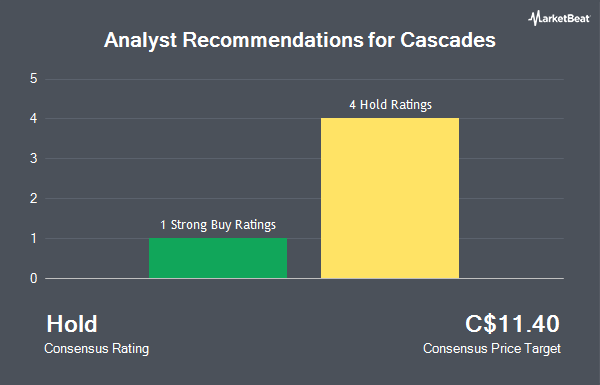

Cascades Inc. (TSE:CAS - Get Free Report) has been given an average rating of "Moderate Buy" by the six brokerages that are covering the company, MarketBeat.com reports. Four research analysts have rated the stock with a hold recommendation, one has issued a buy recommendation and one has assigned a strong buy recommendation to the company. The average 1-year price objective among analysts that have updated their coverage on the stock in the last year is C$13.25.

Several research analysts recently commented on CAS shares. Royal Bank of Canada increased their price target on Cascades from C$12.00 to C$13.00 and gave the company a "sector perform" rating in a research report on Friday, December 20th. Scotiabank raised Cascades from a "hold" rating to a "strong-buy" rating and raised their price objective for the company from C$12.00 to C$15.50 in a research report on Monday, January 27th. TD Securities raised their price objective on Cascades from C$12.00 to C$14.00 and gave the company a "buy" rating in a research report on Friday, November 8th. Finally, CIBC raised their price objective on Cascades from C$12.00 to C$13.00 in a research report on Wednesday, January 15th.

Read Our Latest Stock Report on Cascades

Cascades Stock Down 2.5 %

TSE CAS traded down C$0.29 during trading hours on Tuesday, hitting C$11.44. 279,195 shares of the company traded hands, compared to its average volume of 252,595. The business's 50-day moving average is C$12.35 and its 200-day moving average is C$11.07. Cascades has a twelve month low of C$8.83 and a twelve month high of C$13.42. The company has a debt-to-equity ratio of 121.37, a quick ratio of 0.86 and a current ratio of 1.22. The stock has a market capitalization of C$1.16 billion, a price-to-earnings ratio of -15.43, a P/E/G ratio of 0.56 and a beta of 0.15.

About Cascades

(

Get Free ReportCascades Inc produces, converts, and markets packaging and tissue products in Canada and the United States. The company operates through three segments: Containerboard, Specialty Products, and Tissue Papers. It offers various packaging solutions and tissue products comprised of recycled fibers; tissue papers, comprising parent rolls of virgin and recycled fibres; specialty products, including uncoated recycled boxboards; and containerboards.

Recommended Stories

Before you consider Cascades, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cascades wasn't on the list.

While Cascades currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.