StockNews.com lowered shares of Catalent (NYSE:CTLT - Free Report) from a hold rating to a sell rating in a research report report published on Friday morning.

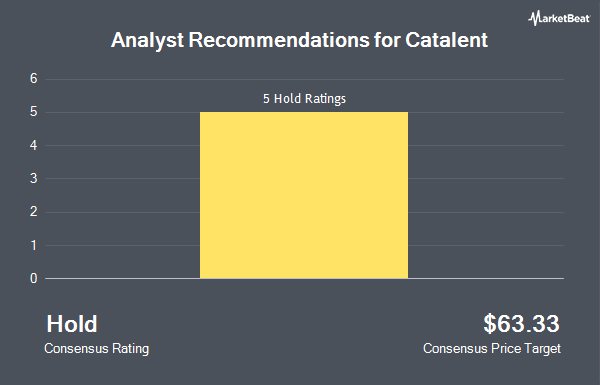

Several other research firms have also weighed in on CTLT. William Blair reissued a "market perform" rating on shares of Catalent in a report on Tuesday, September 3rd. Robert W. Baird restated a "neutral" rating and issued a $63.50 price objective on shares of Catalent in a research report on Tuesday, September 24th. Finally, Baird R W downgraded Catalent from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, September 24th. One analyst has rated the stock with a sell rating and seven have given a hold rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and an average target price of $63.40.

Get Our Latest Analysis on Catalent

Catalent Stock Performance

Shares of NYSE:CTLT traded up $1.32 during trading on Friday, reaching $60.98. The company had a trading volume of 4,869,605 shares, compared to its average volume of 2,036,405. The firm has a market capitalization of $11.07 billion, a price-to-earnings ratio of -26.88, a price-to-earnings-growth ratio of 2.34 and a beta of 1.16. The company has a debt-to-equity ratio of 1.38, a current ratio of 2.51 and a quick ratio of 1.96. The stock's fifty day moving average price is $59.79 and its 200 day moving average price is $58.26. Catalent has a fifty-two week low of $36.74 and a fifty-two week high of $61.50.

Catalent (NYSE:CTLT - Get Free Report) last announced its quarterly earnings data on Tuesday, November 5th. The company reported ($0.13) earnings per share for the quarter, missing analysts' consensus estimates of $0.05 by ($0.18). Catalent had a negative return on equity of 0.66% and a negative net margin of 9.28%. The business had revenue of $1.02 billion for the quarter, compared to analyst estimates of $1.06 billion. During the same period in the prior year, the company earned ($0.10) EPS. The company's revenue was up 4.2% on a year-over-year basis. As a group, equities research analysts predict that Catalent will post 0.84 EPS for the current year.

Insider Buying and Selling at Catalent

In related news, insider David Mcerlane sold 1,994 shares of Catalent stock in a transaction on Thursday, September 26th. The stock was sold at an average price of $59.97, for a total value of $119,580.18. Following the transaction, the insider now directly owns 36,304 shares in the company, valued at $2,177,150.88. The trade was a 5.21 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, Director Michelle R. Ryan sold 2,800 shares of Catalent stock in a transaction on Monday, November 11th. The stock was sold at an average price of $59.70, for a total value of $167,160.00. Following the completion of the transaction, the director now owns 10,835 shares in the company, valued at $646,849.50. The trade was a 20.54 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 5,114 shares of company stock valued at $305,931 in the last quarter. Corporate insiders own 0.31% of the company's stock.

Institutional Trading of Catalent

Institutional investors and hedge funds have recently made changes to their positions in the stock. Brooklyn Investment Group acquired a new position in shares of Catalent in the 3rd quarter worth approximately $31,000. Thurston Springer Miller Herd & Titak Inc. bought a new stake in shares of Catalent in the 2nd quarter valued at $42,000. Sentry Investment Management LLC bought a new stake in shares of Catalent in the 3rd quarter valued at $53,000. Longfellow Investment Management Co. LLC increased its position in shares of Catalent by 45.7% in the 2nd quarter. Longfellow Investment Management Co. LLC now owns 972 shares of the company's stock valued at $55,000 after buying an additional 305 shares in the last quarter. Finally, GAMMA Investing LLC increased its holdings in Catalent by 25.9% during the 2nd quarter. GAMMA Investing LLC now owns 1,032 shares of the company's stock worth $58,000 after purchasing an additional 212 shares in the last quarter.

Catalent Company Profile

(

Get Free Report)

Catalent, Inc, together with its subsidiaries, develops and manufactures solutions for drugs, protein-based biologics, cell and gene therapies, and consumer health products worldwide. It operates in two segments, Biologics, and Pharma and Consumer Health. The Biologics segment provides formulation, development, and manufacturing for biologic proteins, cell gene, and other nucleic acid therapies; pDNA, iPSCs, oncolytic viruses, and vaccines; formulation, development, and manufacturing for parenteral dose forms, including vials, prefilled syringes, and cartridges; and analytical development and testing services for large molecules.

Featured Articles

Before you consider Catalent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Catalent wasn't on the list.

While Catalent currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.