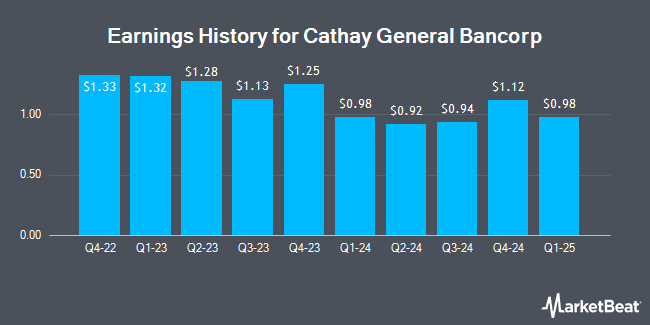

Cathay General Bancorp (NASDAQ:CATY - Get Free Report) is projected to release its earnings data after the market closes on Monday, April 21st. Analysts expect Cathay General Bancorp to post earnings of $0.95 per share and revenue of $186.17 million for the quarter. Individual that wish to listen to the company's earnings conference call can do so using this link.

Cathay General Bancorp (NASDAQ:CATY - Get Free Report) last issued its quarterly earnings results on Wednesday, January 22nd. The bank reported $1.12 EPS for the quarter, topping the consensus estimate of $1.10 by $0.02. Cathay General Bancorp had a net margin of 20.57% and a return on equity of 10.70%. On average, analysts expect Cathay General Bancorp to post $4 EPS for the current fiscal year and $5 EPS for the next fiscal year.

Cathay General Bancorp Stock Up 0.8 %

NASDAQ CATY traded up $0.29 on Friday, hitting $38.63. 581,995 shares of the stock traded hands, compared to its average volume of 352,123. The company has a current ratio of 1.03, a quick ratio of 1.03 and a debt-to-equity ratio of 0.07. The stock has a 50-day moving average of $42.90 and a 200 day moving average of $46.27. Cathay General Bancorp has a twelve month low of $33.88 and a twelve month high of $55.29. The company has a market capitalization of $2.70 billion, a P/E ratio of 9.76 and a beta of 0.99.

Cathay General Bancorp Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Monday, March 10th. Investors of record on Thursday, February 27th were given a dividend of $0.34 per share. This represents a $1.36 annualized dividend and a dividend yield of 3.52%. The ex-dividend date was Thursday, February 27th. Cathay General Bancorp's dividend payout ratio is currently 34.34%.

Analyst Ratings Changes

A number of analysts have weighed in on CATY shares. Piper Sandler dropped their target price on shares of Cathay General Bancorp from $45.00 to $43.00 and set an "underweight" rating on the stock in a report on Monday, January 27th. Keefe, Bruyette & Woods cut their target price on shares of Cathay General Bancorp from $56.00 to $55.00 and set a "market perform" rating on the stock in a report on Thursday, January 23rd. Finally, Stephens lowered their target price on Cathay General Bancorp from $60.00 to $57.00 and set an "overweight" rating for the company in a report on Thursday, January 23rd. One investment analyst has rated the stock with a sell rating, three have issued a hold rating and two have assigned a buy rating to the company's stock. Based on data from MarketBeat, Cathay General Bancorp currently has an average rating of "Hold" and an average target price of $50.80.

Get Our Latest Report on Cathay General Bancorp

About Cathay General Bancorp

(

Get Free Report)

Cathay General Bancorp operates as the holding company for Cathay Bank that offers various commercial banking products and services to individuals, professionals, and small to medium-sized businesses in the United States. The company offers various deposit products, including passbook accounts, checking accounts, money market deposit accounts, certificates of deposit, individual retirement accounts, and public funds deposits.

Read More

Before you consider Cathay General Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cathay General Bancorp wasn't on the list.

While Cathay General Bancorp currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.