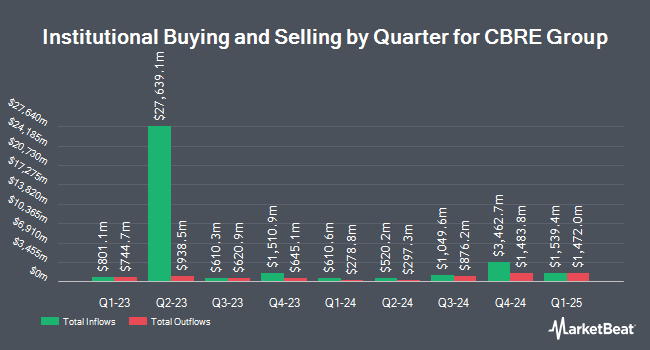

Entropy Technologies LP raised its holdings in CBRE Group, Inc. (NYSE:CBRE - Free Report) by 143.4% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 8,651 shares of the financial services provider's stock after purchasing an additional 5,097 shares during the period. Entropy Technologies LP's holdings in CBRE Group were worth $1,077,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also made changes to their positions in the company. Lindbrook Capital LLC increased its stake in CBRE Group by 4.7% during the 3rd quarter. Lindbrook Capital LLC now owns 1,750 shares of the financial services provider's stock worth $218,000 after buying an additional 79 shares in the last quarter. Stephens Inc. AR raised its stake in CBRE Group by 3.1% in the 3rd quarter. Stephens Inc. AR now owns 2,640 shares of the financial services provider's stock valued at $329,000 after purchasing an additional 80 shares during the last quarter. Fidelis Capital Partners LLC lifted its holdings in CBRE Group by 2.1% in the 3rd quarter. Fidelis Capital Partners LLC now owns 3,994 shares of the financial services provider's stock valued at $492,000 after purchasing an additional 82 shares in the last quarter. Private Advisor Group LLC boosted its stake in CBRE Group by 1.2% during the 3rd quarter. Private Advisor Group LLC now owns 7,688 shares of the financial services provider's stock worth $957,000 after purchasing an additional 90 shares during the last quarter. Finally, Studio Investment Management LLC grew its holdings in shares of CBRE Group by 2.5% during the second quarter. Studio Investment Management LLC now owns 5,546 shares of the financial services provider's stock worth $494,000 after buying an additional 135 shares in the last quarter. 98.41% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of research firms have commented on CBRE. Raymond James increased their price objective on shares of CBRE Group from $122.00 to $124.00 and gave the company a "strong-buy" rating in a report on Thursday, July 25th. Evercore ISI increased their price target on CBRE Group from $123.00 to $132.00 and gave the company an "outperform" rating in a report on Friday, October 4th. Wolfe Research raised CBRE Group to a "strong-buy" rating in a research note on Friday, August 16th. Morgan Stanley assumed coverage on CBRE Group in a research note on Thursday, July 25th. They issued an "equal weight" rating and a $105.00 target price for the company. Finally, Keefe, Bruyette & Woods upped their price objective on shares of CBRE Group from $125.00 to $138.00 and gave the company a "market perform" rating in a report on Tuesday, October 29th. Five analysts have rated the stock with a hold rating, one has given a buy rating and two have given a strong buy rating to the company's stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $116.83.

Read Our Latest Research Report on CBRE

Insider Activity at CBRE Group

In related news, Director Christopher T. Jenny sold 10,847 shares of the company's stock in a transaction that occurred on Tuesday, August 20th. The stock was sold at an average price of $112.00, for a total value of $1,214,864.00. Following the sale, the director now owns 51,244 shares of the company's stock, valued at approximately $5,739,328. This represents a 17.47 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Daniel G. Queenan sold 10,000 shares of the firm's stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $114.67, for a total value of $1,146,700.00. Following the transaction, the chief executive officer now directly owns 217,094 shares of the company's stock, valued at $24,894,168.98. The trade was a 4.40 % decrease in their position. The disclosure for this sale can be found here. 0.54% of the stock is currently owned by company insiders.

CBRE Group Stock Performance

Shares of NYSE:CBRE traded down $3.53 during midday trading on Thursday, hitting $132.02. The stock had a trading volume of 2,456,201 shares, compared to its average volume of 1,667,437. The company has a market capitalization of $40.40 billion, a PE ratio of 43.59 and a beta of 1.39. CBRE Group, Inc. has a 1 year low of $76.63 and a 1 year high of $137.93. The stock has a 50 day moving average price of $124.57 and a two-hundred day moving average price of $106.42. The company has a current ratio of 1.13, a quick ratio of 1.13 and a debt-to-equity ratio of 0.34.

CBRE Group (NYSE:CBRE - Get Free Report) last released its earnings results on Thursday, October 24th. The financial services provider reported $1.20 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.06 by $0.14. The company had revenue of $9.04 billion for the quarter, compared to analysts' expectations of $8.80 billion. CBRE Group had a return on equity of 13.91% and a net margin of 2.79%. The firm's quarterly revenue was up 14.8% on a year-over-year basis. During the same quarter in the previous year, the firm posted $0.72 EPS. As a group, equities analysts predict that CBRE Group, Inc. will post 4.96 earnings per share for the current fiscal year.

CBRE Group Profile

(

Free Report)

CBRE Group, Inc operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally. The Advisory Services segment offers strategic advice and execution to owners, investors, and occupiers of real estate in connection with leasing of offices, and industrial and retail space; clients fully integrated property sales services under the CBRE Capital Markets brand; clients commercial mortgage and structured financing services; originates and sells commercial mortgage loans; property management services, such as marketing, building engineering, accounting, and financial services on a contractual basis for owners of and investors in office, industrial, and retail properties; and valuation services that include market value appraisals, litigation support, discounted cash flow analyses, and feasibility studies, as well as consulting services, such as property condition reports, hotel advisory, and environmental consulting.

Featured Stories

Before you consider CBRE Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CBRE Group wasn't on the list.

While CBRE Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.