StockNews.com lowered shares of Casey's General Stores (NASDAQ:CASY - Free Report) from a strong-buy rating to a buy rating in a research report released on Friday.

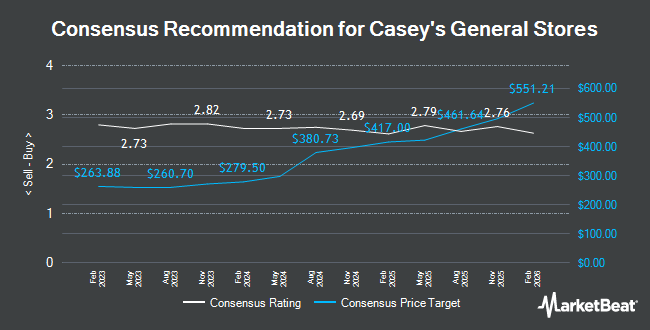

Several other analysts have also recently commented on CASY. Wells Fargo & Company increased their price target on shares of Casey's General Stores from $415.00 to $425.00 and gave the company an "overweight" rating in a research note on Friday, September 6th. Deutsche Bank Aktiengesellschaft raised their price target on Casey's General Stores from $451.00 to $454.00 and gave the company a "buy" rating in a report on Wednesday, November 6th. Evercore ISI upped their target price on shares of Casey's General Stores from $435.00 to $440.00 and gave the company an "outperform" rating in a research report on Wednesday, October 16th. JPMorgan Chase & Co. downgraded shares of Casey's General Stores from a "neutral" rating to an "underweight" rating and increased their price target for the company from $300.00 to $337.00 in a research report on Thursday, September 19th. Finally, Melius Research started coverage on shares of Casey's General Stores in a research report on Monday, September 23rd. They set a "buy" rating and a $435.00 price target on the stock. One investment analyst has rated the stock with a sell rating, three have given a hold rating and nine have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $412.83.

View Our Latest Stock Report on Casey's General Stores

Casey's General Stores Price Performance

CASY traded down $0.43 during midday trading on Friday, reaching $425.27. 187,688 shares of the company's stock were exchanged, compared to its average volume of 266,349. The company has a quick ratio of 0.44, a current ratio of 0.88 and a debt-to-equity ratio of 0.74. The business has a 50-day simple moving average of $405.04 and a two-hundred day simple moving average of $381.40. The firm has a market capitalization of $15.79 billion, a price-to-earnings ratio of 29.64 and a beta of 0.80. Casey's General Stores has a one year low of $266.58 and a one year high of $439.68.

Casey's General Stores (NASDAQ:CASY - Get Free Report) last released its quarterly earnings results on Monday, December 9th. The company reported $4.85 EPS for the quarter, beating analysts' consensus estimates of $4.29 by $0.56. The firm had revenue of $3.95 billion for the quarter, compared to analyst estimates of $4.03 billion. Casey's General Stores had a net margin of 3.57% and a return on equity of 17.17%. The company's revenue for the quarter was down 2.9% compared to the same quarter last year. During the same period in the previous year, the business earned $4.24 earnings per share. As a group, research analysts predict that Casey's General Stores will post 14.28 EPS for the current year.

Casey's General Stores Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Monday, February 17th. Stockholders of record on Monday, February 3rd will be paid a dividend of $0.50 per share. The ex-dividend date of this dividend is Monday, February 3rd. This represents a $2.00 annualized dividend and a dividend yield of 0.47%. Casey's General Stores's dividend payout ratio is currently 13.94%.

Insider Activity

In other news, Director Mike Spanos bought 267 shares of the stock in a transaction that occurred on Wednesday, September 18th. The shares were acquired at an average cost of $376.18 per share, for a total transaction of $100,440.06. Following the completion of the acquisition, the director now owns 2,594 shares in the company, valued at approximately $975,810.92. This represents a 11.47 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, insider Katrina S. Lindsey sold 450 shares of the stock in a transaction on Thursday, December 12th. The shares were sold at an average price of $427.13, for a total transaction of $192,208.50. Following the completion of the sale, the insider now owns 2,247 shares of the company's stock, valued at approximately $959,761.11. This represents a 16.69 % decrease in their position. The disclosure for this sale can be found here. 0.56% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On Casey's General Stores

Institutional investors and hedge funds have recently modified their holdings of the company. Soros Capital Management LLC raised its stake in Casey's General Stores by 1,825.6% in the third quarter. Soros Capital Management LLC now owns 27,632 shares of the company's stock valued at $10,382,000 after buying an additional 26,197 shares during the period. PNC Financial Services Group Inc. raised its stake in Casey's General Stores by 9.9% in the 3rd quarter. PNC Financial Services Group Inc. now owns 14,725 shares of the company's stock valued at $5,532,000 after acquiring an additional 1,332 shares during the period. FMR LLC raised its stake in Casey's General Stores by 3.8% in the 3rd quarter. FMR LLC now owns 1,046,830 shares of the company's stock valued at $393,305,000 after acquiring an additional 38,226 shares during the period. OneDigital Investment Advisors LLC lifted its holdings in Casey's General Stores by 111.7% during the 3rd quarter. OneDigital Investment Advisors LLC now owns 4,004 shares of the company's stock valued at $1,504,000 after purchasing an additional 2,113 shares during the last quarter. Finally, Segall Bryant & Hamill LLC increased its holdings in shares of Casey's General Stores by 5.8% in the third quarter. Segall Bryant & Hamill LLC now owns 48,872 shares of the company's stock valued at $18,362,000 after purchasing an additional 2,679 shares during the last quarter. 85.63% of the stock is owned by institutional investors.

Casey's General Stores Company Profile

(

Get Free Report)

Casey's General Stores, Inc, together with its subsidiaries, operates convenience stores under the Casey's and Casey's General Store names. Its stores offer pizza, donuts, breakfast items, and sandwiches; and tobacco and nicotine products. The company's stores provide soft drinks, energy, water, sports drinks, juices, coffee, and tea and dairy products; beer, wine, and spirits; snacks, candy, packaged bakery, and other food items; ice, ice cream, meals, and appetizers; health and beauty aids, automotive products, electronic accessories, housewares, and pet supplies; and ATM, lotto/lottery, and prepaid cards.

Featured Stories

Before you consider Casey's General Stores, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Casey's General Stores wasn't on the list.

While Casey's General Stores currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report