Fred Alger Management LLC decreased its position in shares of Casella Waste Systems, Inc. (NASDAQ:CWST - Free Report) by 4.7% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 1,068,552 shares of the industrial products company's stock after selling 52,161 shares during the quarter. Fred Alger Management LLC owned 1.69% of Casella Waste Systems worth $106,310,000 as of its most recent filing with the Securities & Exchange Commission.

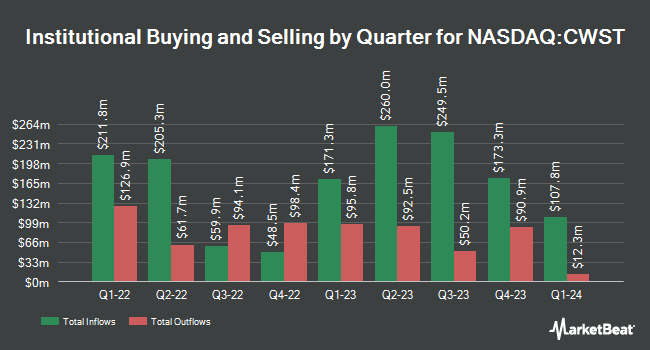

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Harbor Capital Advisors Inc. boosted its stake in Casella Waste Systems by 108.0% during the 3rd quarter. Harbor Capital Advisors Inc. now owns 66,129 shares of the industrial products company's stock valued at $6,579,000 after purchasing an additional 34,340 shares during the last quarter. Williams Financial LLC purchased a new position in Casella Waste Systems in the 2nd quarter worth about $2,427,000. Millennium Management LLC lifted its stake in Casella Waste Systems by 667.9% during the 2nd quarter. Millennium Management LLC now owns 48,231 shares of the industrial products company's stock valued at $4,785,000 after acquiring an additional 41,950 shares during the period. Dimensional Fund Advisors LP grew its stake in shares of Casella Waste Systems by 3.1% in the second quarter. Dimensional Fund Advisors LP now owns 861,463 shares of the industrial products company's stock worth $85,476,000 after acquiring an additional 26,189 shares during the period. Finally, MQS Management LLC purchased a new position in shares of Casella Waste Systems during the third quarter valued at approximately $562,000. Institutional investors own 99.51% of the company's stock.

Casella Waste Systems Stock Performance

NASDAQ CWST traded up $0.93 on Friday, reaching $113.21. 107,742 shares of the stock were exchanged, compared to its average volume of 314,627. The company's 50-day simple moving average is $103.90 and its two-hundred day simple moving average is $102.58. The company has a current ratio of 2.55, a quick ratio of 2.48 and a debt-to-equity ratio of 0.68. The firm has a market capitalization of $7.17 billion, a PE ratio of 943.42, a PEG ratio of 6.65 and a beta of 0.99. Casella Waste Systems, Inc. has a one year low of $79.47 and a one year high of $114.56.

Casella Waste Systems (NASDAQ:CWST - Get Free Report) last issued its earnings results on Wednesday, October 30th. The industrial products company reported $0.27 earnings per share for the quarter, missing the consensus estimate of $0.28 by ($0.01). The firm had revenue of $411.63 million during the quarter, compared to the consensus estimate of $412.59 million. Casella Waste Systems had a return on equity of 3.04% and a net margin of 0.46%. The company's quarterly revenue was up 16.7% on a year-over-year basis. During the same period in the prior year, the company posted $0.35 EPS. Analysts expect that Casella Waste Systems, Inc. will post 0.65 EPS for the current fiscal year.

Insider Buying and Selling

In other news, SVP Paul Ligon sold 1,730 shares of the firm's stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $106.81, for a total transaction of $184,781.30. Following the completion of the transaction, the senior vice president now owns 21,085 shares in the company, valued at $2,252,088.85. This trade represents a 7.58 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. 4.24% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

Several brokerages recently issued reports on CWST. Raymond James raised their target price on shares of Casella Waste Systems from $121.00 to $122.00 and gave the stock a "strong-buy" rating in a report on Thursday, September 19th. Stifel Nicolaus reissued a "buy" rating and issued a $117.00 target price (up previously from $110.00) on shares of Casella Waste Systems in a report on Monday, August 5th. William Blair began coverage on Casella Waste Systems in a research report on Thursday, October 3rd. They issued an "outperform" rating on the stock. Finally, Deutsche Bank Aktiengesellschaft lowered their price objective on shares of Casella Waste Systems from $114.00 to $107.00 and set a "hold" rating on the stock in a research note on Friday, November 1st. Two equities research analysts have rated the stock with a hold rating, three have issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $111.50.

View Our Latest Report on Casella Waste Systems

About Casella Waste Systems

(

Free Report)

Casella Waste Systems, Inc, together with its subsidiaries, operates as a vertically integrated solid waste services company in the United States. It offers resource management services primarily in the areas of solid waste collection and disposal, transfer, recycling, and organics services to residential, commercial, municipal, institutional, and industrial customers.

Featured Articles

Before you consider Casella Waste Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Casella Waste Systems wasn't on the list.

While Casella Waste Systems currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.