Catalina Capital Group LLC grew its holdings in Shell plc (NYSE:SHEL - Free Report) by 279.6% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 13,139 shares of the energy company's stock after acquiring an additional 9,678 shares during the period. Catalina Capital Group LLC's holdings in Shell were worth $867,000 at the end of the most recent quarter.

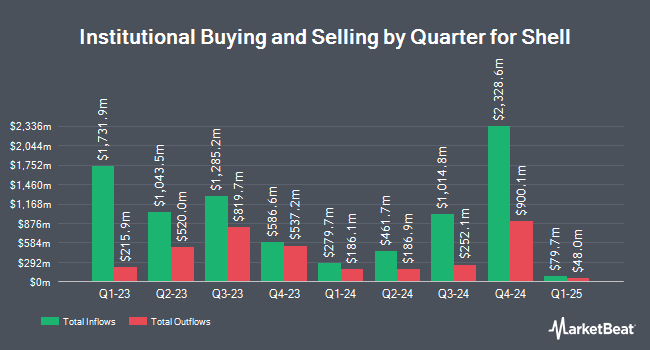

Other hedge funds have also recently modified their holdings of the company. Allspring Global Investments Holdings LLC grew its stake in Shell by 1,293.5% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 6,898 shares of the energy company's stock valued at $462,000 after acquiring an additional 6,403 shares during the period. Norden Group LLC boosted its stake in shares of Shell by 72.5% in the first quarter. Norden Group LLC now owns 10,015 shares of the energy company's stock worth $671,000 after acquiring an additional 4,210 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. lifted its holdings in Shell by 5.8% in the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 116,199 shares of the energy company's stock valued at $7,790,000 after purchasing an additional 6,356 shares in the last quarter. Janney Montgomery Scott LLC boosted its stake in Shell by 1.2% during the 1st quarter. Janney Montgomery Scott LLC now owns 144,885 shares of the energy company's stock worth $9,713,000 after purchasing an additional 1,728 shares during the last quarter. Finally, FORA Capital LLC purchased a new stake in Shell during the 1st quarter valued at about $467,000. Hedge funds and other institutional investors own 28.60% of the company's stock.

Shell Trading Up 0.2 %

Shares of NYSE SHEL traded up $0.14 on Wednesday, reaching $68.36. 7,714,763 shares of the company traded hands, compared to its average volume of 4,208,594. The stock has a market capitalization of $212.75 billion, a PE ratio of 14.07, a P/E/G ratio of 2.04 and a beta of 0.56. Shell plc has a fifty-two week low of $60.34 and a fifty-two week high of $74.61. The company has a current ratio of 1.40, a quick ratio of 1.13 and a debt-to-equity ratio of 0.34. The company has a 50 day moving average of $67.81 and a 200 day moving average of $70.45.

Shell Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, December 19th. Investors of record on Friday, November 15th will be issued a dividend of $0.688 per share. The ex-dividend date of this dividend is Friday, November 15th. This represents a $2.75 annualized dividend and a dividend yield of 4.03%. Shell's payout ratio is 56.58%.

Wall Street Analyst Weigh In

A number of research firms recently commented on SHEL. Sanford C. Bernstein upgraded Shell to a "strong-buy" rating in a report on Friday, October 11th. Berenberg Bank upgraded Shell to a "strong-buy" rating in a report on Monday, August 5th. Wells Fargo & Company boosted their price target on shares of Shell from $84.00 to $88.00 and gave the stock an "overweight" rating in a research note on Tuesday, October 8th. Scotiabank decreased their price target on shares of Shell from $90.00 to $80.00 and set a "sector outperform" rating for the company in a research report on Thursday, October 10th. Finally, Wolfe Research started coverage on Shell in a research report on Thursday, July 18th. They issued a "peer perform" rating on the stock. Three research analysts have rated the stock with a hold rating, four have given a buy rating and three have issued a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average target price of $82.00.

Read Our Latest Research Report on Shell

Shell Profile

(

Free Report)

Shell plc operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and Rest of the Americas. The company operates through Integrated Gas, Upstream, Marketing, Chemicals and Products, and Renewables and Energy Solutions segments. It explores for and extracts crude oil, natural gas, and natural gas liquids; markets and transports oil and gas; produces gas-to-liquids fuels and other products; and operates upstream and midstream infrastructure to deliver gas to market.

Recommended Stories

Before you consider Shell, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shell wasn't on the list.

While Shell currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.