749 shares of the company's stock after selling 6,665 shares during the period. Point72 Hong Kong Ltd's holdings in Carvana were worth $4,309,000 at the end of the most recent reporting period.

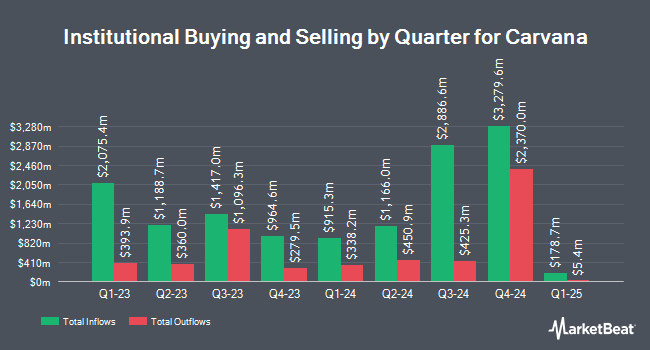

Several other institutional investors and hedge funds have also recently bought and sold shares of the stock. Sugarloaf Wealth Management LLC acquired a new position in Carvana during the third quarter valued at $32,000. Capital Performance Advisors LLP acquired a new position in Carvana in the 3rd quarter valued at approximately $40,000. Ridgewood Investments LLC acquired a new position in Carvana in the 2nd quarter valued at approximately $32,000. First Horizon Advisors Inc. increased its stake in Carvana by 363.0% in the 3rd quarter. First Horizon Advisors Inc. now owns 250 shares of the company's stock valued at $44,000 after buying an additional 196 shares during the period. Finally, Summit Securities Group LLC increased its stake in Carvana by 110.0% in the 2nd quarter. Summit Securities Group LLC now owns 300 shares of the company's stock valued at $39,000 after buying an additional 3,300 shares during the period. Institutional investors and hedge funds own 56.71% of the company's stock.

Analyst Ratings Changes

CVNA has been the topic of a number of research reports. Needham & Company LLC upped their price target on shares of Carvana from $200.00 to $300.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Bank of America upped their target price on Carvana from $185.00 to $210.00 and gave the stock a "buy" rating in a research report on Wednesday, October 9th. Citigroup increased their price objective on Carvana from $125.00 to $195.00 and gave the stock a "neutral" rating in a report on Thursday, October 3rd. Evercore ISI increased their price objective on Carvana from $186.00 to $190.00 and gave the stock an "in-line" rating in a report on Wednesday, October 30th. Finally, Royal Bank of Canada upgraded shares of Carvana to a "sector perform" rating and increased their price target for the stock from $166.00 to $170.00 in a research note on Monday, August 19th. Eleven research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to MarketBeat.com, Carvana has an average rating of "Hold" and an average target price of $217.71.

Check Out Our Latest Report on Carvana

Insider Activity at Carvana

In other Carvana news, major shareholder Ernest C. Garcia II sold 75,000 shares of the company's stock in a transaction on Thursday, September 5th. The stock was sold at an average price of $141.72, for a total value of $10,629,000.00. Following the transaction, the insider now directly owns 40,733,131 shares of the company's stock, valued at $5,772,699,325.32. This represents a 0.18 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through this hyperlink. Also, CFO Mark W. Jenkins sold 20,000 shares of the company's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $241.78, for a total transaction of $4,835,600.00. Following the completion of the transaction, the chief financial officer now owns 170,732 shares in the company, valued at $41,279,582.96. This trade represents a 10.49 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 2,118,063 shares of company stock worth $389,949,579. Insiders own 17.12% of the company's stock.

Carvana Stock Performance

CVNA stock traded up $5.45 on Friday, reaching $260.42. 1,441,332 shares of the company were exchanged, compared to its average volume of 2,663,815. The company has a debt-to-equity ratio of 18.99, a current ratio of 3.25 and a quick ratio of 2.12. The firm has a market capitalization of $54.07 billion, a PE ratio of 26,068.07 and a beta of 3.37. Carvana Co. has a 12 month low of $29.84 and a 12 month high of $268.34. The stock's fifty day moving average price is $213.39 and its 200 day moving average price is $159.35.

Carvana (NYSE:CVNA - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The company reported $0.64 EPS for the quarter, beating the consensus estimate of $0.23 by $0.41. The company had revenue of $3.66 billion during the quarter, compared to analyst estimates of $3.47 billion. During the same quarter in the prior year, the firm earned $0.23 earnings per share. Carvana's revenue for the quarter was up 31.8% on a year-over-year basis. On average, research analysts anticipate that Carvana Co. will post 0.76 EPS for the current fiscal year.

Carvana Company Profile

(

Free Report)

Carvana Co, together with its subsidiaries, operates an e-commerce platform for buying and selling used cars in the United States. Its platform allows customers to research and identify a vehicle; inspect it using company's 360-degree vehicle imaging technology; obtain financing and warranty coverage; purchase the vehicle; and schedule delivery or pick-up from their desktop or mobile devices.

Read More

Before you consider Carvana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carvana wasn't on the list.

While Carvana currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.