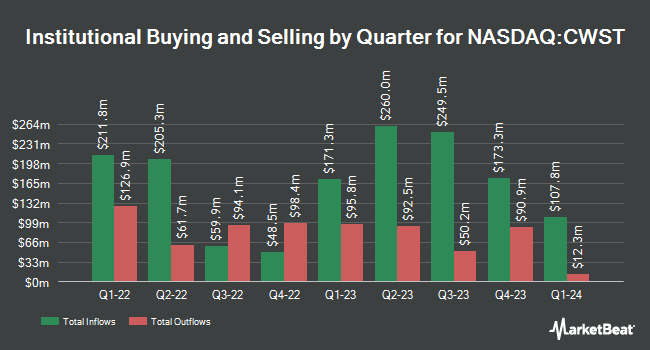

Geode Capital Management LLC increased its holdings in Casella Waste Systems, Inc. (NASDAQ:CWST - Free Report) by 1.1% during the 4th quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 1,446,875 shares of the industrial products company's stock after acquiring an additional 15,917 shares during the quarter. Geode Capital Management LLC owned approximately 2.29% of Casella Waste Systems worth $153,129,000 as of its most recent filing with the SEC.

Other institutional investors have also modified their holdings of the company. Wellington Management Group LLP raised its stake in Casella Waste Systems by 50.4% during the third quarter. Wellington Management Group LLP now owns 1,454,453 shares of the industrial products company's stock worth $144,704,000 after acquiring an additional 487,661 shares during the period. Norges Bank bought a new position in shares of Casella Waste Systems during the fourth quarter valued at approximately $43,785,000. Raymond James Financial Inc. acquired a new stake in shares of Casella Waste Systems during the 4th quarter worth approximately $31,326,000. Franklin Resources Inc. lifted its holdings in shares of Casella Waste Systems by 41.1% in the 3rd quarter. Franklin Resources Inc. now owns 495,294 shares of the industrial products company's stock worth $50,604,000 after purchasing an additional 144,212 shares during the last quarter. Finally, American Century Companies Inc. boosted its position in Casella Waste Systems by 23.9% during the 4th quarter. American Century Companies Inc. now owns 716,267 shares of the industrial products company's stock valued at $75,788,000 after purchasing an additional 138,229 shares during the period. Institutional investors and hedge funds own 99.51% of the company's stock.

Casella Waste Systems Price Performance

Shares of Casella Waste Systems stock traded up $1.08 on Friday, hitting $115.08. The company had a trading volume of 561,353 shares, compared to its average volume of 347,359. Casella Waste Systems, Inc. has a 52 week low of $86.41 and a 52 week high of $116.31. The company has a debt-to-equity ratio of 0.70, a current ratio of 2.00 and a quick ratio of 2.48. The company has a market cap of $7.29 billion, a PE ratio of 500.35, a PEG ratio of 3.86 and a beta of 0.96. The business has a 50-day simple moving average of $110.35 and a 200-day simple moving average of $107.55.

Casella Waste Systems (NASDAQ:CWST - Get Free Report) last announced its earnings results on Wednesday, February 12th. The industrial products company reported $0.41 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.16 by $0.25. Casella Waste Systems had a return on equity of 4.15% and a net margin of 0.87%. Research analysts expect that Casella Waste Systems, Inc. will post 1.16 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

CWST has been the subject of several analyst reports. TD Cowen began coverage on shares of Casella Waste Systems in a report on Wednesday. They set a "buy" rating and a $130.00 price target for the company. William Blair restated an "outperform" rating on shares of Casella Waste Systems in a research report on Friday, February 14th. Stifel Nicolaus lifted their price target on Casella Waste Systems from $127.00 to $129.00 and gave the company a "buy" rating in a report on Tuesday, February 18th. UBS Group boosted their price objective on Casella Waste Systems from $130.00 to $135.00 and gave the stock a "buy" rating in a research report on Friday. Finally, Jefferies Financial Group cut Casella Waste Systems from a "buy" rating to a "hold" rating and lowered their target price for the company from $115.00 to $113.00 in a research report on Thursday, January 23rd. Two research analysts have rated the stock with a hold rating, four have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, Casella Waste Systems currently has a consensus rating of "Moderate Buy" and a consensus price target of $122.67.

Get Our Latest Report on CWST

Casella Waste Systems Profile

(

Free Report)

Casella Waste Systems, Inc, together with its subsidiaries, operates as a vertically integrated solid waste services company in the United States. It offers resource management services primarily in the areas of solid waste collection and disposal, transfer, recycling, and organics services to residential, commercial, municipal, institutional, and industrial customers.

Recommended Stories

Before you consider Casella Waste Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Casella Waste Systems wasn't on the list.

While Casella Waste Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.