Artemis Investment Management LLP raised its stake in CBIZ, Inc. (NYSE:CBZ - Free Report) by 18.5% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 393,910 shares of the business services provider's stock after buying an additional 61,376 shares during the quarter. Artemis Investment Management LLP owned about 0.78% of CBIZ worth $32,234,000 at the end of the most recent reporting period.

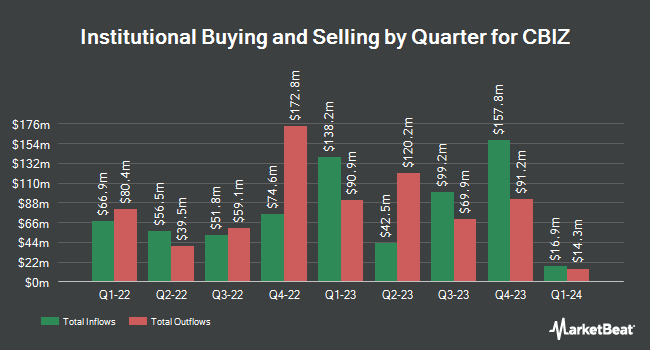

Several other institutional investors and hedge funds also recently made changes to their positions in the stock. Signaturefd LLC raised its position in CBIZ by 55.8% in the 3rd quarter. Signaturefd LLC now owns 961 shares of the business services provider's stock valued at $65,000 after buying an additional 344 shares during the last quarter. Quarry LP raised its holdings in shares of CBIZ by 6,335.3% in the third quarter. Quarry LP now owns 1,094 shares of the business services provider's stock valued at $74,000 after purchasing an additional 1,077 shares during the last quarter. KBC Group NV raised its holdings in shares of CBIZ by 29.7% in the third quarter. KBC Group NV now owns 1,553 shares of the business services provider's stock valued at $105,000 after purchasing an additional 356 shares during the last quarter. US Bancorp DE boosted its holdings in CBIZ by 16.1% during the third quarter. US Bancorp DE now owns 1,796 shares of the business services provider's stock worth $121,000 after purchasing an additional 249 shares during the last quarter. Finally, Mercer Global Advisors Inc. ADV bought a new position in CBIZ in the second quarter valued at $203,000. Institutional investors and hedge funds own 87.44% of the company's stock.

Wall Street Analyst Weigh In

Separately, StockNews.com upgraded shares of CBIZ from a "sell" rating to a "hold" rating in a research note on Friday, December 27th.

Get Our Latest Stock Report on CBZ

CBIZ Stock Down 0.4 %

Shares of NYSE:CBZ traded down $0.34 during trading on Monday, hitting $84.40. 144,739 shares of the company were exchanged, compared to its average volume of 263,882. CBIZ, Inc. has a fifty-two week low of $62.10 and a fifty-two week high of $86.36. The company has a current ratio of 1.49, a quick ratio of 1.49 and a debt-to-equity ratio of 0.36. The firm has a fifty day moving average price of $80.90 and a two-hundred day moving average price of $74.64. The stock has a market cap of $4.24 billion, a price-to-earnings ratio of 35.76 and a beta of 0.95.

CBIZ (NYSE:CBZ - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The business services provider reported $0.84 EPS for the quarter, beating analysts' consensus estimates of $0.76 by $0.08. The firm had revenue of $438.90 million during the quarter, compared to analysts' expectations of $440.16 million. CBIZ had a net margin of 7.08% and a return on equity of 15.12%. The company's revenue for the quarter was up 6.9% compared to the same quarter last year. During the same quarter last year, the company posted $0.66 earnings per share. As a group, research analysts anticipate that CBIZ, Inc. will post 2.65 earnings per share for the current fiscal year.

About CBIZ

(

Free Report)

CBIZ, Inc provides financial, insurance, and advisory services in the United States and Canada. It operates through Financial Services, Benefits and Insurance Services, and National Practices segments. The Financial Services segment offers accounting and tax, financial advisory, valuation, risk and advisory, and government healthcare consulting services.

Further Reading

Before you consider CBIZ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CBIZ wasn't on the list.

While CBIZ currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.