Charles Schwab Investment Management Inc. raised its stake in shares of Catalent, Inc. (NYSE:CTLT - Free Report) by 1.1% in the third quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 1,656,506 shares of the company's stock after buying an additional 17,681 shares during the quarter. Charles Schwab Investment Management Inc. owned about 0.91% of Catalent worth $100,335,000 at the end of the most recent reporting period.

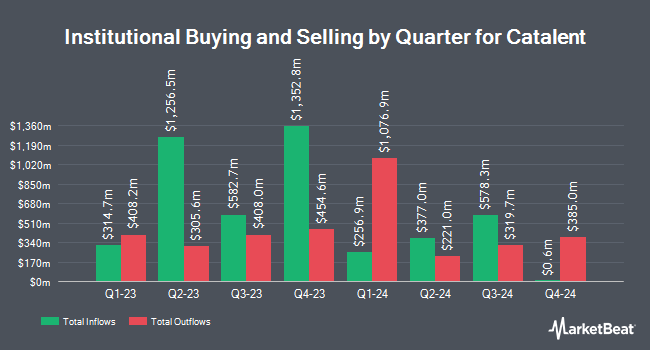

A number of other institutional investors and hedge funds have also recently modified their holdings of the company. Millennium Management LLC raised its holdings in shares of Catalent by 129.2% in the 2nd quarter. Millennium Management LLC now owns 4,079,964 shares of the company's stock valued at $229,416,000 after acquiring an additional 2,299,784 shares in the last quarter. ING Groep NV increased its position in shares of Catalent by 162.5% in the third quarter. ING Groep NV now owns 1,130,504 shares of the company's stock worth $68,475,000 after purchasing an additional 699,851 shares during the last quarter. Healthcare of Ontario Pension Plan Trust Fund purchased a new stake in Catalent in the second quarter valued at approximately $29,172,000. Mizuho Markets Americas LLC bought a new stake in Catalent during the third quarter valued at approximately $30,285,000. Finally, Bank of Montreal Can grew its stake in Catalent by 222.0% in the 2nd quarter. Bank of Montreal Can now owns 644,123 shares of the company's stock worth $36,219,000 after buying an additional 444,084 shares in the last quarter.

Catalent Trading Up 0.3 %

NYSE CTLT traded up $0.21 during trading on Wednesday, hitting $60.96. 56,664 shares of the company's stock traded hands, compared to its average volume of 2,030,067. The firm has a market cap of $11.06 billion, a P/E ratio of -26.88, a PEG ratio of 2.44 and a beta of 1.16. The stock has a fifty day moving average of $59.84 and a two-hundred day moving average of $58.39. The company has a debt-to-equity ratio of 1.38, a current ratio of 2.51 and a quick ratio of 1.96. Catalent, Inc. has a 12-month low of $36.74 and a 12-month high of $61.50.

Catalent (NYSE:CTLT - Get Free Report) last posted its quarterly earnings results on Tuesday, November 5th. The company reported ($0.13) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.05 by ($0.18). The company had revenue of $1.02 billion for the quarter, compared to the consensus estimate of $1.06 billion. Catalent had a negative return on equity of 0.66% and a negative net margin of 9.28%. Catalent's revenue was up 4.2% compared to the same quarter last year. During the same quarter in the previous year, the business earned ($0.10) earnings per share. As a group, sell-side analysts expect that Catalent, Inc. will post 0.84 EPS for the current year.

Insider Transactions at Catalent

In related news, Director Michelle R. Ryan sold 2,800 shares of the business's stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $59.70, for a total transaction of $167,160.00. Following the transaction, the director now owns 10,835 shares in the company, valued at $646,849.50. The trade was a 20.54 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, insider David Mcerlane sold 1,994 shares of the stock in a transaction that occurred on Thursday, September 26th. The stock was sold at an average price of $59.97, for a total value of $119,580.18. Following the completion of the sale, the insider now owns 36,304 shares of the company's stock, valued at approximately $2,177,150.88. This trade represents a 5.21 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 5,114 shares of company stock worth $305,931. Insiders own 0.31% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms have recently weighed in on CTLT. William Blair restated a "market perform" rating on shares of Catalent in a research report on Tuesday, September 3rd. Robert W. Baird restated a "neutral" rating and set a $63.50 price target on shares of Catalent in a research report on Tuesday, September 24th. StockNews.com lowered Catalent from a "hold" rating to a "sell" rating in a research note on Friday, November 22nd. Finally, Baird R W lowered Catalent from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, September 24th. One research analyst has rated the stock with a sell rating and seven have assigned a hold rating to the company's stock. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and a consensus price target of $63.40.

Read Our Latest Stock Report on Catalent

Catalent Profile

(

Free Report)

Catalent, Inc, together with its subsidiaries, develops and manufactures solutions for drugs, protein-based biologics, cell and gene therapies, and consumer health products worldwide. It operates in two segments, Biologics, and Pharma and Consumer Health. The Biologics segment provides formulation, development, and manufacturing for biologic proteins, cell gene, and other nucleic acid therapies; pDNA, iPSCs, oncolytic viruses, and vaccines; formulation, development, and manufacturing for parenteral dose forms, including vials, prefilled syringes, and cartridges; and analytical development and testing services for large molecules.

See Also

Before you consider Catalent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Catalent wasn't on the list.

While Catalent currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.