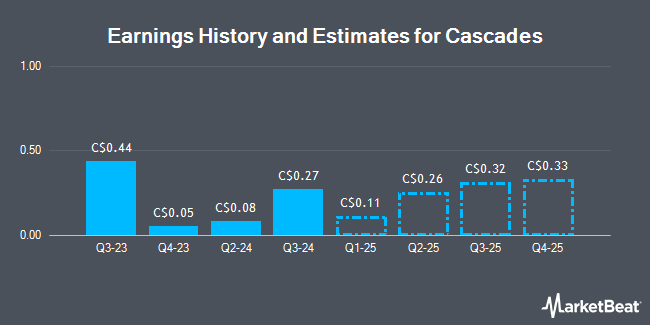

Cascades Inc. (TSE:CAS - Free Report) - National Bank Financial boosted their FY2024 earnings per share (EPS) estimates for Cascades in a report issued on Thursday, November 7th. National Bank Financial analyst Z. Evershed now expects that the company will post earnings per share of $0.56 for the year, up from their prior estimate of $0.50. The consensus estimate for Cascades' current full-year earnings is $1.30 per share.

Several other analysts also recently weighed in on CAS. TD Securities lifted their target price on shares of Cascades from C$12.00 to C$14.00 and gave the company a "buy" rating in a report on Friday. Scotiabank dropped their target price on Cascades from C$12.00 to C$11.00 and set a "sector perform" rating on the stock in a report on Monday, August 12th. CIBC reduced their price objective on shares of Cascades from C$11.00 to C$10.50 and set a "neutral" rating for the company in a research report on Monday, August 12th. Finally, Royal Bank of Canada lifted their price target on Cascades from C$11.00 to C$12.00 in a research report on Friday. Five analysts have rated the stock with a hold rating and one has issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of C$11.92.

Get Our Latest Report on CAS

Cascades Trading Up 2.0 %

Shares of TSE CAS traded up C$0.22 during mid-day trading on Monday, reaching C$11.22. 86,002 shares of the company's stock were exchanged, compared to its average volume of 222,309. The firm has a market capitalization of C$1.13 billion, a price-to-earnings ratio of -26.19, a PEG ratio of 0.56 and a beta of 0.15. Cascades has a 52-week low of C$8.83 and a 52-week high of C$15.00. The company's 50-day moving average is C$10.14 and its 200-day moving average is C$9.65. The company has a debt-to-equity ratio of 119.55, a quick ratio of 0.86 and a current ratio of 1.23.

Cascades (TSE:CAS - Get Free Report) last released its quarterly earnings results on Thursday, August 8th. The company reported C$0.08 EPS for the quarter, beating the consensus estimate of C$0.06 by C$0.02. The firm had revenue of C$1.18 billion for the quarter, compared to analyst estimates of C$1.17 billion. Cascades had a negative net margin of 0.91% and a negative return on equity of 1.44%.

Cascades Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Thursday, December 5th. Stockholders of record on Thursday, December 5th will be paid a dividend of $0.12 per share. This represents a $0.48 dividend on an annualized basis and a dividend yield of 4.28%. The ex-dividend date is Thursday, November 21st. Cascades's dividend payout ratio (DPR) is -114.29%.

About Cascades

(

Get Free Report)

Cascades Inc produces, converts, and markets packaging and tissue products in Canada and the United States. The company operates through three segments: Containerboard, Specialty Products, and Tissue Papers. It offers various packaging solutions and tissue products comprised of recycled fibers; tissue papers, comprising parent rolls of virgin and recycled fibres; specialty products, including uncoated recycled boxboards; and containerboards.

Further Reading

Before you consider Cascades, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cascades wasn't on the list.

While Cascades currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.